In today's article on the AUD/USD currency pair, we will summarize the results of the last week's trading, consider the prospects for the current five-day trading period, and, of course, will again touch on the monetary policy of the Reserve Bank of Australia (RBA) and the Federal Reserve System (FRS). Let's start with the last one. I believe it's no secret that the Fed intends and has already begun to tighten its monetary policy. In the current situation, analysts are vying with each other to put forward their forecasts regarding the number of Fed rate increases on federal funds this year. It should be noted that opinions differ. Some analytical departments of large commercial banks, for example, do not exclude that in 2022 the US Central Bank may raise the rate 6 or even more times. In my personal opinion, such expectations are too high, which creates downside risks for the US dollar if they are not reflected in the actual actions of the Fed. Against this background, the RBA's position looks much more "dovish".

The Australian Central Bank mostly takes a wait-and-see position and hopes that the inflationary pressure that has engulfed all the leading economies will eventually weaken. Most likely, this will happen over time. However, it is completely unclear how much time it will take for inflation to return to the target levels of the regulator. Meanwhile, the economic situation in Australia is quite good. There is a demand for labor in the country, consumer demand is also quite high. Perhaps the only fly in the ointment is consumer confidence indicators, which have deteriorated slightly in recent months. Nevertheless, the quite stable economic situation in Australia, as well as the acceptable state of the economy, allow the RBA to adopt a tougher monetary policy and curb soaring inflation to begin the process of raising rates. However, as noted above, the RBA takes a patient position, which in comparison with the Fed's rate, it would seem, should have played in favor of the US dollar.

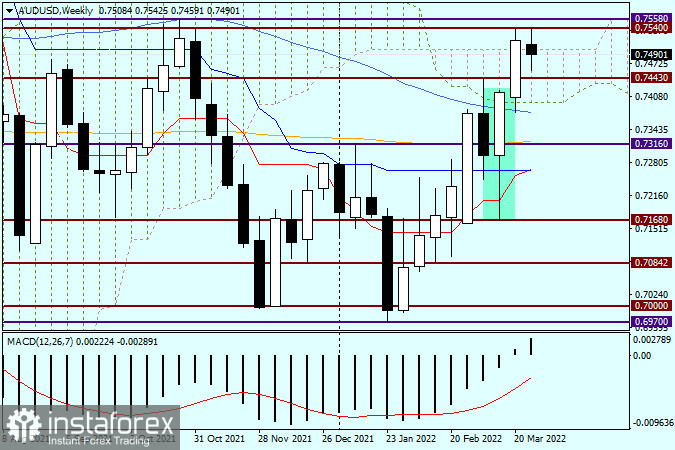

Weekly

However, as can be seen on the weekly price chart, not everything is so unambiguous and simple. The previous two weeks of fairly strong growth clearly showed the desire of the pair to move in a northerly direction. I would especially like to mention the week before last with a very long lower shadow, which clearly shows that then, during trading on AUD/USD, there was a sharp change in market sentiment. As a result of that growth, the pair broke through the 50-simple and moving average and closed the week within the Ichimoku indicator cloud. Thus, last week there were all technical grounds to assume continued growth. And it happened. The pair went up from the weekly Ichimoku indicator cloud, which only confirmed the high probability of further implementation of the bullish scenario. However, at the auction of the current five-day trading period, growth has stopped, and at the time of completion of the article, the "Australian" is trading with a slight decrease. The reason for this was the strong resistance of sellers, which the pair encountered near the 0.7540 mark. I fully admit that the market has pulled back to the broken upper boundary of the cloud, as well as the most important psychological mark of 0.7500, which coincide.

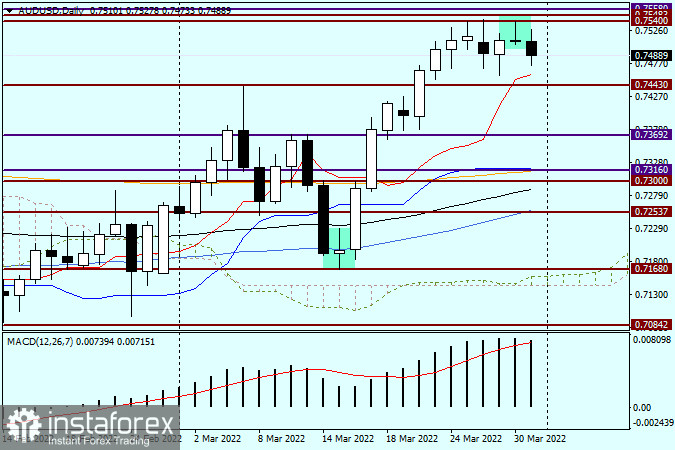

Daily

On the daily chart, yesterday's candle of the Doji variety, which is more perceived as a reversal model of the "Tombstone" candle analysis, can also be perceived as the completion of a downward scenario and a trend change. In any case, everything will be decided tomorrow, when the US labor market data for March will be published. I believe that the future fate of the US currency will largely depend on the actual indicators. Strong data will strengthen the market's confidence that the Fed will raise the rate at almost every meeting. If the labor reports bring disappointment to the market, then aggressive sales of the US currency will begin after it, as investors will have concerns that the Fed will slow down and slow down the process of raising rates a little. Taking into account the not quite definite technical picture of AUD/USD, as well as tomorrow's Nonfarm Payrolls, I suggest taking a wait-and-see position on "Aussie" for now. At least until the publication of tomorrow's labor reports from the United States.