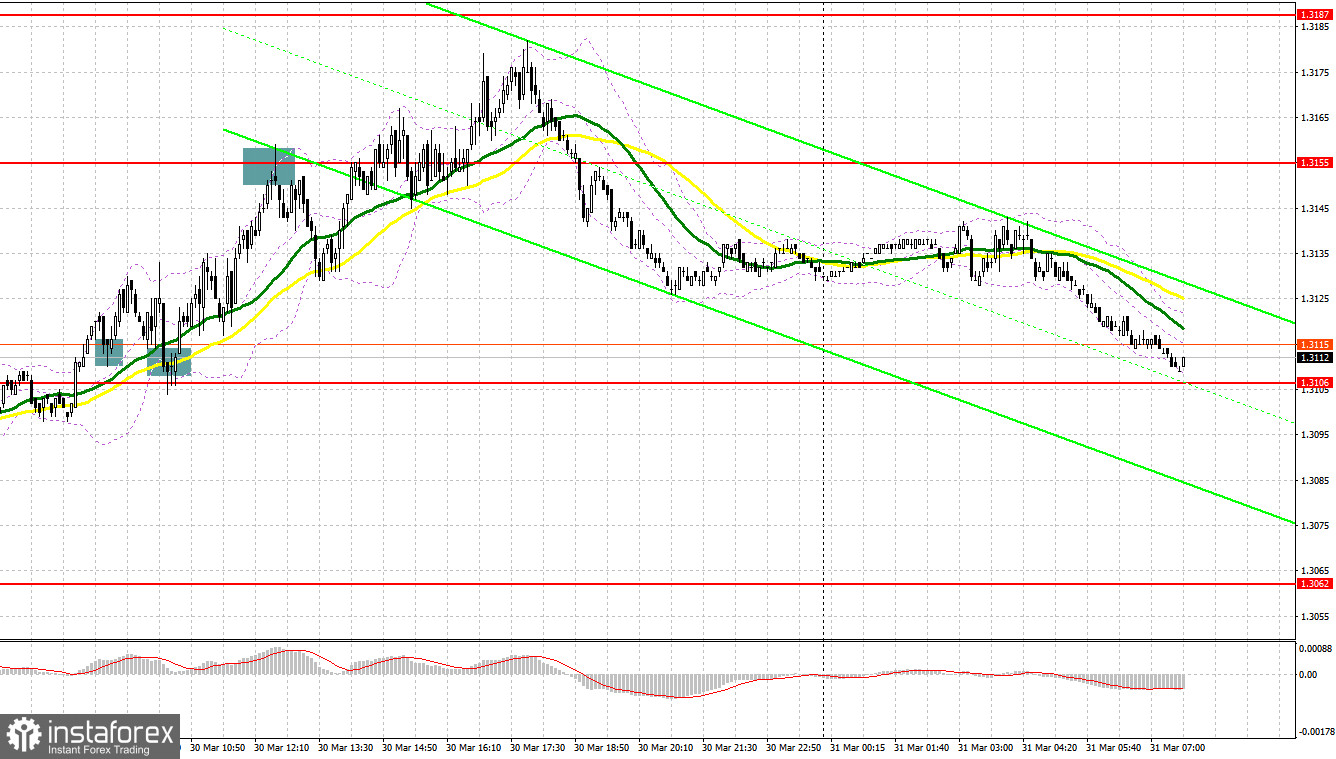

Yesterday, several excellent signals were formed to enter the market. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the level of 1.3114 and recommended in detail what to do if this price is reached. A breakout and consolidation above this range with a reverse test from top to bottom, and there were several of them at once, led to the formation of signals to buy the pound to update the maximum of 1.3155, which happened. As a result, the upward movement was about 40 points. A false breakout at 1.3155 gave a signal to sell the pound. In total, the pair went down about 20 points before the demand for the pound returned. In the afternoon, it was not possible to achieve the formation of clear signals for entering the market. And what were the entry points for the euro?

To open long positions on GBP/USD, you need:

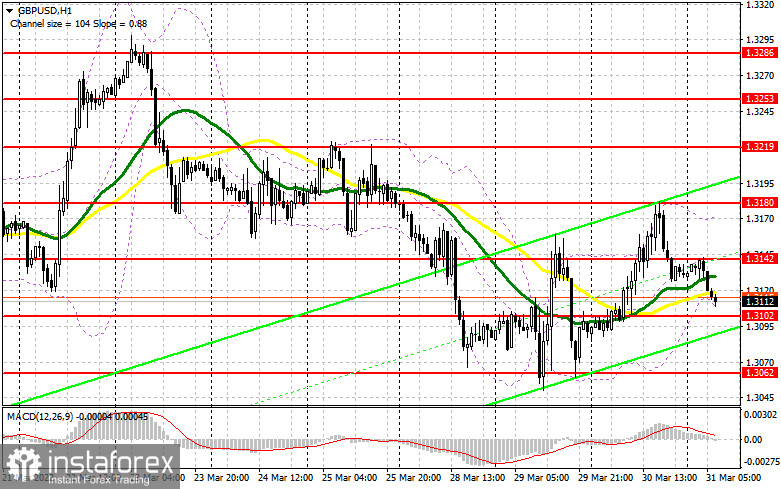

All yesterday's attempts at growth were crossed out at one point - a similar situation was the day before when during the American session there were active sales of the pair after a slight increase in the first half of the day. From a technical point of view, almost nothing has changed, but after yesterday's upward surge, the market is still on the buyers' side. Today, we have a fairly large number of fundamental statistics for the UK, which will certainly affect the direction of the British pound. Good data on changes in the volume of UK GDP and the current account balance of the balance of payments will protect the level of 1.3102, and a false breakdown will lead to the formation of a buy signal that can return GBP/USD to the resistance area of 1.3142. The breakdown of 1.3142 and the test of this area from top to bottom form an additional entry point into long positions, which will strengthen the position of buyers and open up the prospect of growth in the area of yesterday's high of 1.3180, where I recommend fixing the profits. A more distant target will be the 1.3219 area. However, it will be quite difficult to get to this level. In the scenario of the GBP/USD falling during the European session and the lack of activity at 1.3102, it is best to postpone purchases to a larger level of 1.3062. I advise you to enter the market there only if there is a false breakdown. You can buy GBP/USD immediately on a rebound from 1.3033, or even lower - in the area of 1.3003 and only with the aim of correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

Yesterday's sharp response of the bears and the fall of the pound in the afternoon indicate a difficult situation with buyers of the trading instrument. The bears are still feeling quite calm, even though the bulls are taking action to build a new upward correction of the pair. At the moment, trading is conducted in the area of moving averages, which indicates the lateral nature of the market and the active confrontation between buyers and sellers. The primary task of the bears is to protect the 1.3142 range. The formation of a false breakdown at this level will give an entry point to short positions to return to the bear market and the subsequent decline of the pair to the area of 1.3102. We will have to fight for this level since re-going beyond this range will lead to the demolition of several buyers' stop orders, which will bring GBP/USD to the lows: 1.3062 and 1.3033. A more distant target will be the 1.3003 area, where I recommend fixing the profits. If the pair grows during the European session and sellers are weak at 1.3142, it is best to postpone sales to 1.3180 - yesterday's maximum. I also advise you to open short positions there only in case of a false breakdown. You can sell GBP/USD immediately for a rebound from the maximum of 1.3219, or even higher - from 1.3253, counting on the pair's rebound down by 30-35 points within a day.

The COT reports (Commitment of Traders) for March 22 recorded a sharp increase in short positions and only a slight strengthening of long ones. Several statements made by representatives of the Federal Reserve System last week returned pressure on the British pound, which is already experiencing quite serious problems with growth due to problems in the economy, which have already led to a decline in household living standards. Experts note that the situation will only worsen, as inflation risks, which mainly negatively affect the economy, are now quite difficult to assess. High energy prices and the geopolitical situation in Ukraine, together with several sanctions from the UK and other countries - all will slow down the economy. The softer position of the governor of the Bank of England this week has already led to another sell-off of the British pound, which is likely to continue due to the lack of good news. The only thing the bulls can count on now is the positive results of the negotiations between the representatives of Russia and Ukraine and progress towards a settlement of the conflict. The COT report for March 22 indicated that long non-commercial positions rose from the level of 32,442 to the level of 32,753, while short non-commercial positions jumped from the level of 61,503 to the level of 69,997. This led to an increase in the negative value of the non-commercial net position from -29,061 to -37,244. The weekly closing price increased from 1.3010 to 1.3169.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the upper limit of the indicator around 1.3170 will act as resistance. In case of a decline in the pound, the lower limit of the indicator in the area of 1.3110 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.