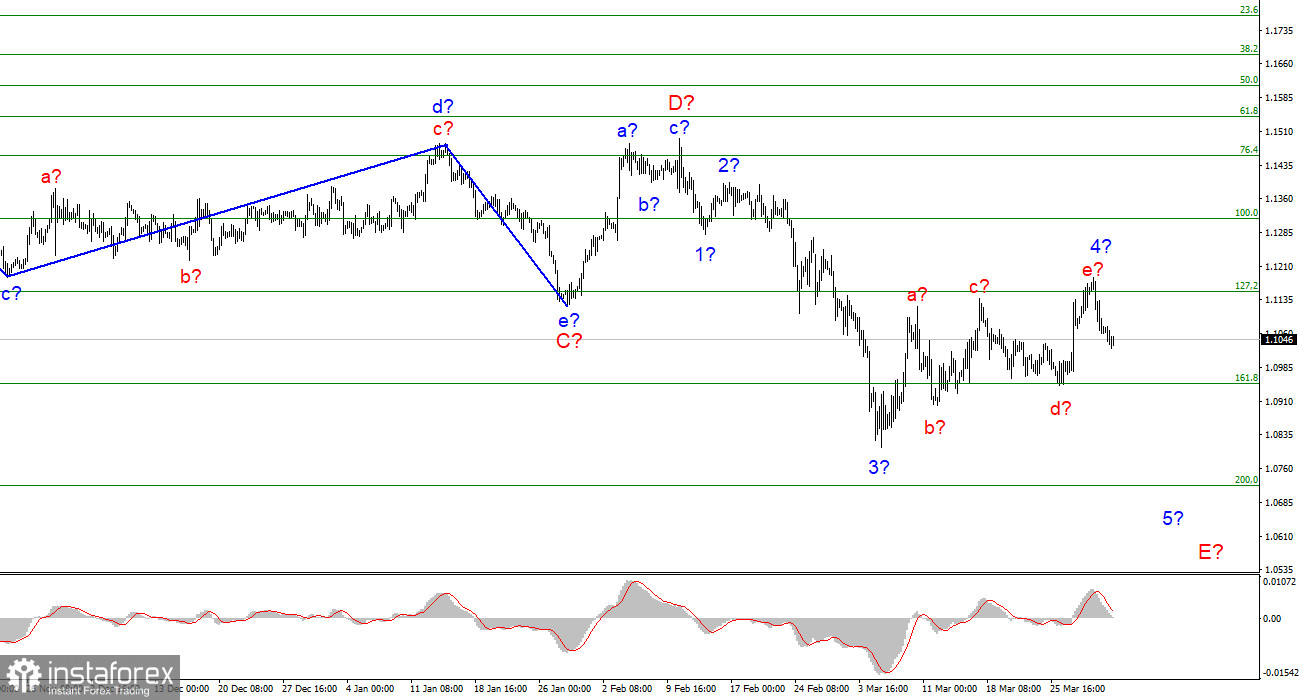

The wave marking of the 4-hour chart for the euro/dollar instrument has become more complicated due to a new increase in quotes. Now the assumed wave 4 has taken a five-wave form and fits rather poorly into the current wave layout, in which the corrective wave 2 is very short. However, the wave pattern does not require drastic changes. If the construction of the supposed wave 4 has ended after all (the wave can no longer take a more complex form), then the tool can still build the supposed wave 5 in E. If the increase in quotes resumes again, then the entire wave marking will require adjustments. I note that wave 4 in any case looks like a correction and, accordingly, it cannot be the first wave of a new upward trend segment. The 127.2% Fibonacci level, near which waves a and c ended at 4, did not miss the instrument above itself. An unsuccessful attempt to break through it indicates that the market is ready for new sales of the instrument. Thus, at this time, the wave marking remains, and the demand for the US dollar should continue to grow so that it remains so.

The market is rushing from side to side.

The euro/dollar instrument fell by only 25 basis points on Friday. Although there were a lot of important statistics on this day both in the EU and in America. However, quite unexpectedly, the market did not pay attention to inflation in the EU, nor did it pay attention to Nonfarm Payrolls in the USA. It did not pay attention to anything at all. Because 25 basis points are not only a decrease in the instrument, it is almost the entire activity of the market during the day. Inflation in Europe by the end of March has already increased to 7.5% y/y. Prices are rising literally for everything, and the time when inflation starts to slow down, which Christine Lagarde talked about, still does not come. An increase in inflation could support the demand for the euro currency, if not for a whole series of "buts" at once. Rising inflation now means almost nothing, except that prices are rising and will rise very quickly.

If in the case of the United States, rising inflation means that rates will rise more quickly and more strongly, then in the case of the European Union, this means that economic stimulus programs will be reduced a little more quickly. That is, by and large, the ECB is still stimulating its economy and is not even thinking about raising the interest rate. As you can see, the difference in the approaches of the Fed and the ECB is huge. Therefore, well, although inflation has increased in the EU, it still will not affect monetary policy in any way. Therefore, the market did not rush to buy euros. Therefore, the market did not react at all. Geopolitics also remains complicated and is not on the side of the euro currency. After Tuesday this week, when the market believed in the possibility of signing a peace agreement between Ukraine and Russia, only a few days have passed, and faith has already managed to evaporate in an unknown direction. Therefore, the European currency is again under market pressure due to the military conflict in Ukraine.

General conclusions.

Based on the analysis, I still conclude that the construction of wave E is currently underway. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave marking assumes the construction of a wave 5 in E. This option will be canceled in case of a successful attempt to break the 1.1153 mark, which equates to 127.2% Fibonacci.

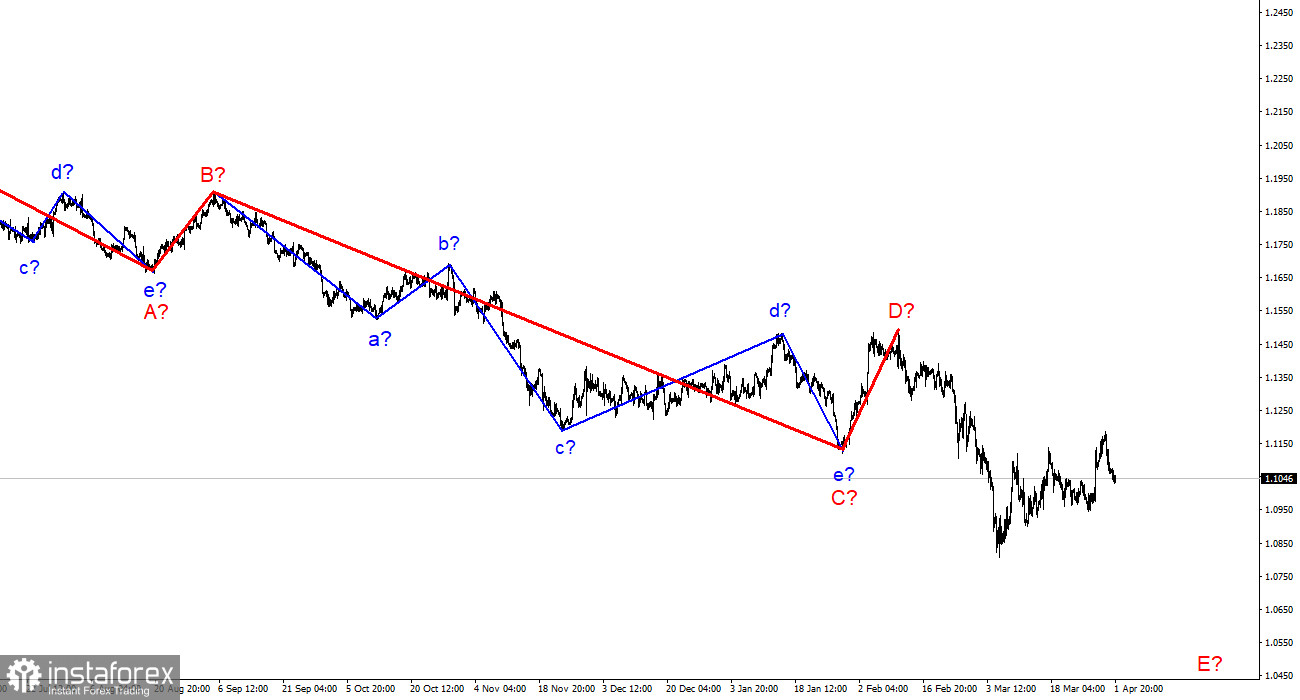

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.