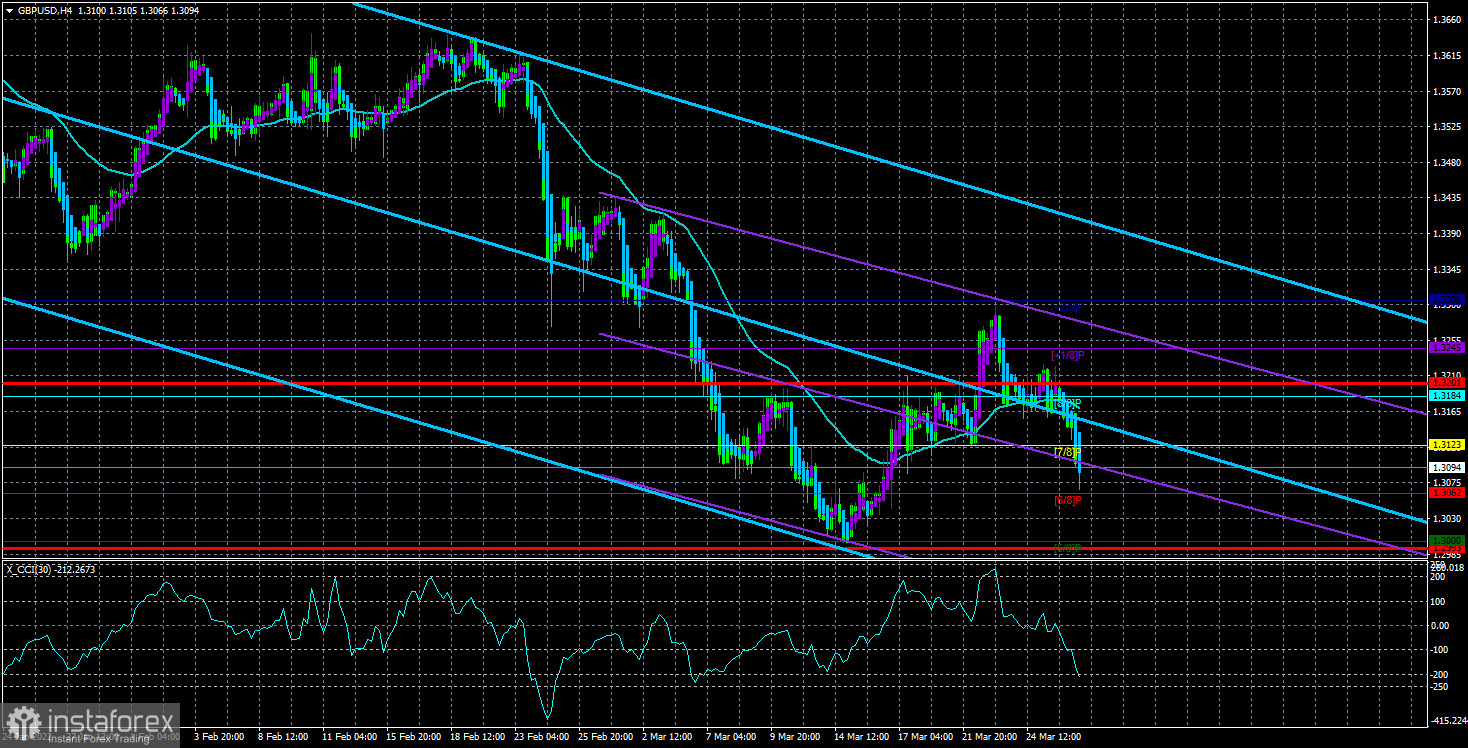

The GBP/USD currency pair also quickly and cheerfully rushed down on Monday. Our assumption that the market may be trading flat for some time has not yet been confirmed. A new week has begun and traders have shown that they do not intend to "wait for the weather by the sea." At the moment, both linear regression channels are directed downwards, and the price is located below the moving average line. Also note that a week ago, the CCI indicator visited the overbought area (above 250), which is often a harbinger of a strong fall. Thus, the set of factors that created pressure on the pound in the last month has not changed. Just a few months ago, we seriously considered the option of forming a new long-term upward trend, since, from our point of view, the British currency has adjusted sufficiently in 2021. But the new year 2022 began with new shocks, so now the "coronavirus period" no longer seems to be the worst thing that could happen to humanity and the economy. By the way, the "coronavirus" has not gone away, everyone just forgot about it against the background of the Ukrainian-Russian conflict. For example, lockdowns are now being introduced in China in certain regions, as the number of infections is growing exponentially.

However, Russia and Ukraine are not up to COVID right now. Formally, negotiations are continuing, and the next round was supposed to take place in Turkey last night. So far, there are no results in the literal and figurative sense of the word. Kyiv and Moscow cannot find common ground on the most important points, so negotiations may drag on for many months. And even in this case, there are no guarantees that they will end with the signing of a peace treaty. However, it doesn't even matter now. The peace treaty, of course, will stop the hostilities, but it will not restore the destroyed cities in Ukraine, the Russian economy, which will now fall into "isolation" for many years, and will not return all those lives that the conflict in Ukraine took. And the echoes of this conflict will be visible for a long time in many countries of the world. The UK, of course, is already an isolated country from the European Union, so its crisis will affect less than the EU countries. It is easier for London to solve problems with oil, gas, and inflation since it needs to take into account only its interests, and not the interests of 27 countries. Therefore, the pound still looks more resistant against the dollar than the euro currency.

Boris Johnson does not stop in his "anti-Russian rhetoric".

British Prime Minister Johnson is rightly considered one of the main opponents of Russia at the current time. Johnson is not stingy in his expressions and constantly comments on the state of things in Ukraine. According to the Prime Minister, Vladimir Putin does not want peace in a neighboring state. He wants to redouble his efforts and achieve his goals. That is, the change of the "western" vector of Ukraine to "pro-Russian" with the removal of President Zelensky. Johnson believes that if Ukraine stops assisting, it will have to capitulate. And this means that the Kremlin can move further to Poland, the Baltic states. Of course, it is not for us to judge what the Kremlin thinks and what plans there are. If they were known to the whole world, then, probably, there would be no conflict. However, what is important here is what is considered in London, because London is located to the west of other European countries and at this time can freely make any statements.

However, the more Johnson is crucified, the more relations between Russia and the UK, between Russia and the West, deteriorate. And now we need to achieve, first of all, world peace. Only in this way will it be possible to avoid the devastating consequences for the world economy and the Third World War. Remember how the Second World War began, also a conflict between the two countries. However, there is a feeling that no one wants peace. Everyone is talking about it, but the cases show a greater desire to preserve the conflict than the desire to resolve it. Let's hope we're wrong. In the meantime, the pound, under the pressure of the geopolitical factor, rushed down again and decided not to take a "musical pause" for at least a couple of weeks.

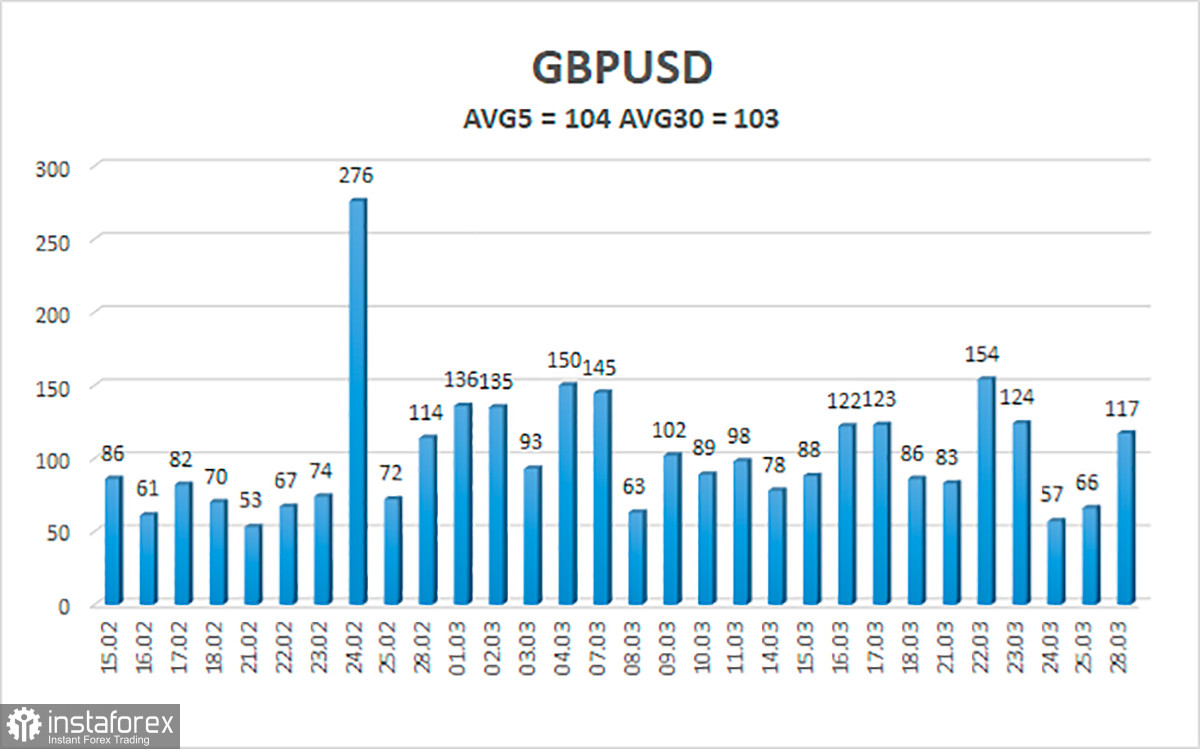

The average volatility of the GBP/USD pair is currently 104 points per day. For the pound/dollar pair, this value is "average". On Tuesday, March 29, thus, we expect movement inside the channel, limited by the levels of 1.2993 and 1.3201. The upward reversal of the Heiken Ashi indicator signals a new round of upward correction.

Nearest support levels:

S1 – 1.3062

S2 – 1.3000

S3 – 1.2939

Nearest resistance levels:

R1 – 1.3123

R2 – 1.3184

R3 – 1.3245

Trading recommendations:

The GBP/USD pair has started a new round of downward movement in the 4-hour timeframe. Thus, at this time, it is possible to maintain sell orders with targets of 1.3000 and 1.2939 until the Heiken Ashi indicator turns upwards. It will be possible to consider long positions no earlier than fixing the price above the moving average with targets of 1.3245 and 1.3306.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.