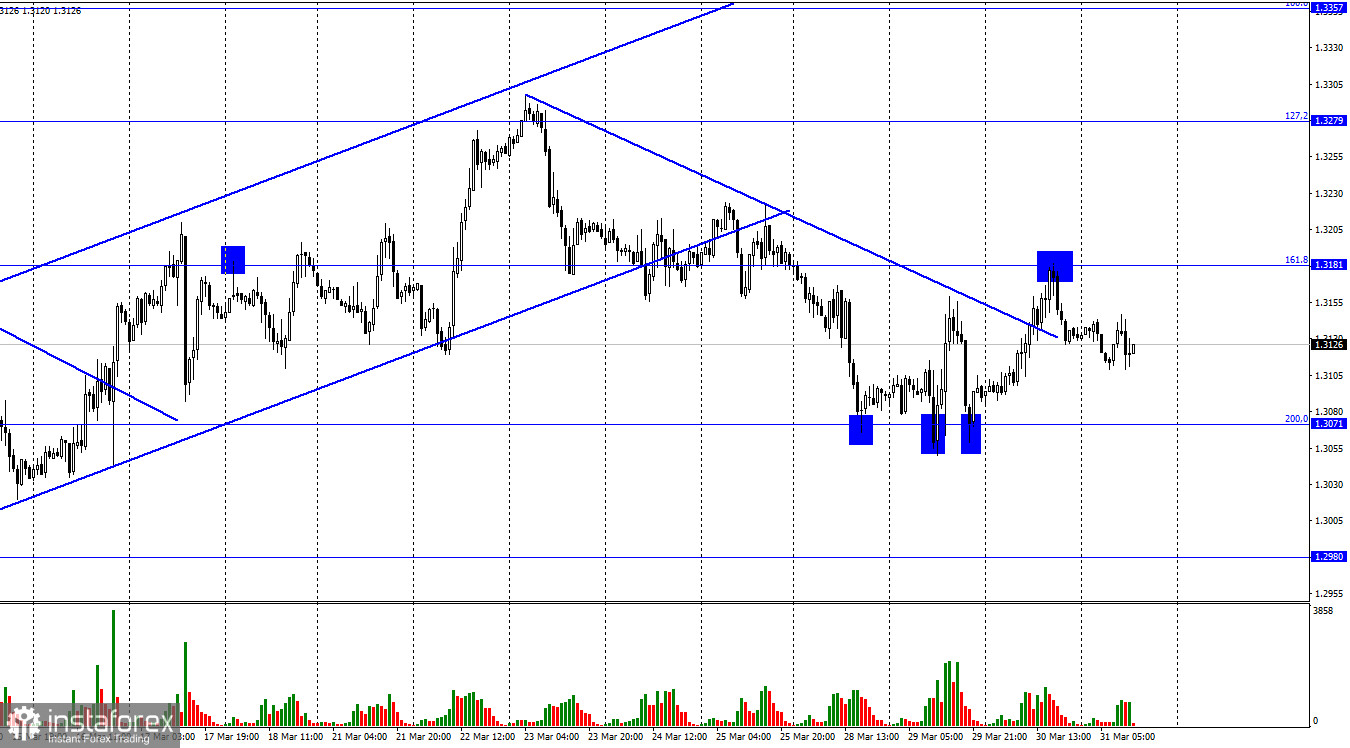

According to the hourly chart, the GBP/USD pair on Wednesday performed an increase to the corrective level of 161.8% (1.3181), rebound from it, a reversal in favor of the US currency, and began a new process of falling towards the Fibo level of 200.0% (1.3071). The rebound of quotes from this level will allow us to count on a reversal in favor of the British and some growth in the direction of the corrective level of 161.8% (1.3181). Fixing the pair's rate at 200.0% will increase the chances of continuing the fall towards the next level of 1.2980. Yesterday was quite interesting in terms of information. In the US, a report on GDP in the fourth quarter was released, which turned out to be slightly worse than traders' expectations. At the same time, the ADP report on the change in the number of employees (analogous to Nonfarm Payrolls) exactly met expectations but turned out to be worse than the value of the previous month. Thus, the fall of the American dollar in the afternoon would be a logical development of the situation, but instead, the dollar began to show growth.

Today, the UK has already released a report on GDP for the fourth quarter, which turned out to be better than traders' expectations and amounted to +1.3% q/q and 6.6% y/y. However, the Briton did not feel a special surge of strength today. I think that economic reports are interesting and important now, but traders show their willingness to pay attention only to geopolitics. Bull traders failed to break through the 1.3181 level, and in general, the British dollar has not grown very much over the past two days. Given that optimism about the Ukrainian-Russian negotiations has greatly decreased today, the British and the European can resume the fall. Now bear traders need to close at 1.3071, from which the rate fought off three times on Monday and Tuesday. The Briton will get new chances for growth only above the level of 1.3181, but today it is not necessary to count on the support of the information. In America, all reports will not be the most important, and today and yesterday traders ignored two reports on GDP, which cannot be called "unimportant".

On the 4-hour chart, the pair may resume falling to the corrective level of 76.4% (1.3044). The rebound of the pair's quotes from this level will allow traders to count on a reversal in favor of the British and some growth in the direction of the corrective level of 61.8% (1.3274). Fixing the pair's exchange rate below the 76.4% level will increase the probability of a further fall in the direction of the next Fibo level of 100.0% (1.2674).

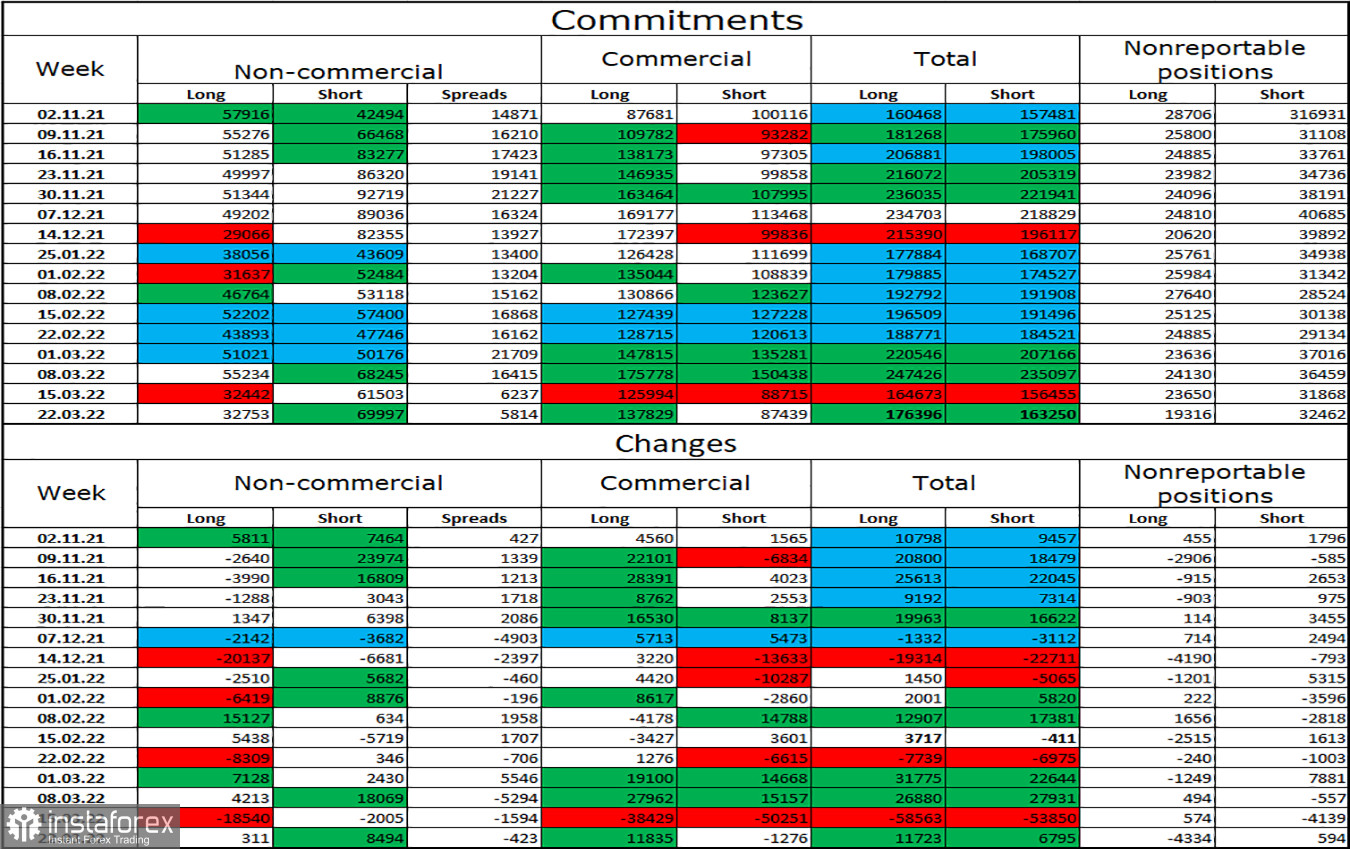

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts increased in the hands of speculators by only 311, and the number of short contracts increased by 8494. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators already corresponds to the real state of things - there are twice as many longs. The British dollar is falling, and the big players are selling the pound more than buying it. Thus, I expect the pound to continue its decline. This can be seen both based on geopolitics and the basis of the COT report.

News calendar for the USA and the UK:

UK - change in GDP (06:00 UTC).

US - change in the level of spending of the population (12:30 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

On Wednesday, the calendars of US and UK economic events do not contain important entries. I believe that the influence of the information background will be absent today since even the GDP report did not affect the mood of traders.

GBP/USD forecast and recommendations to traders:

Sales of the British dollar are now possible with a target of 1.3071, as a rebound from the level of 1.3181 was performed on the hourly chart. New sales - at the close under the level of 76.4% (1.3044) on the 4-hour chart with a target of 1.2980. I recommend buying the British when rebounding from the 1.3071 level on the hourly chart with a target of 1.3181.