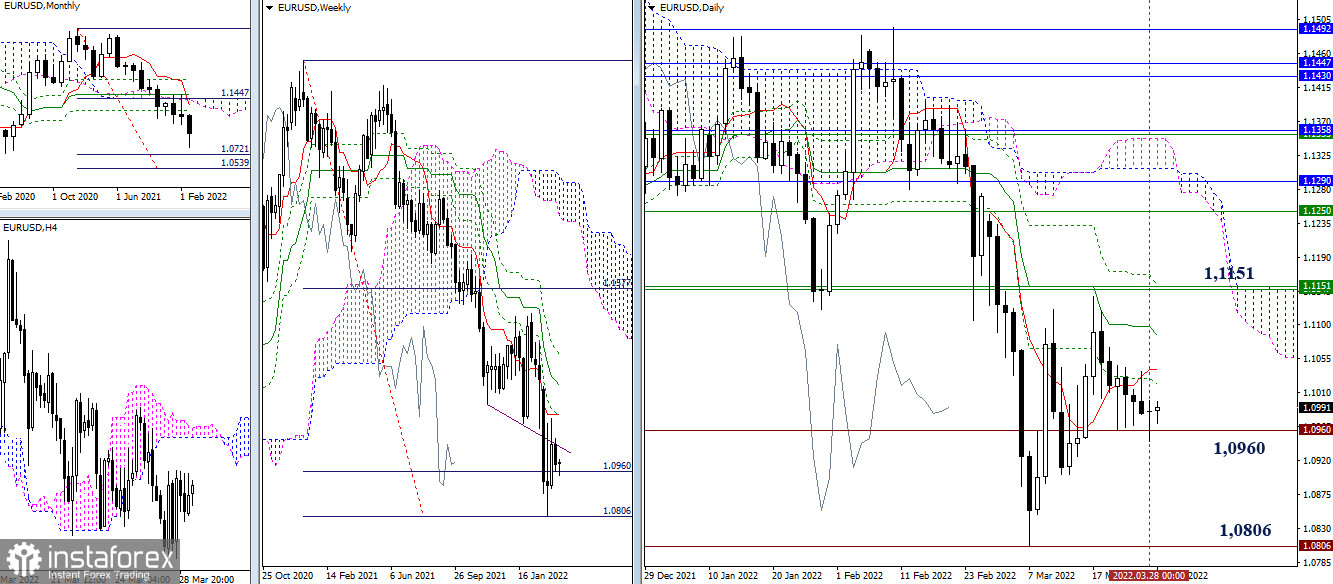

EUR/USD

Yesterday there was little movement. The pair kept the uncertainty and remained in the zone of attraction and influence of the target - 1.0960. As a result, all the main conclusions and expectations outlined earlier have retained their significance and relevance. For bulls, the most important in this area is the resistance around 1.1151 (weekly and daily levels), intermediate resistance may be provided by daily levels at 1.1020-41 and 1.1086. For bears, the main task now is to restore the downward trend by updating the minimum extremum of 1.0806 and going beyond the weekly target to the monthly target reference points (1.0721 - 1.0539).

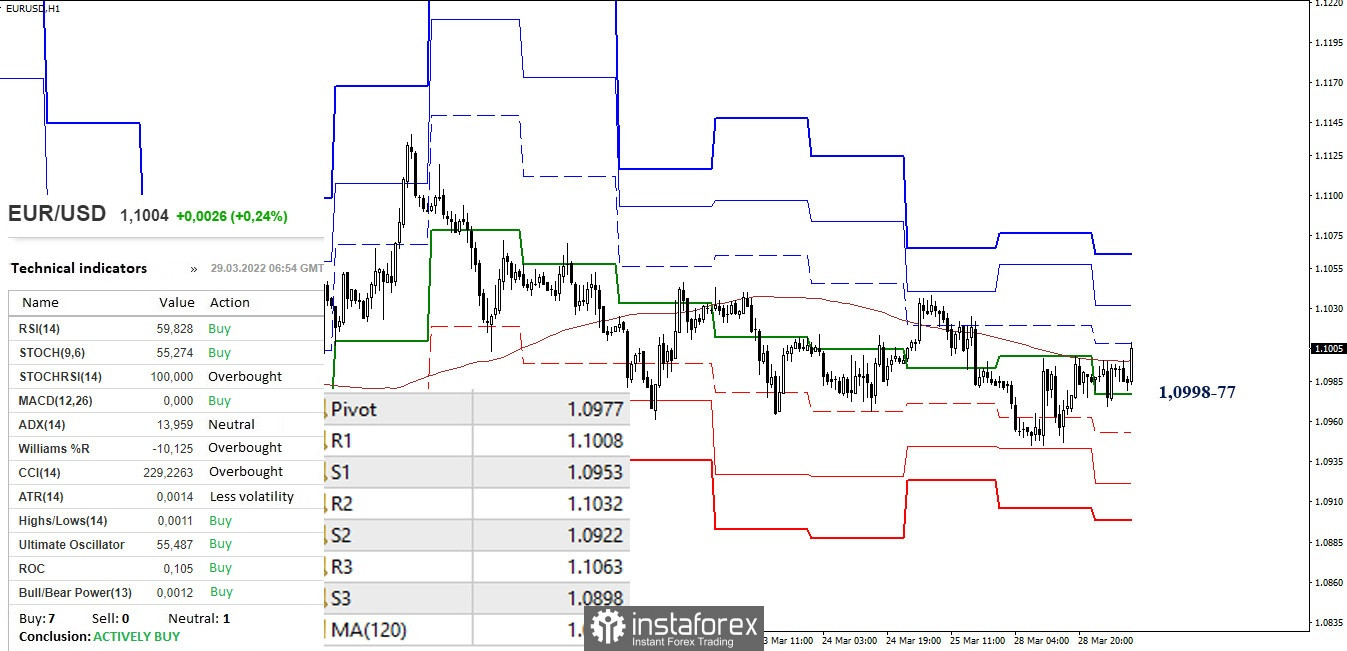

At the moment, there is another battle for the key levels on H1, which are now joining forces in the area of 1.0998-77 (central pivot point + weekly long-term trend). Consolidation and work above the levels will enhance bullish sentiment and advantages. Upward references within the day are located at 1.1008 - 1.1032 - 1.1063 (classic pivot points). Working below the key levels will give preference to bears, their reference points in the lower timeframes, in this case, will be 1.0953 - 1.0922 - 1.0898 (support for the classic pivot points).

***

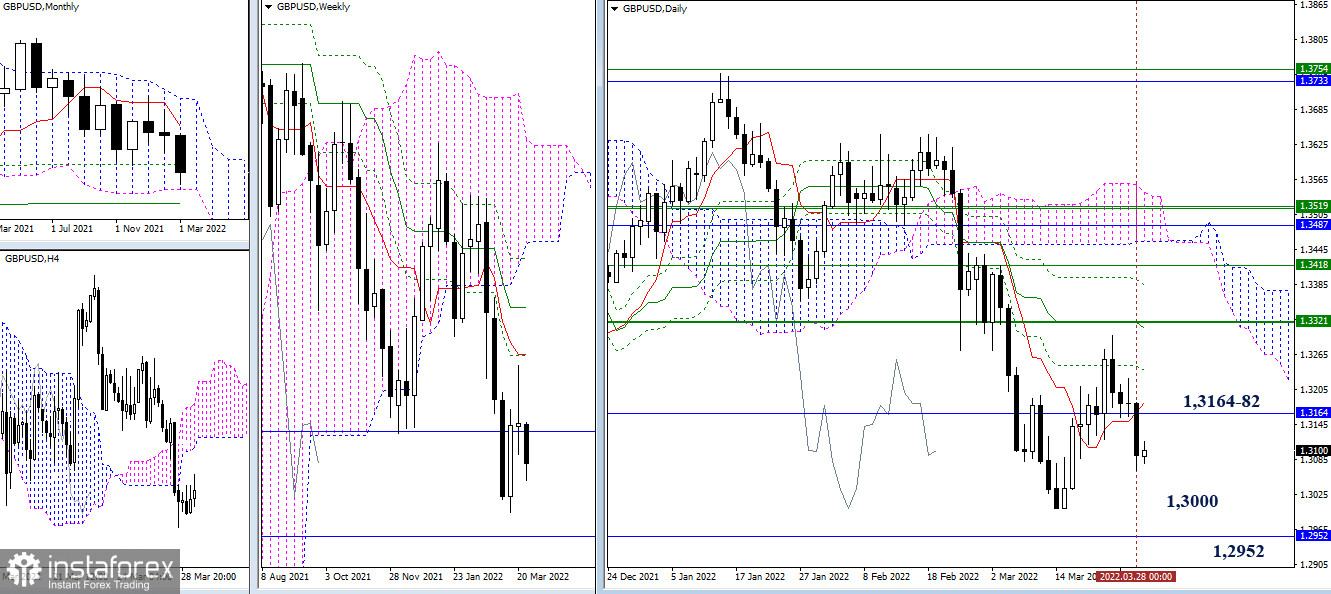

GBP/USD

The initiative yesterday was on the side of the bears. They performed a fairly effective reduction. Among the downward references in the current situation are the minimum extremum (1.3000) and the support of the lower boundary of the monthly cloud (1.2952). In case of the restoration of the bullish position, the nearest attraction and resistance today will be the area of 1.3164-82 (daily short-term trend + monthly Fibo Kijun).

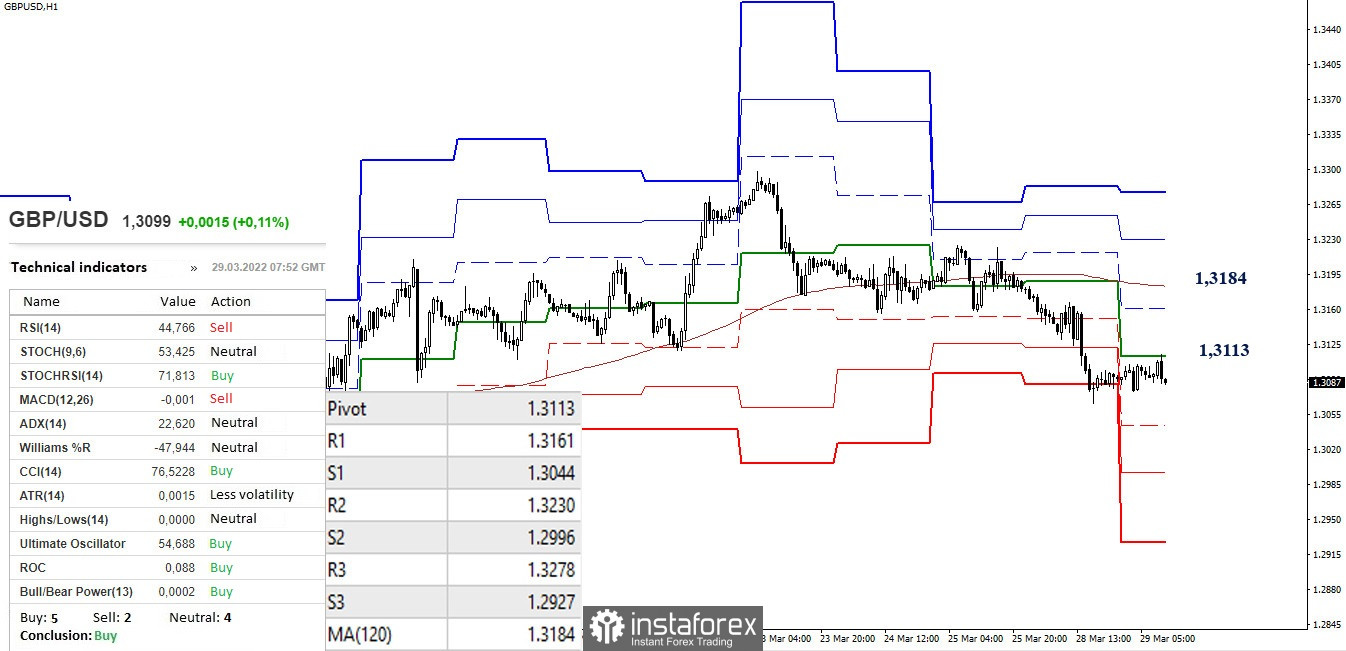

On the lower timeframes, the main advantage is now on the side of the bears. Nevertheless, the pair performed a corrective rise and is testing the central pivot point (1.3113). When leaving the correction zone and continuing the downward trend, reference points for the intraday decline will be the support of the classic pivot points, which are at 1.3044 - 1.2996 - 1.2927. If the corrective rise continues, then its next main reference point will be the resistance of the weekly long-term trend (1.3184). This level is responsible for the distribution of forces.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)