Attempts to squeeze Russia out of the oil market led to instability and rising prices. This is well understood by OPEC+, which, in response to the U.S. demands to act tougher toward Russia, states that the cartel has many years of experience in managing market processes, and that the exclusion of the third producer of oil in the world from the Alliance will not allow it to effectively stabilize prices. Producing countries appear set to stick to their previous strategy of increasing production by 400,000 bpd, which, coupled with a gradual reduction in Russian exports, allows Brent to find ground after massive sales at the beginning of the week by April 1.

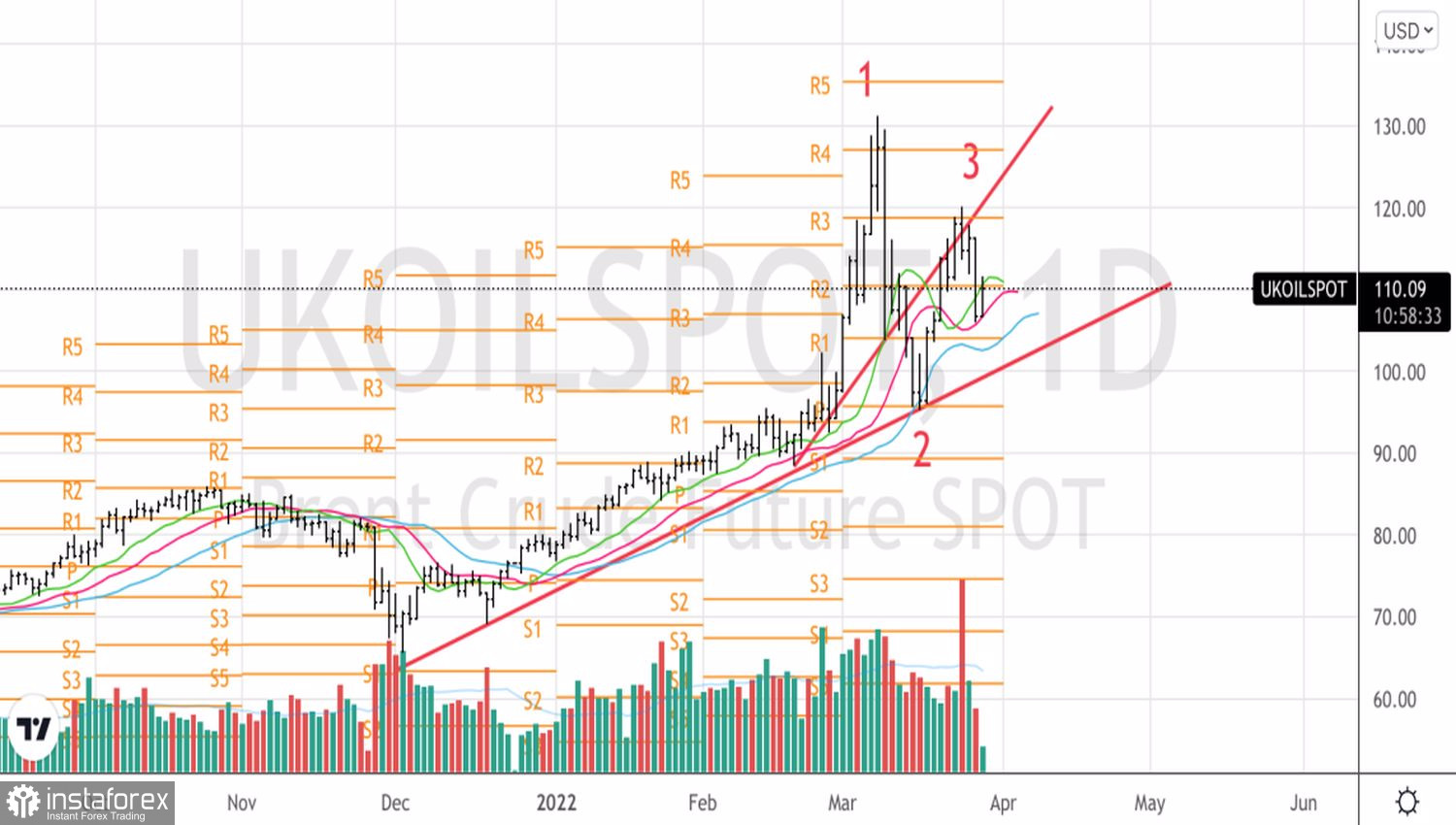

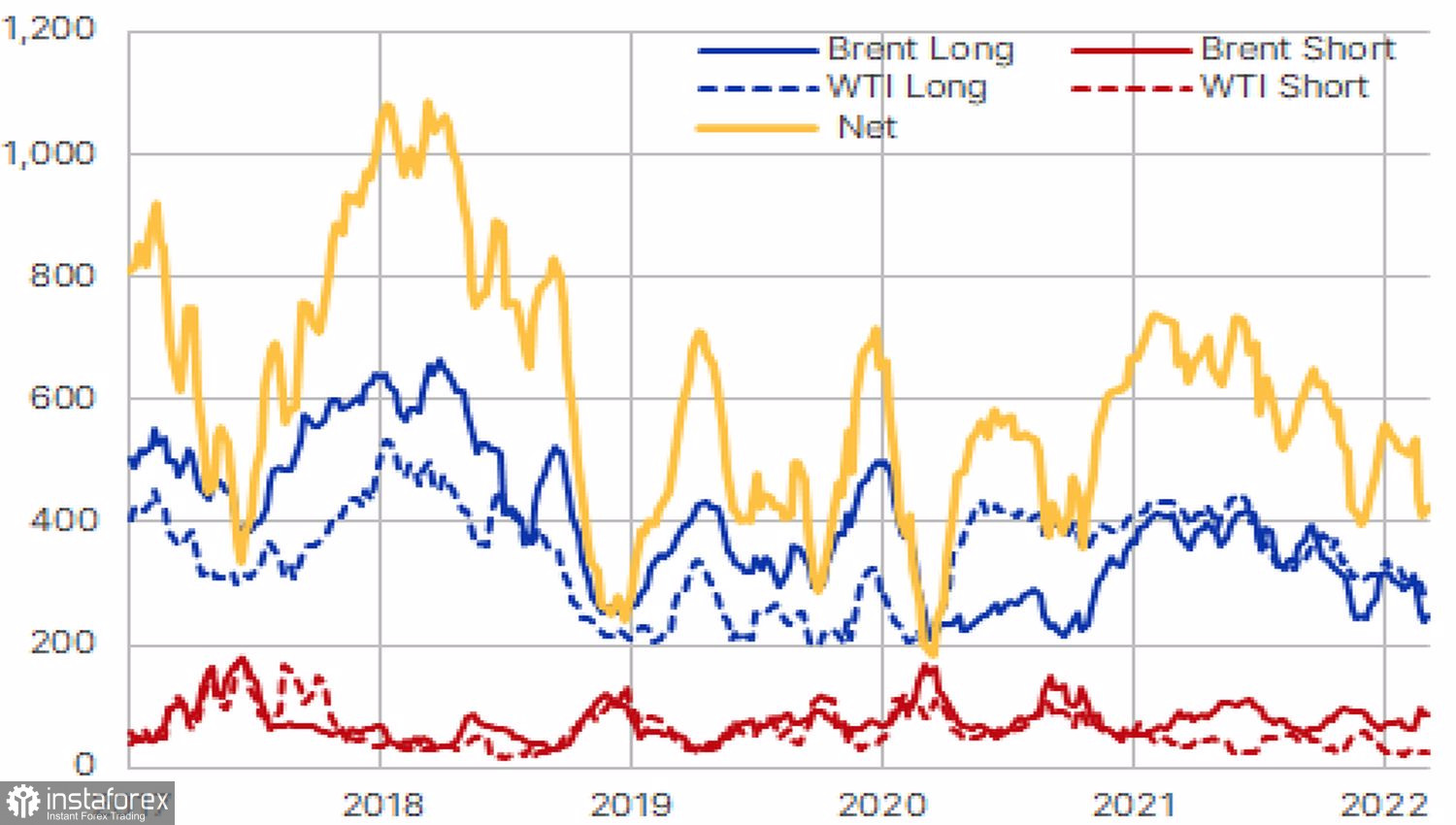

Instability and uncertainty lead to the fact that prices jump up and down. Frightened by the biggest outbreak of COVID-19 in China, hedge funds were dumping the North Sea and Texas varieties in two five-day periods by March 15 at the speed of a courier train. They were dumped from the hands of 123 lots, but a week later the speculators returned to purchasing and purchased 13,000 lots.

Dynamics of speculative positions on Brent and WTI

On March 28, a hurricane swept through the oil market again: according to Rystad Energy, the lockdown in Shanghai will lead to a reduction in global demand by 200,000 bpd. At the same time, Bloomberg notes that about 62 million people are currently or will be in isolation in the future. The numbers are decent, but the International Energy Forum, an organization based in Riyadh, estimates that Russian oil flows have fallen by 1.5 million bpd since the introduction of troops into Ukraine. UBS calls the figure at 2 million bpd. The fact that oil is usually shipped three weeks after the conclusion of the contract makes it clear that the impact of squeezing Russia out of the black gold market is only now beginning to be felt.

The news from Kazakhstan, where production at the Tengiz and Kashagan fields is declining due to the repair of the pipeline damaged by the hurricane, does not add optimism to the "bulls" for Brent.

The supply shock and continued oil demand in the U.S. and Europe at elevated levels suggest that the massive sell-off in Brent trading on March 28 has a psychological aspect as the main reason - greed, forcing hedge funds to take profits as soon as something appears. In fact, from a fundamental point of view, there is no reason to doubt the stability of the upward trend for the North Sea variety.

The strong U.S. dollar does not help sellers of oil either. It is generally believed that since oil is quoted in the U.S. currency, the growth of the USD index should be considered a "bearish" factor for it. In reality, everything looks different. Brent is influenced by supply and demand, and the dynamics of the dollar is secondary.

Dynamics of oil and U.S. dollar

Technically, the North Sea variety wanders between the trend lines of the splash and reversal with acceleration pattern. Only a drop below $99 per barrel will allow us to talk about breaking the upward trend and working out the 1-2-3 reversal model. Until this happens, it makes sense to buy Brent in the hope of its growth to $118.7 and $123.5 per barrel.

Brent, Daily chart