It is worth paying attention to the fact that, unlike the pound, the single European currency, in principle, remained standing still. Although the information background seems to be the same for both currencies. At least the macroeconomic calendar is empty, the same as today. News about the confrontation with Russia had an equal impact on both the single European currency and the pound, so they had to behave the same. Nevertheless, there is one significant difference, which determined the course of events. Trading began with a gradual weakening of both currencies. But then the single European currency began to grow rapidly due to reports in some American media.

Judging by them, many traders demand that the European Central Bank immediately begin tightening monetary policy and raise the interest rate at least four times by the end of this year. It sounds extremely strange and suspicious. Moreover, just before the opening of the American trading session, these messages have already been lost in the general flow of news, and have not received further development. So it's more like a banal information stuffing to manipulate the market. And as a result, the single European currency returned to the values of the beginning of the trading day.

Today's trading, as well as yesterday, began with the synchronous decline of the pound and the single European currency. Both currencies are under pressure from the situation with gas and the decision of the Russian Federation to sell it to Europe for rubles. This decision will come into force on April 1. Europe itself declares its refusal to pay in Russian currency, to which Moscow said yesterday that if it refused to pay in rubles, it would stop gas supplies. So in the next two or three days, both the pound and the single European currency will be under pressure until this issue is resolved.

The EURUSD currency pair has been moving along the amplitude of 1.0960/1.1050 for a week, showing variable activity. Taking into account the long-term movement within the boundaries of the flat, it can be assumed that the market is in the process of accumulation of trading forces. Thus, as a result, an acceleration process will occur, where the most optimal trading tactic is the method of breaking through one or another stagnation border.

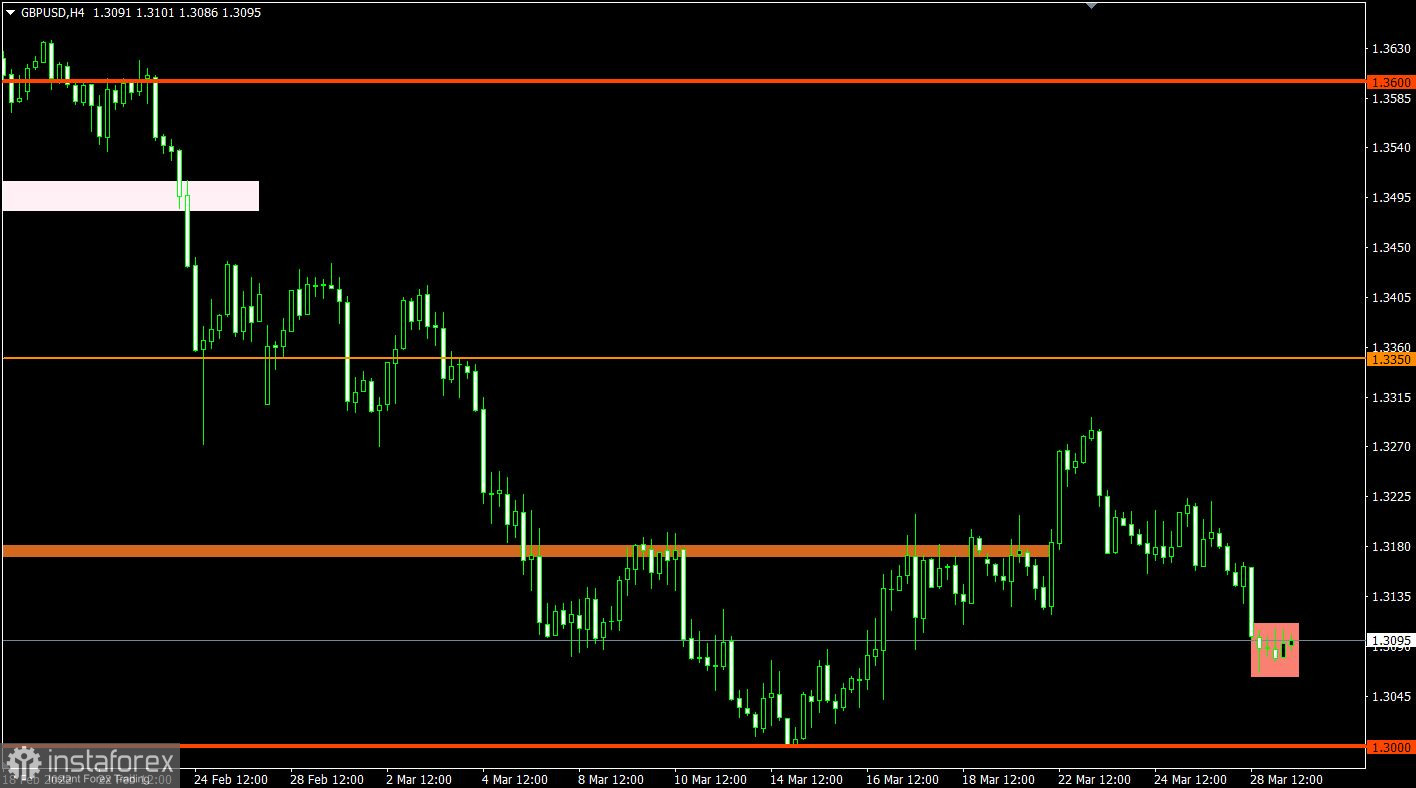

The GBPUSD currency pair showed high activity yesterday, as a result of which there was a sharp price change of more than 100 points. The quote fell to the area of 1.3100, where a local stagnation arose. To prolong the downward cycle, the quote needs to stay below the value of 1.3066, this step will open the way in the direction of 1.3000. The signal about the transition from stagnation to the rollback stage will be considered by traders if the price holds above 1.3110.