Such market behavior is mostly associated with the fact that Russia has recently demanded that European countries pay for gas in rubles. The transition to rubles was scheduled for April 1. However, it is not all that simple. On March 29, the press secretary for the President of Russia said that there will be no transition to a new way of settlement on April 1 since it is a complex and time-consuming process. Allegedly, on March 31, the Russian government will only consider a bill that requires gas deliveries to be settled in rubles. Yet, along with these statements, there were also threats that in case of a refusal to pay for gas in rubles, Russia will suspend supply. This makes the whole situation even more confusing.

So, it seems that the shift to ruble settlements will take place a bit later. All this creates strong uncertainty in the market which is a favorable ground for speculations, and this is exactly the case now. The foreign exchange has been wild lately. The pound has been trading flat for the second day in a row although it is actively rising during the European session. Yet, in the US trading hours, it returns to its opening levels. At the same time, market participants completely downplay any macroeconomic data. All movements occur either before the publication of the data or long after it. In such a market, it is almost impossible to forecast the direction of the quote as it can move according to an unpredictable scenario.

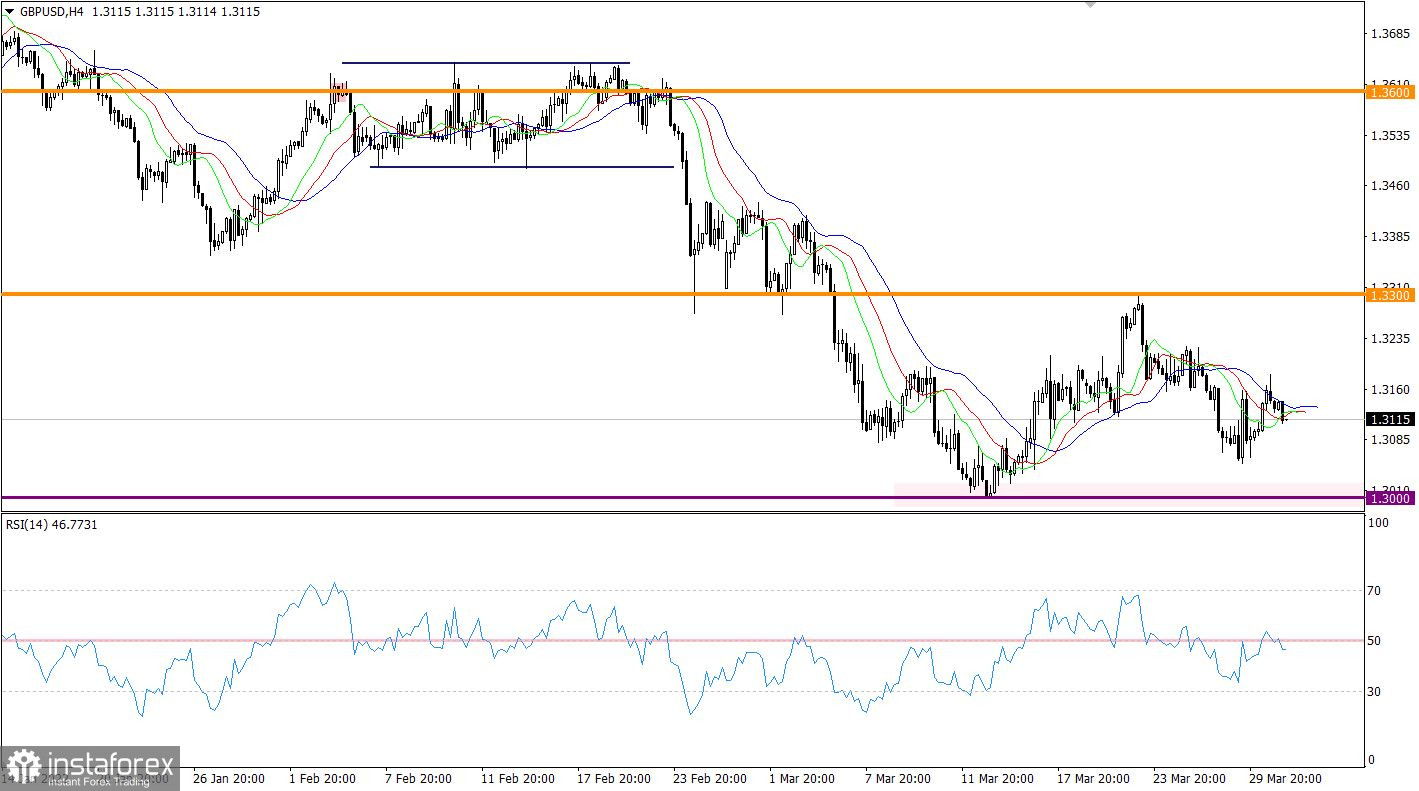

Unlike its European counterpart, GBPUSD is recovering after a correction. Recently, the quote has approached the key pivot point at 1.3000 where traders reduced the volume of short positions and caused a pullback.

The RSI is moving within the middle line of 50 on the four-hour chart which indicates a flat movement. RSI on D1 is moving in the lower area, signaling a high selling interest in the market.

The moving averages of the Alligator Indicator on H4 cross each other, confirming a flat movement. Alligator on D1 is signaling a downtrend while its MAs are moving downwards.

On the daily chart, the US dollar is regaining ground after a recent correction. The level of 1.3000 serves as the main support for the pair.

Outlook:

Currently, the recovery process of the US dollar after a correction is still relevant. To complete the correction and continue the medium-term downtrend, the quote needs to stay below the psychological level of 1.3000 and then test the level of 1.2950. Otherwise, the existing recovery process may give way to a sideways movement.

Complex indicator analysis shows a mixed signal on the short-term and intraday time frames due to the flat market. In the medium term, indicators generate a sell signal as the downtrend remains in place.