Positive news from Ukraine allowed gold bulls to cling to the level of $1,900 per ounce and go on a counterattack. At first glance, this looks surprising, because it was thanks to the armed conflict in Eastern Europe that the precious metal was able to soar above $2,000 for the second time in less than two years, although it did not stay there. But if in early March the market was ruled by emotions, now it is returning to its fundamentals.

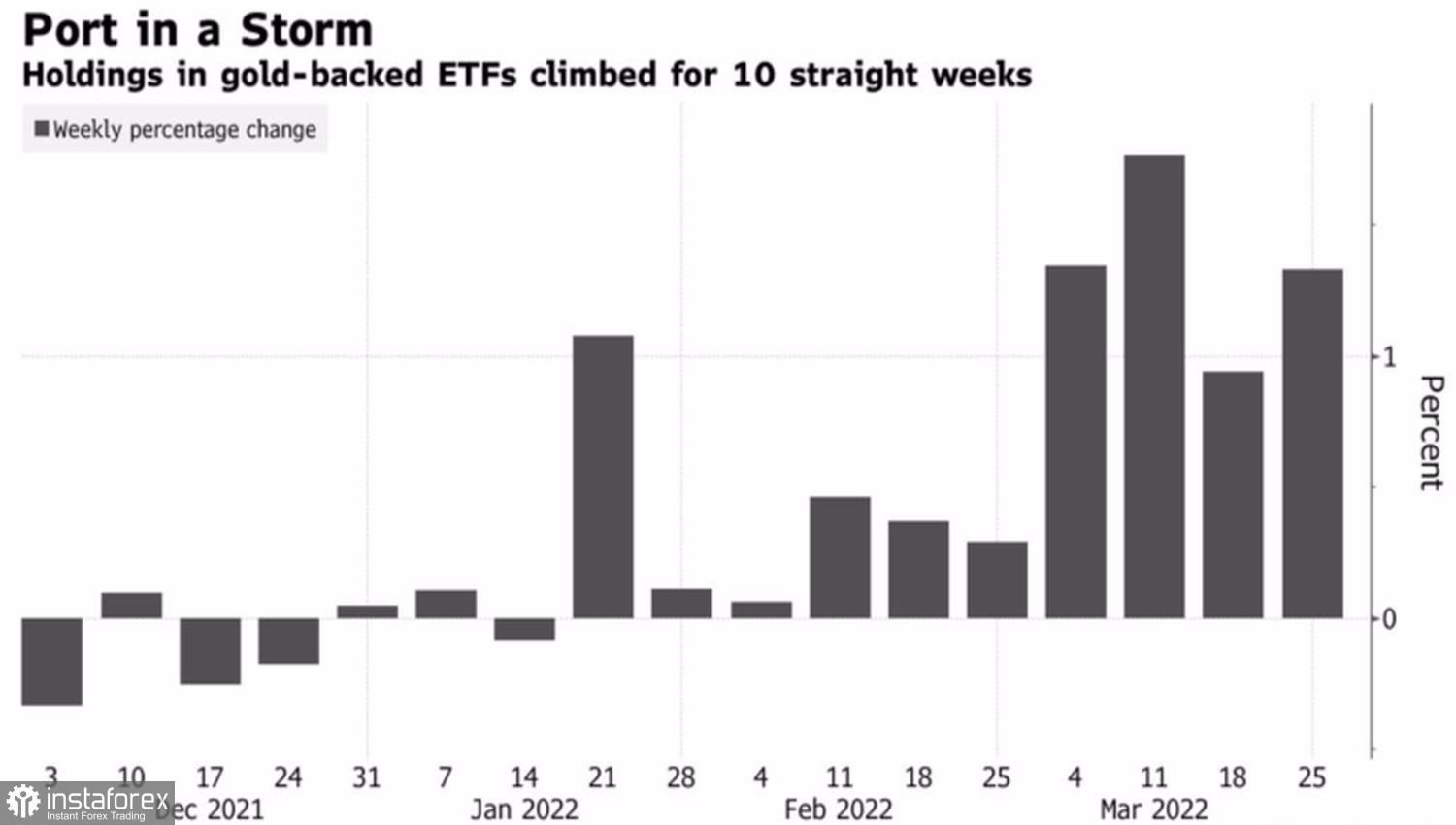

A strong dollar and skyrocketing U.S. Treasury yields are two of the factors that usually cause gold to sign a death sentence. The precious metal is quoted in U.S. currency, so the growth of the USD index, as a rule, forces investors to sell it. Gold is unable to compete with income-generating bonds, so a rally in yields is another reason to open shorts. In March, everything turned upside down. Despite the strengthening of the dollar as a safe haven asset and the rise in interest rates on debt obligations due to the aggressive "hawkish" rhetoric of FOMC members, the bulls on XAUUSD felt confident. They were called to the upside by geopolitics and the associated inflow of capital into ETFs.

Capital flows to gold-based ETFs

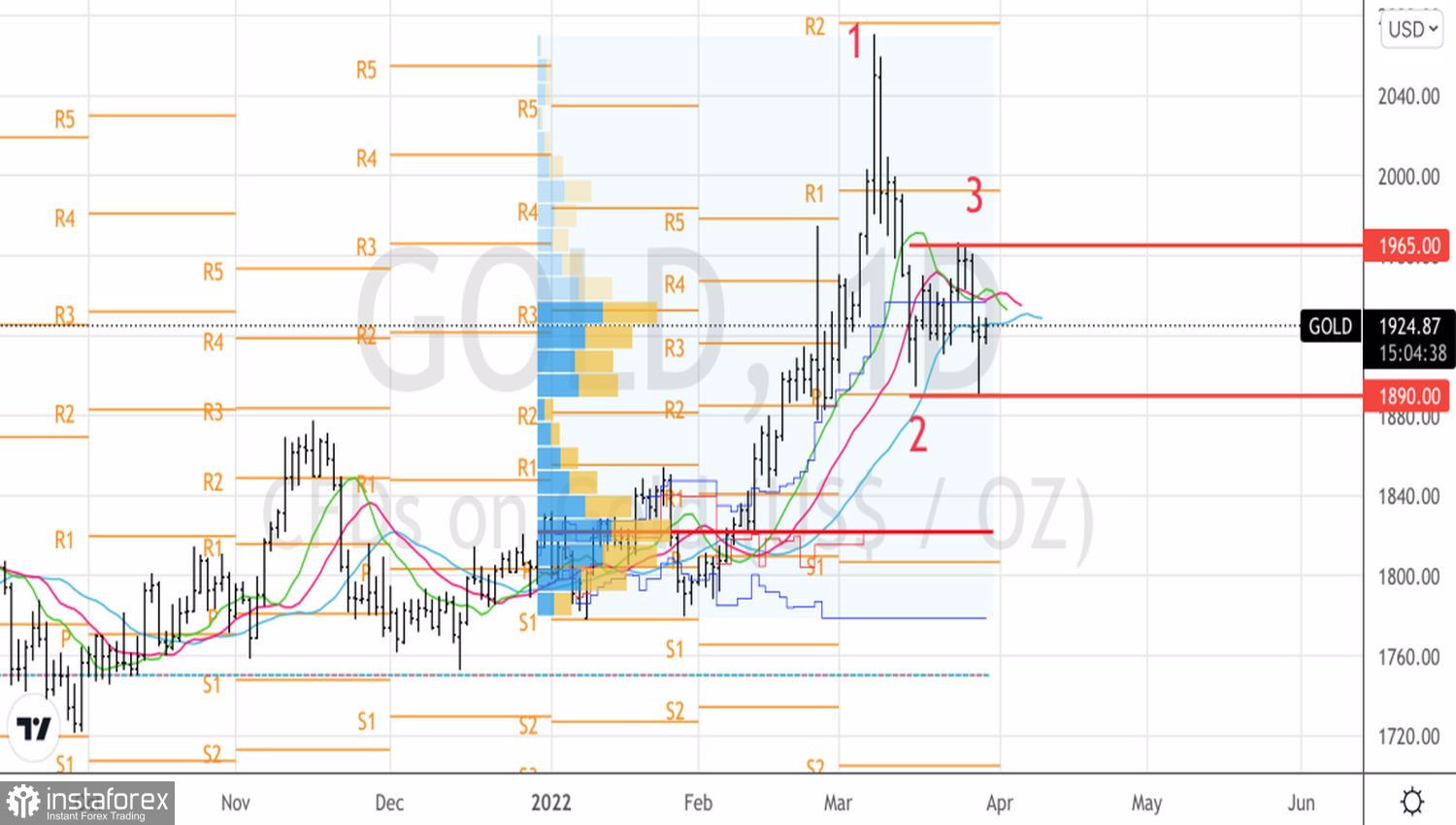

All the more curious is the rebound of gold from the lower limit of the consolidation range of $1,890-1,965 per ounce against the backdrop of reports that Russia is withdrawing troops from Kyiv and considers this a de-escalation of the conflict. At the same time, Ukraine is ready to discuss issues of its own neutrality. The USD index fell as this kind of news boosted demand for European currencies, led by the euro. U.S. Treasury yields are also off 3-year highs as investors don't trust the Russians. Moscow said the same thing on the eve of the military operation, when it allegedly withdrew troops from the borders and then crossed them. It is unlikely that the war will end there. They just change direction. Donbas will be in Russia's priorities.

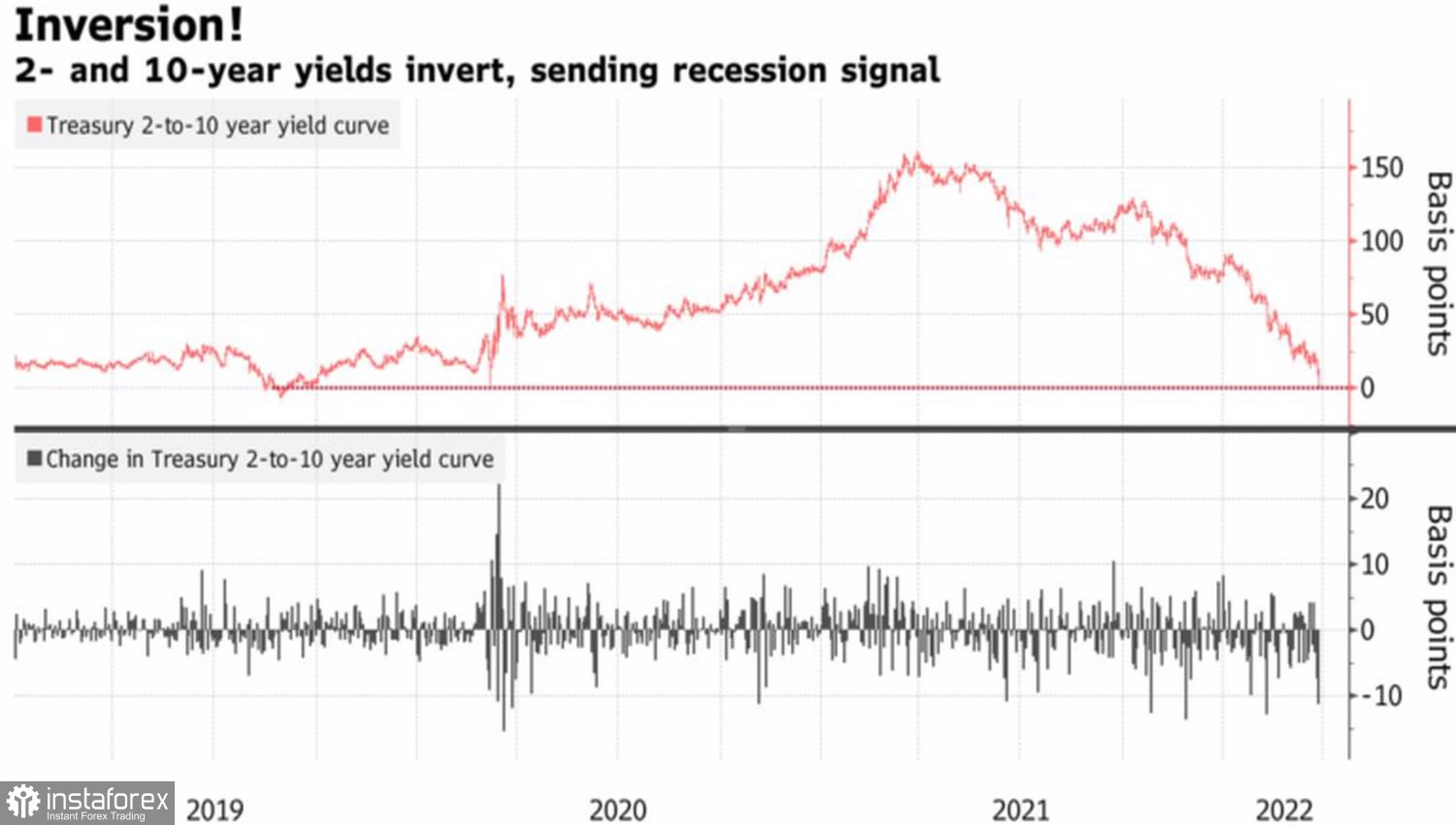

Gold is also supported by the first inversion of the yield curve since 2019 – the spread in rates on 10- and 2-year U.S. Treasury bonds. It is considered to be the first signal of an approaching recession. Three years ago, no one believed in a recession, hoping that the trade war between the United States and China would soon end. In fact, the recession did happen in 2020 due to the pandemic. In times of crisis, investors tend to seek to protect rather than increase their capital, which leads to an increase in demand for safe-haven assets, including gold.

Dynamics of the yield curve in the USA

Although the Fed believes that aggressive monetary restrictions can slow inflation in the second half of 2022, rising energy and food prices suggest otherwise. An extended period of high inflation is a boon for XAUUSD bulls.

Technically, gold has drawn a consolidation range of $1,890-1,965 per ounce as part of the Splash and Shelf pattern. Within its limits, falling prices should be used for purchases, growth – for sales. We can talk about opening medium-term positions only in case of a breakout of support at $1,890 or resistance at $1,965.

Gold, Daily chart