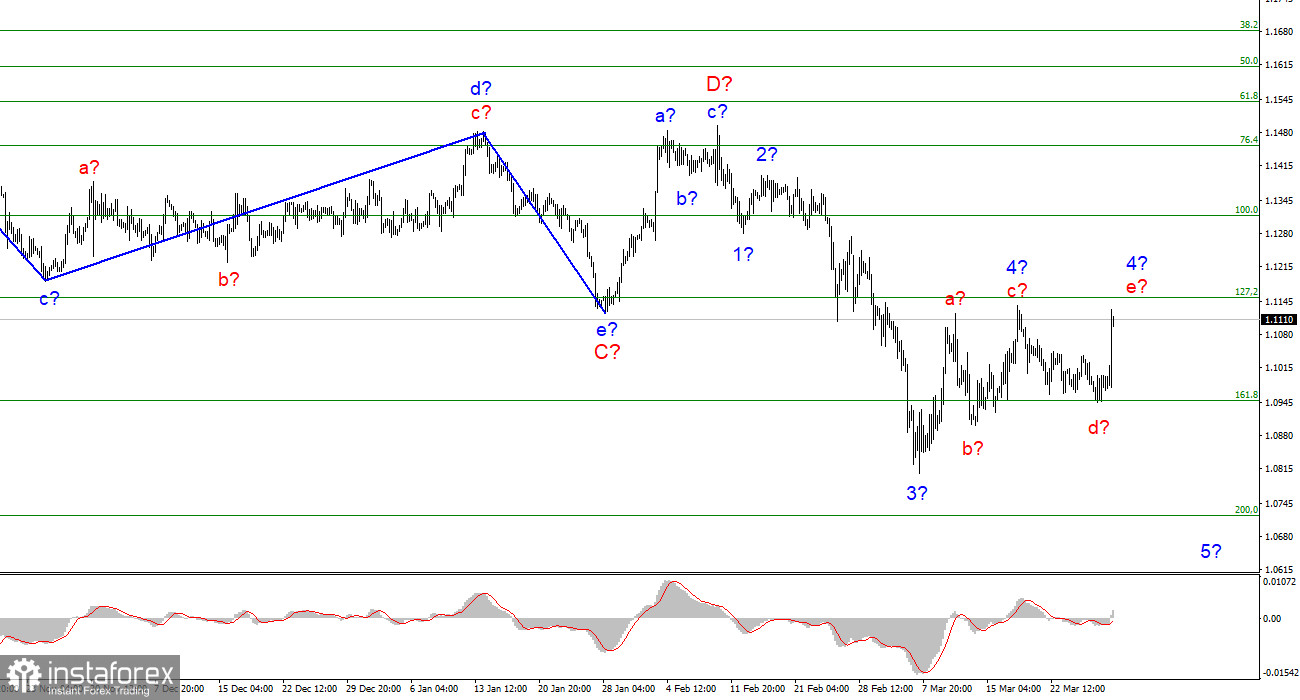

The wave marking of the 4-hour chart for the euro/dollar instrument is becoming more complicated due to today's increase in quotes. Now the proposed wave 4 can take a five-wave form and fits very poorly into the current wave layout. Nevertheless, the wave pattern still does not require drastic changes. If the construction of the proposed wave 4 still ends in the coming days, then the tool can still build the proposed wave 5 in E. If the increase in quotes continues, then the entire wave markup will require adjustments. The 127.2% Fibonacci level, near which waves a and c ended at 4, should not miss the instrument above itself. An unsuccessful attempt to break through it will signal that the market is ready for new sales of the instrument. If the decline in the quotes of the instrument ends there, then the entire wave E will take a single wave form and will be recognized as completed on March 7. Geopolitics had a serious impact on the market on Tuesday, but it may have it in the future. Therefore, I would now allow an option with the beginning of the formation of a new upward section of the trend, too.

Negotiations between Ukraine and the Russian Federation were successful.

The euro/dollar instrument rose by 140 basis points on Tuesday. Thus, the market activity was very high. There was practically no news background during the day if we look at the calendar of economic events. However, it became known yesterday that negotiations between Kyiv and Moscow will take place these days. Few people believed that they would be able to bring results. However, on Tuesday afternoon, it suddenly became known that the parties had become closer on many key issues and were approaching the signing of relevant agreements that would stop the "military operation". However, these agreements will be signed personally by Vladimir Putin and Vladimir Zelensky. And for their meeting to come to an end at all, they must be 100% coordinated. And before that, unfortunately, it is still very far away.

To date, it has become known that Kyiv is ready to provide Moscow with guarantees about non-entry into NATO, about the refusal to deploy military bases on its territory. Moscow has stated that it is not against Ukraine's accession to the European Union and is ready to abandon the idea of "denazification" and "demilitarization". In addition, the issues of Crimea and Donbas were discussed at the talks, but no clear decisions were made on them. Information has leaked that they say these issues will have to be resolved with the help of a referendum in Ukraine, at which the Ukrainian people will decide how to deal with their territories. However, it seems to me that the question "Whose Crimea?" and "Whose Donbas?" remain the main ones. Of course, the Russian and Ukrainian authorities may try to freeze the resolution of these issues for many years. Now the main thing for both sides is to stop hostilities and embark on the path of a civilized solution to the conflict situation. Then Ukraine will cease to incur catastrophic economic and infrastructural losses, and Russia will cease to collect sanctions from the whole world and will cease to incur huge financial losses. The foreign exchange market considered that it is still possible to count on peace in Ukraine, which explains the increase in demand for the euro and the pound on Tuesday.

General conclusions.

Based on the analysis, I still conclude that the construction of wave E is currently underway. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave marking assumes the construction of wave 5 in E. This option will be canceled in the event of a further increase in quotes, above the 1.1153 mark.

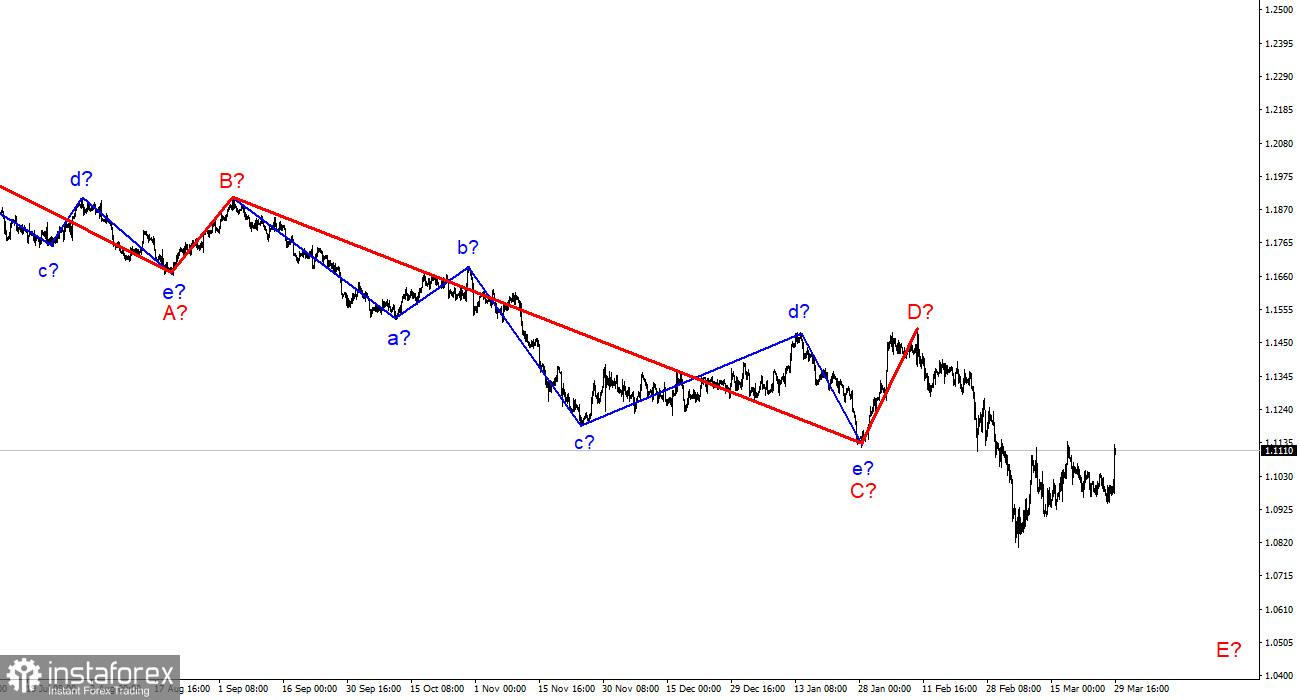

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has already updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.