It is worth paying attention to the fact that, unlike the pound, the single European currency, in principle, remained standing still. Although the information background seems to be the same for both currencies. At least the macroeconomic calendar is completely empty. Basically, just like today. The news regarding the confrontation with Russia has an equal impact for both the single European currency and the pound. So they had to behave exactly the same. Nevertheless, there is one significant difference that determines the course of events. Trading began with a gradual weakening of both currencies. But then, the euro started to grow actively. And this is due to reports in a number of American media. Judging by them, many traders demand that the European Central Bank immediately begin tightening monetary policy and raise the refinancing rate at least four times by the end of this year. It sounds extremely strange and suspicious. Moreover, just before the opening of the US trading session, these messages have already been lost in the general flow of news, and have not received further development. So it's more like a banal information stuffing, with the aim of manipulating the market. And as a result, the euro returned to the values of the beginning of the trading day.

Today's trading, as well as yesterday, began with the synchronous decline of the pound and the euro. Both currencies are under pressure from the situation with gas, and Russia's decision to sell it to Europe for rubles. This decision will come into force on April 1. Europe itself declares its refusal to pay in Russian currency. To which Moscow said yesterday that in case of refusal to pay in rubles, it would stop gas supplies. So in the next two or three days, the pound will be under pressure. Until a point is made in this matter.

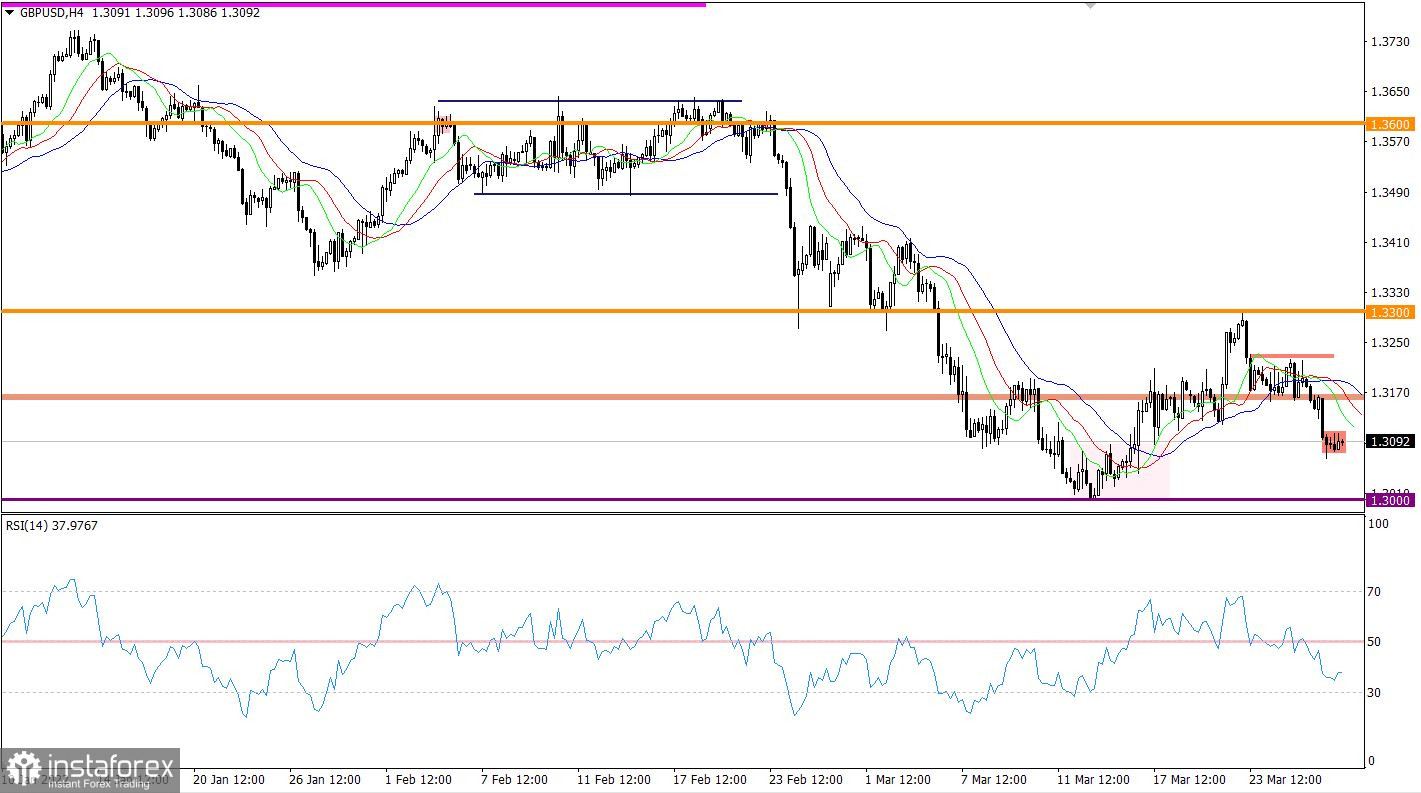

Price stagnation in the area of 1.3175/1.3220 had a positive effect on the volume of short positions. A new trading week was opened with a downward move, where the pound lost about 100 points of value. As a result, the quote fell below 1.3100.

The RSI technical instrument is moving in the lower area of the 30/50 indicator in a four-hour period, which indicates a high interest of traders in short positions.

The Alligator indicator in H4, after the end of the stagnation stage, went down, where the signal to sell the pound was confirmed. Alligator D1 still indicates a downward trend in the medium term. There are no intersections between MA moving lines.

On the trading chart of the daily period, there is a process of recovery of dollar positions relative to the recent correction. The psychological level of 1.3000 serves as the main point of support.

Expectations and prospects:

A strong price change during the past day led to a local oversold of the British currency in the short term. This is expressed on the chart as a price stagnation of 1.3075/1.3105. The signal about the prolongation of the downward cycle will appear at the moment when the price stays below 1.3066, which will lead to a movement towards the pivot point of 1.3000.

An alternative scenario allows for a transition from the stagnation stage to a local rollback if the price stays above 1.3110.

Complex indicator analysis has a variable signal in the short term due to stagnation. Indicators in the intraday and medium-term periods give a sell signal due to a downward trend.