UK's 4th quarter GDP came out slightly better than expected. It rose 1.3% m/m, while the year-on-year amounted to 6.6%. Surprisingly, there was no market reaction in GBP/USD.

In the European Union, data on the unemployment rate was published. There was a decrease in the data for February, but it was lower than what was expected. Instead of falling to 6.7%, it declined to 6.8%. Nevertheless, EUR/USD fell because of this report.

Weekly data on US jobless claims is expected to be published today. Analysts predict an increase in volume, which is negative for both the US labor market and dollar. Initial applications is expected to increase from 187,000 to 197,000, while the repeated applications is projected to remain at 1,350,000.

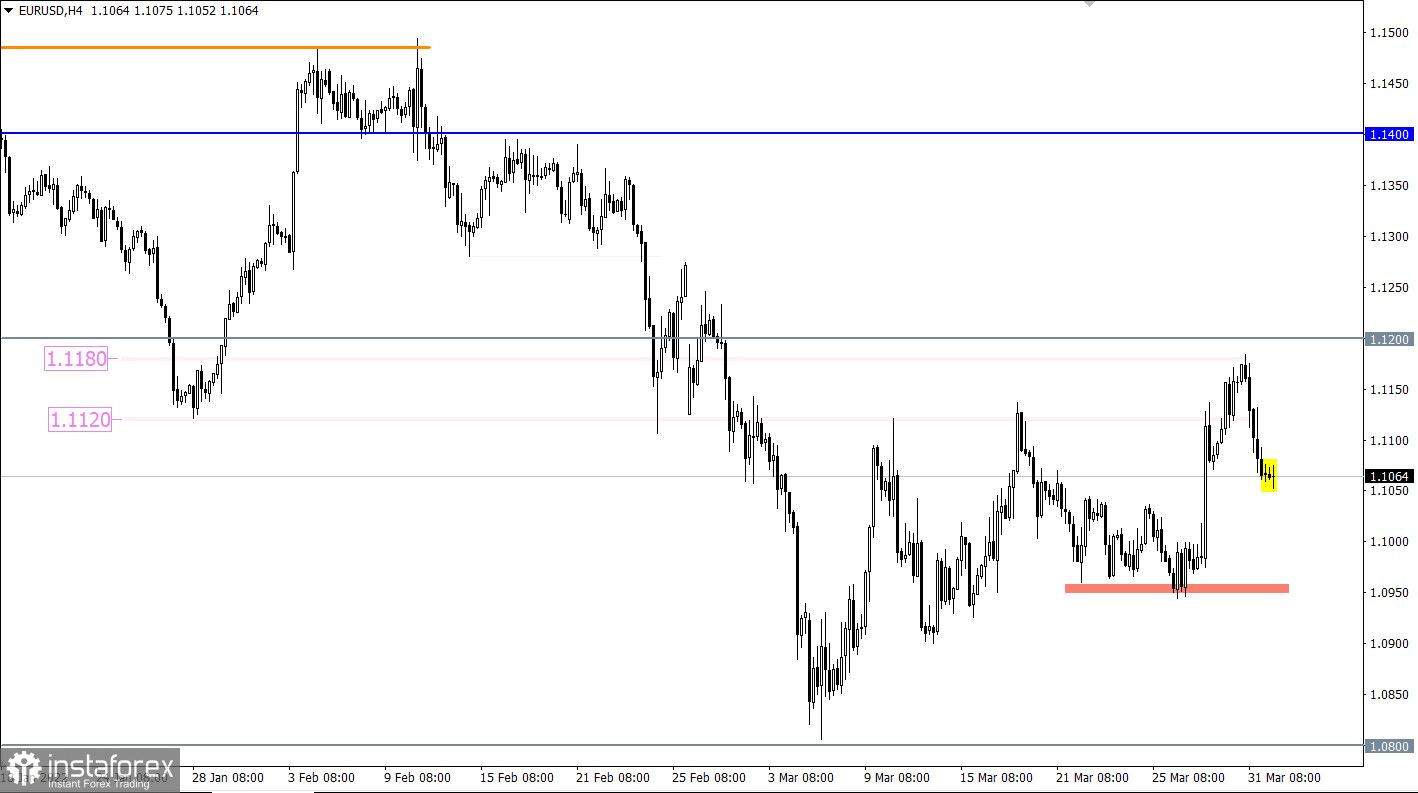

Analysis of trading charts from March 31

EUR/USD bounced back from the upper limit of 1.1120/1.1180, which led to a significant increase in the volume of short positions. As a result, euro lost about 100 pips.

GBP/USD slowed down after a slight rollback from 1.3000/1.3050. This formed doji-type candles, which signals uncertainty among traders.

Economic calendar for April 1

Preliminary data on EU inflation will be released today, and analysts expect an acceleration in consumer prices from 5.9% to 6.6%. This is a negative factor for the European currency.

The main macroeconomic event is considered to be the report of the United States Department of Labor, which predicts by no means bad indicators. The unemployment rate could drop from 3.8% to 3.7%, and 480,000 new jobs could be created outside of agriculture. We have a strong US labor market, which could support the US dollar.

Trading plan for EUR/USD on April 1

There is a slight stagnation around 1.1060, which may play into the hands of traders in the upcoming acceleration. So, in order for the downward cycle to resume, the quote needs to stay below 1.1050. That will ensure a move towards 1.1000, or even to 1.0970.

An alternative scenario is a return to 1.1120/1.1180.

Trading plan for GBP/USD on April 1

A consolidation in the range of 1.3105/1.3180 is possible. If that happens, new price jumps will be seen in the pair.

Considering this, it is best to buy in the market when the price holds above 1.3185. That has a potential move towards 1.3220.

Meanwhile, sell positions should be considered after the quote dips below 1.3100. That is likely to lead to a decline to 1.3060-1.3000.

What is reflected in the trading charts?

A candlestick chart shows graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.