The US dollar index is trading near 12-month highs at 98.85 despite a drop that occurred during the Asian trading session today. The US dollar receives support from rising US government bond yields and from a status of a safe-haven asset because investors prefer it to other traditional hedging assets such as the Swiss franc and gold. As we know, it is rising with increasing sales of government bonds. Thus, the yield on 10-year US bonds has recently exceeded 2.50%, which is the level last seen 3 years ago.

Last week, Fed Chairman Jerome Powell confirmed the possibility of a one-time 0.50% interest rate hike. The Fed officials are planning six more interest rate hikes this year. Thus, the Fed interest rate should be at least 2% or more by the end of the year if it is raised by 0.50% instead of 0.25%.

Under normal economic conditions, a tightening of the central bank's monetary policy leads to a strengthening of the national currency. This is what most financial market participants expect from the US dollar. Nevertheless, expectations of its significant strengthening may not be justified if the Fed leaders fail to cope with the hiking inflation in the US which reached a 40-year high (the growth of the annual consumer price index (CPI) in February was +7.8%), according to the latest data.

Notably, the Fed has not raised its key rate by 0.50% since May 2000, indicating its extreme concern about accelerating inflation in the US.

The military conflict in Ukraine against the background of Western sanctions against Russia may lead to an even greater increase in energy and food prices around the world, which will cause increased inflationary pressure on the global economy.

Meanwhile, against the backdrop of geopolitical and economic uncertainty, the Australian economy looks quite resilient, which strengthens the Australian currency.

Today, the Australian government released the country's budget plan draft for the fiscal year of 2022-2023. It includes fuel tax cuts, tax relief for low- and middle-income earners, and one-time payments to nearly a quarter of the country's population to support household financial health.

The government expects the economy to grow by 3.5% in 2022-2023, with unemployment falling to its lowest level since the early 1970s and wages rising by about 3.25%. In February, unemployment in Australia fell to 4.0%, the lowest since August 2008. All the above will allow the Reserve Bank of Australia to begin normalizing monetary policy.

Immediately after the release of Australia's draft budget for 2022-2023, S&P Global Ratings affirmed Australia's sovereign rating at "AAA" with a strong outlook.

Australia's economic recovery is accelerating and the fiscal track is ahead of earlier expectations, the S&P reports.

This recovery is confirmed, in particular, by this morning's retail sales data, which added 1.8% in February. This is the second time the reading has reached such a high level in history.

AUD is strengthening in the foreign exchange market, also receiving support from rising commodity prices. Australia is known to be the world's largest exporter of coal and iron ore. Among the most important export goods of the country, there are also LNG, gold, and agricultural products. AUD is also strengthening against the US dollar, despite the fact that its position remains quite strong because of the continuing demand for USD as a safe-haven asset.

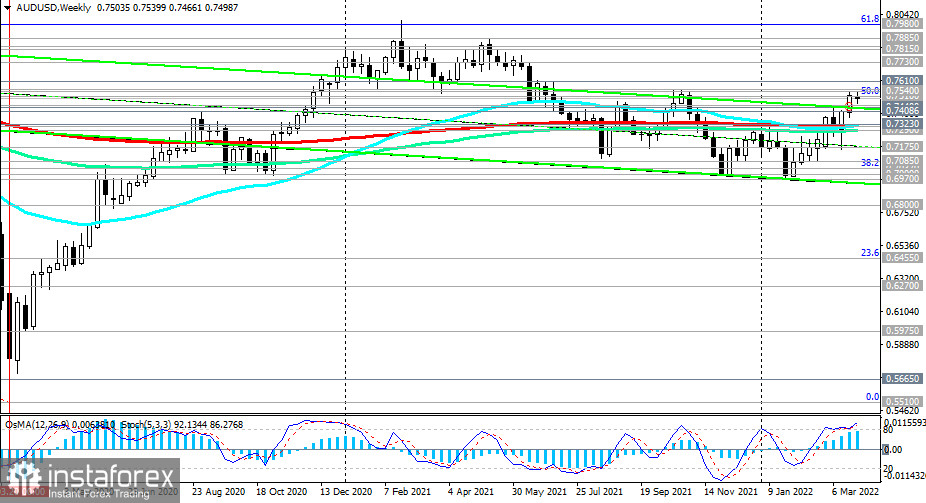

Currently, the AUD/USD pair is trading near 0.7500, maintaining an uptrend. A piercing of the long-term resistance at 0.7610 and further growth may finally bring AUD/USD into the area of a long-term bull market.

Next week, the RBA will hold a meeting. Most likely, before this meeting, the AUD/USD pair is likely to be trading near current levels, unless the US dollar does not strengthen, and the global stock and commodity markets do not have another collapse.

Technical analysis and trading recommendations

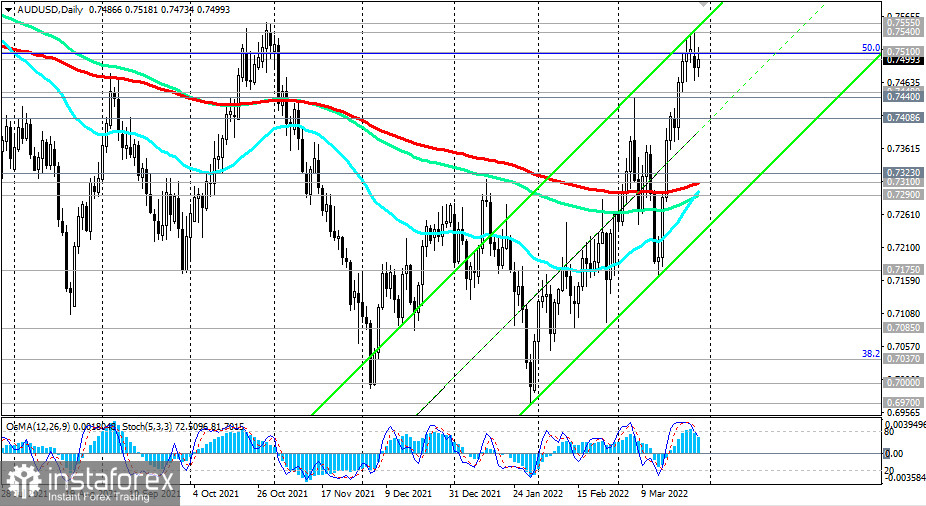

As I noted above, the AUD/USD pair is developing an uptrend, while AUD gets support from rising commodity prices, rising global stock indices, and positive macroeconomic data from Australia.

Last week, the pair closed on the upside, gaining more than 1.4%.

A breakthrough of the swing highs at 0.7540 and 0.7555 will confirm the bullish trend of the pair and is likely to send it towards the key long-term resistance level at 0.7610 (EMA200 on the monthly chart), a pierce of which further growth may finally establish the long-term bull market.

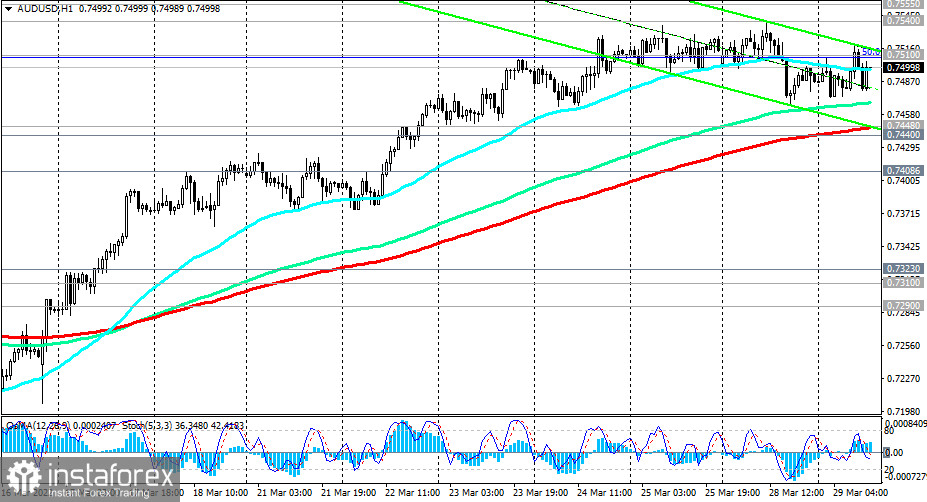

In the alternative scenario, we expect a new decline in the AUD/USD pair. A breakthrough of the local support at 0.7465 will be the first signal of a decline and a breakthrough of support at 0.7448 (EMA200 on the 1-hour chart) will confirm it.

Nevertheless, the decline to the support levels of 0.7310 (EMA200 on the daily chart), and 0.7290 (EMA144 on the daily and weekly charts) will be considered corrective.

Only their breakdown will return AUD/USD into the bear market zone.

In the current situation, long positions look preferable.

Support levels: 0.7465, 0.7448, 0.7400, 0.7323, 0.7310, 0.7290, 0.7175, 0.7085, 0.7037, 0.7000, 0.6970

Resistance levels: 0.7510, 0.7540, 0.7555, 0.7610, 0.7730, 0.7775, 0.7815, 0.7900, 0.8000

Trading Recommendations

Sell Stop 0.7460. Stop-Loss 0.7520. Take-Profit 0.7448, 0.7400, 0.7323, 0.7310

Buy Stop 0.7520. Stop-Loss 0.7460. Take-Profit 0.7540, 0.7555, 0.7610, 0.7730, 0.7775, 0.7815, 0.7900, 0.8000