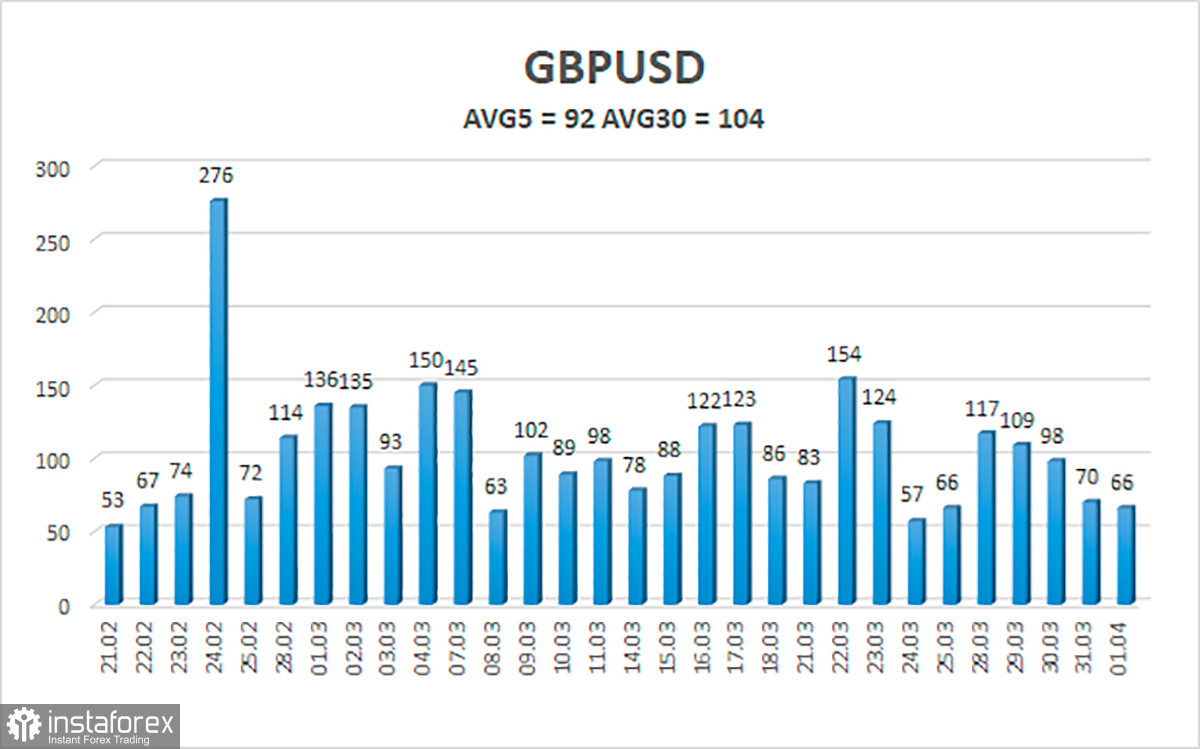

The GBP/USD currency pair on Friday showed "mind-blowing" volatility equal to 66 points. And this is on the day when the Nonfarm Payrolls report was published in the States. The Nonfarm report turned out to be not as resonant as the markets are used to. The number of new jobs created outside the agricultural sector amounted to 431 thousand with a forecast of 492 thousand. From our point of view, this value is not a failure, since +431 thousand is still a lot, given that unemployment has already fallen to 3.6%. The US economy cannot create half a million new jobs every month. Therefore, the dollar did not show a fall on Friday, but at the same time, it did not show much growth either. It did not even show high volatility, which also often happens during the publication of important reports. All other reports of the day were less significant. The unemployment rate is an important indicator, but traders rarely react to it. The ISM index of business activity in the manufacturing sector dropped to only 57.1, and this value is still high. Wages have hardly changed. Thus, the market could only react to Non-Farm. Nothing was interesting at all in the UK. One index of business activity in the manufacturing sector.

Thus, the geopolitical factor was and is in the foreground for traders. Unfortunately, there is no positive news from the fronts in Ukraine at the moment. The talks, which gave hope for a peace agreement on Tuesday, had faded by Thursday. Although the "consultations" are continuing, and the Ukrainian Armed Forces announced the liberation of the entire Kyiv region, Russian troops have not left the territory of Ukraine. Yesterday, a missile strike was launched on Odessa, which was officially announced by the Ministry of Defense of the Russian Federation. Thus, the de-escalation of the conflict is still very far away, and negotiations, we can say, have stalled due to an absolute misunderstanding of how to resolve the issue with Crimea and Donbas. According to unofficial information, the Kremlin decided to focus its activity on the Donetsk and Lugansk republics. However, it is unlikely that the concentration of Russian troops in only two areas and missile strikes throughout Ukraine can be considered a "de-escalation of the conflict." Moreover, fighting for Mariupol is also continuing in southwestern Ukraine. Thus, the complex geopolitical background speaks in favor of the continuation of the fall of the British currency, which has also adjusted slightly in recent weeks, so it has the technical capabilities for a new fall.

There will not be many important events in the period from April 4 to April 8

During the new week, there will be quite a lot of macroeconomic and fundamental events planned in the UK and the US. Already on Monday, Andrew Bailey, who has rarely spoken about the economy and monetary policy lately, will give a speech. More and more about inflation. On Tuesday - the index of business activity in the UK services sector, as well as the ISM business activity index in the US services sector. In the current circumstances, this is not the most important data. On Wednesday, the index of business activity in the UK construction sector and the "minutes of the Fed". Thursday - applications for unemployment benefits in the United States, speech by James Bullard from the Fed. Nothing on Friday. Thus, there are many events planned, but there are practically no important ones among them. If Powell's speech does not take place this week, then we would say that the most important event of the week will be the speech of Bullard, who is an active "hawk". This means that all attention will again be paid to geopolitics, and traders will trade following the general fundamental background. It is not as weak for the British currency as for the euro, because the Bank of England has already raised the key rate three times. Nevertheless, the pound sterling, which is located below the moving average, continues to be in the "risk zone".

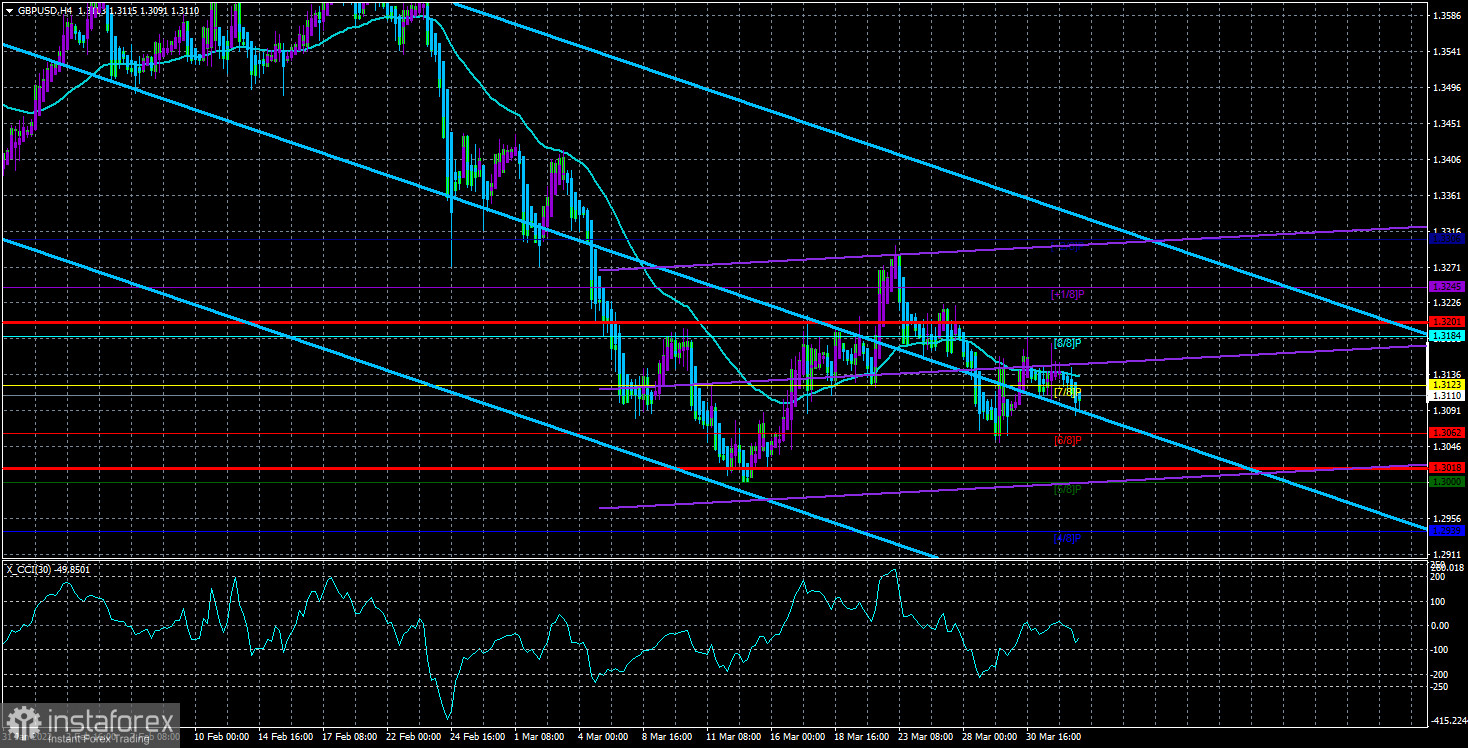

The average volatility of the GBP/USD pair is currently 92 points per day. For the pound/dollar pair, this value is the average. On Monday, April 4, thus, we expect movement inside the channel, limited by the levels of 1.3018 and 1.3201. A reversal of the Heiken Ashi indicator upwards will signal the resumption of the upward movement with a possible consolidation above the moving average.

Nearest support levels:

S1 – 1.3062;

S2 – 1.3000;

S3 – 1.2939.

Nearest resistance levels:

R1 – 1.3123;

R2 – 1.3184;

R3 – 1.3245.

Trading recommendations:

The GBP/USD pair has started a new round of upward movement in the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.3062 and 1.3018 until the Heiken Ashi indicator turns up. It will be possible to consider long positions no earlier than fixing the price above the moving average line with targets of 1.3184 and 1.3201.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.