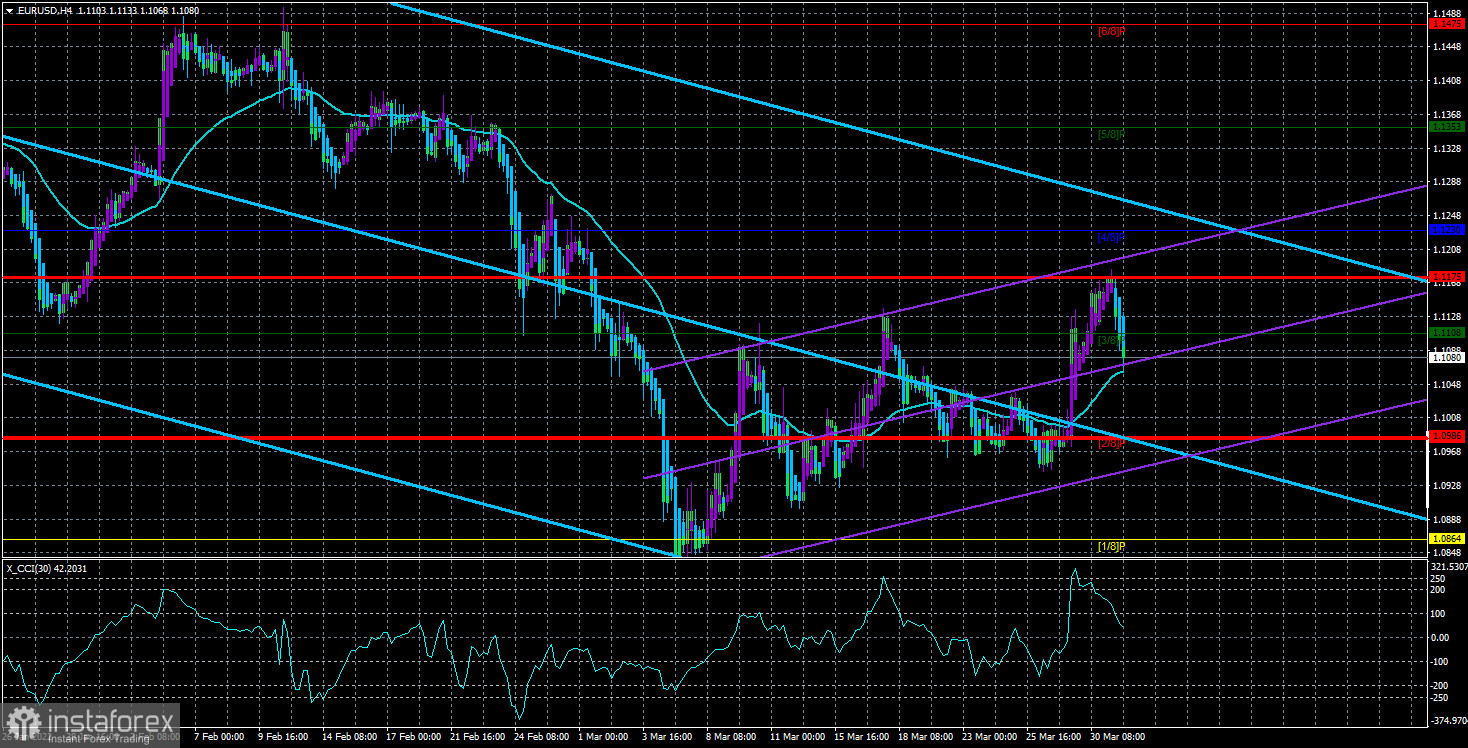

The EUR/USD currency pair began to decline towards the moving average line on Thursday. At the moment, this decline cannot be called strong, but several factors favor the fact that the euro will fall in the coming days. And there are also a huge number of factors that indicate a new fall in the euro in the medium term. Let's start with the first ones. Starting from March 7, the European currency is adjusted. There is no doubt that this is a correction since at the moment the pair managed to grow only by 50% from the previous round of the fall (which was far from the first). We see in the illustration above several turns of growth, each of which ended with a strong pullback down. Thus, this segment no longer pulls on a new upward trend. Second, the last round of growth occurred after the interim results of the meeting of the negotiating groups of Russia and Ukraine in Turkey became known. It happened on Tuesday. According to Dmitry Kuleba and Vladimir Medinsky, some progress has been made towards signing a peace agreement. However, the markets considered this information as the signing of a peace agreement possible in the next few days.

We have already said in previous articles that no important decisions were made in Turkey, and the concepts of "breakthrough in negotiations" or "progress" are very stretched. For example, by a certain point, Ukraine and the Russian Federation managed to reach a consensus on 10% of the issues. Then significant progress was made and now there are 20% of such issues. Progress? Progress. Is there a possibility of concluding a peace agreement in the near future? No. Moreover, military operations continue to be conducted in Ukraine all this time. The withdrawal of troops from Kyiv and Chernihiv is being talked about only in the Russian media, in reality, nothing like this is observed. And even if the withdrawal of troops does begin, it can be a simple redeployment or replacement of personnel. Russia also says that in the near future they will concentrate their military presence in the Donbas, so even if troops are withdrawn from Kyiv, the military operation will continue with the same intensity in the Donbas. What kind of truce is possible here in the near future?

Medium-term factors of the fall of the European currency.

Now let's look at the more global factors of the fall of the euro. Everything is simple here since these factors have not changed over the past month. The first factor is the difference between the monetary policies of the ECB and the Fed. And every new statement by Christine Lagarde or Jerome Powell only exacerbates this difference. Lagarde's every speech is a confirmation that the European economy is too weak at the moment, and raising rates with such weak economic growth is suicide. Each new statement by Powell assures the market that the Fed will raise the key rate for the whole of 2022 and, in the worst case, will raise it only by 0.25% each time. And in the best case, there will also be several increases of 0.5%. Naturally, the tougher monetary policy becomes, the stronger the national currency, since the rate hike itself means the "overheating" of the economy and the need to cool it down. Now inflation is more important, which is growing based on all the factors available to it, but the meaning of the Fed's actions remains the same.

Well, the second factor is the factor of geopolitics. As we said above, there is now no reason to say that the entire military conflict between Ukraine and Russia will end in the next couple of weeks or at least months. Moreover, it has every chance to move to the "Donbas 2.0" stage in the next few years. After all, how the parties are going to negotiate on the LPR and the DPR is completely unclear. These "people's republics" may declare independence from Ukraine and join Russia, but Kyiv insists on restoring the borders of Ukraine of the 1991 model and does not make concessions on this issue. Thus, even if there are only a few "stumbling blocks", and not a whole dump truck, it can still stall negotiations.

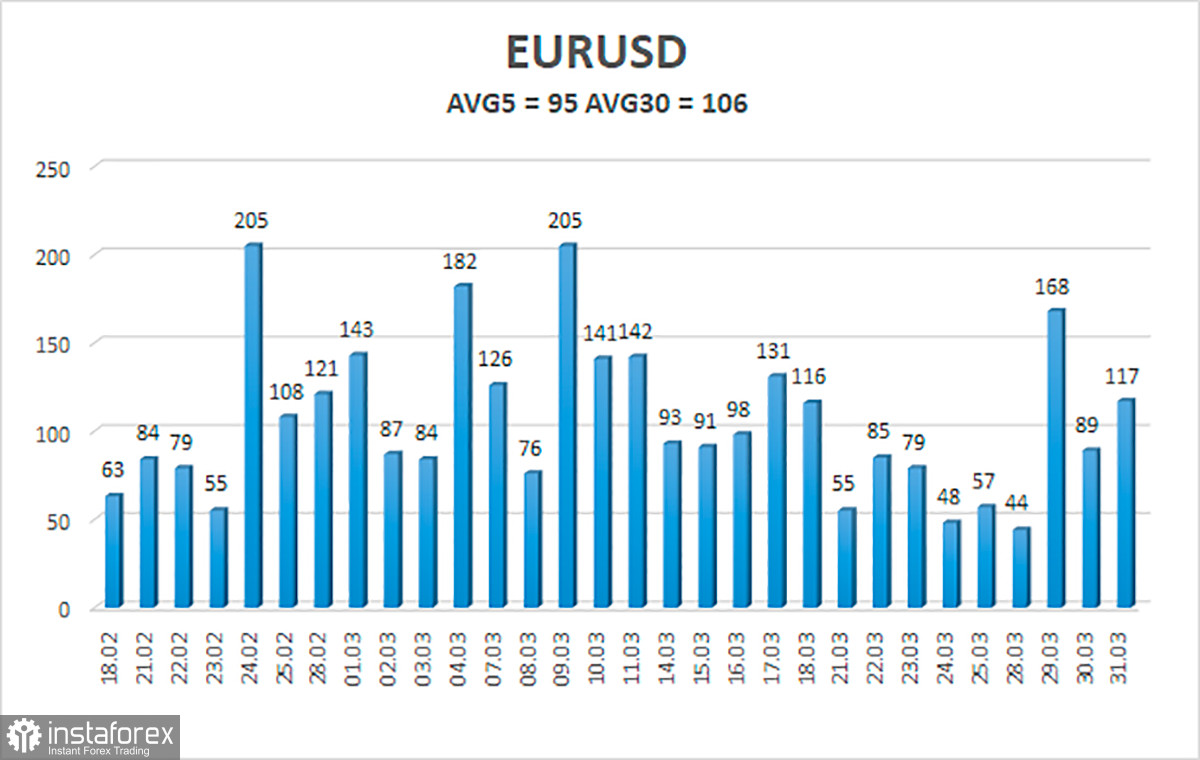

The volatility of the euro/dollar currency pair as of April 1 is 95 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0985 and 1.1175. The upward reversal of the Heiken Ashi indicator signals the resumption of the upward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair adjusted to the moving average line again. Thus, now we should consider new long positions with targets of 1.1175 and 1.1230 in case of a rebound from the moving average. Short positions should be opened with targets of 1.0986 and 1.0864 if the pair is fixed below the moving average.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.