Technical factor matters

While I have already revised upwards my forecast for the euro/dollar pair, many analysts at large commercial banks still see a downtrend for the pair. But I doubt that this is true. From a fundamental point of view, the upside of the US dollar against the euro is quite logical. However, I think that these factors have already been taken into account or they are simply downplayed by traders.

According to forecasts, soaring energy prices and Russia's special military operation in Ukraine may considerably limit the economic growth of the euro zone. In addition, the inflation rate is likely to rise even more. In this situation, the European Central Bank (ECB) may either tighten its monetary policy or start stimulating the economy. This is the main concern for investors right now. The regulator is largely expected to choose the second option. If so, the US dollar will have a significant advantage over the euro, especially given the rate hike by the Fed. However, when the Fed raised the rate by 25 basis points, EUR/USD unexpectdely went up.

So, it is not a good idea to predict the future direction of the pair based only on the difference in the monetary policy of the ECB and the Fed, as well as the difference in the economies of the two countries. We should always keep in mind the importance of the technical factor. Yesterday, ECB President Christine Lagarde said that more time was needed to stabilize the supply chain, while rising fuel and food prices would lead to even higher inflation. Her statements once again prove that the ECB takes a wait-and-see stance, hoping that everything will change over time. At the same time, ECB's representative Holzmann expressed a more hawkish view on the situation. In his opinion, high inflation will eventually force the regulator to raise interest rates although a bit later. As I have already mentioned in my previous reviews, market players expect the ECB to raise the rate once or even twice this year. It could be that the current growth of the euro against the US dollar is fueled by such market expectations.

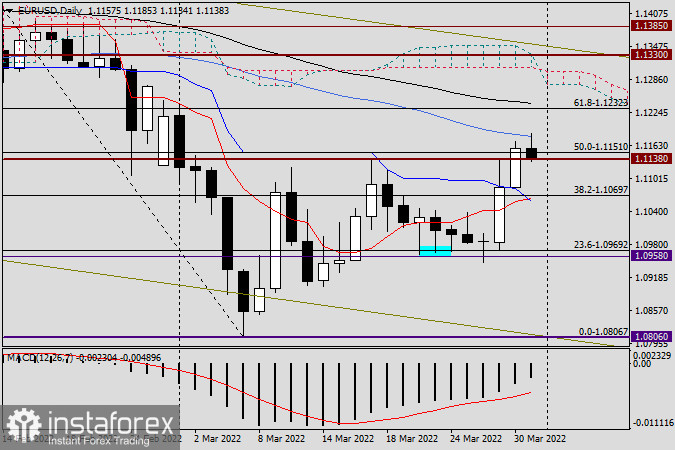

Daily chart

On March 30, the EUR/USD pair continued to trade within the uptrend. It was hardly surprising given the previous large breakout formed by the bullish candlestick. So, in the course of its bullish run, the euro/dollar pair managed to break through the strong resistance level of 1.1138 and closed yesterday's trading above this mark. It may be too early to talk about a true breakout as the quote still needs to consolidate above the level of 1.1138. Today is the last day of the month, so market participants will fight fiercely for the closing price of March. A close above 1.1138 and other strong technical levels of 1.1150 and 1.1180 will definitely confirm the further growth of the pair. By the way, the 50-day MA is located at 1.1181 and is now blocking the way for bulls towards higher targets. If the pair closes the day above the 50-day MA, this will confirm the persistence of the euro bulls. If a reversal candlestick pattern appears below this moving average, the quote is likely to pull back to the area of 1.1070-1.1060 where the red Tenkan line and the blue Kijun line of the Ichimoku indicator are located.

I think that the EUR/USD pair will follow a bullish scenario. In case of breaking through the 50-day MA, its closest target will be the price area of 1.1200-1.1240. By the way, the black 89 EMA coincides with the level of 1.1242. Therefore, if this assumption is true, the pair's next target will be the 89 EMA. Based on the technical analysis, I prefer to buy the pair, at least for now. In a risky approach, you can open long positions from the current levels. But to avoid the risk, it is better to wait until the monthly session is over and the 50-day MA is broken through. Then you can enter the market. As for the economic calendar, I recommend paying attention to US data on initial jobless claims, as well as to the personal consumption expenditures price index and changes in personal monthly income and spending. And do not forget about the nonfarm payrolls on Friday.

Good luck!