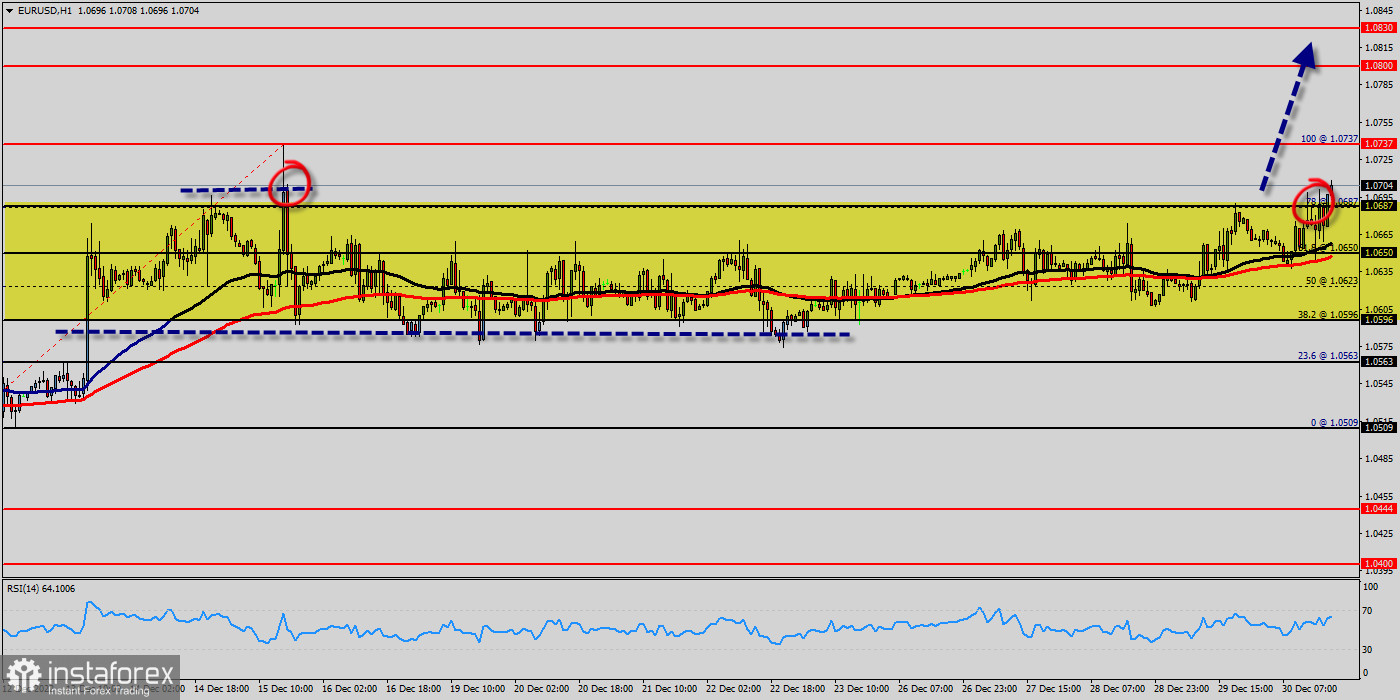

As expected the EUR/USD pair is still moving upwards from the level of 1.0650. Yesterday, the pair rose from the level of 1.0650 (this level of 1.0650 is represented a major support) to the top around 1.0687.

Today, the first resistance level is seen at 1.0737 followed by 1.0800, while daily support 1 is seen at 1.0650.

According to the previous events, the EUR/USD pair is still moving between the levels of 1.0650 and 1.0800; for that we expect a range of 150 pips (1.0650 - 1.0800).

If the EUR/USD pair fails to break through the minor support level of 1.0687, the market will rise further to 1.0737.

This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs.

Moreover, the RSI starts signaling a downward trend, as the trend is still showing strength above the moving average (100) and (50). Thus, the market is indicating a bullish opportunity above the level of 1.0650.

The pair is expected to rise lower towards at least 1.0800 with a view to test the daily resistance.

On the contrary, if a breakout takes place at the support level of 1.0650 (major support), then this scenario may become invalidated.