Analysis and tips on how to trade GBP/USD

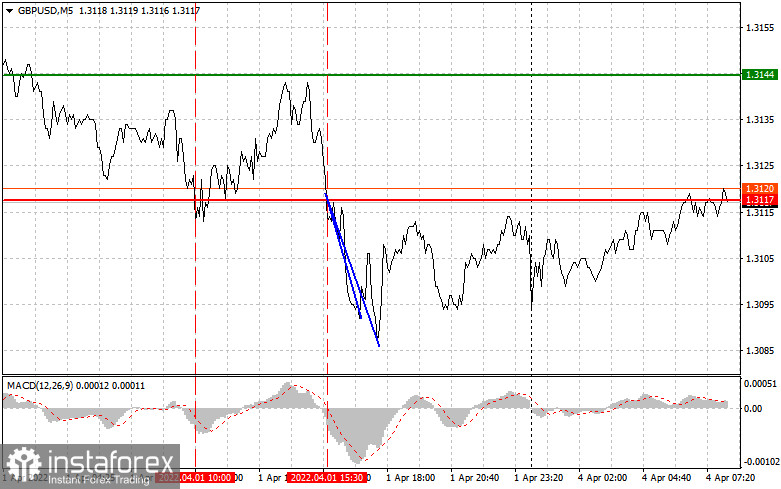

The price tested the 1.3117 mark for the first time when the MACD was far below zero, which limited the pair's downside potential. Therefore, I decided not to sell the instrument. As it turned out, I did the right thing. The quote tested the level for the second time right after the release of macro statistics in the US. Back then, the MACD indicator just started to move down from the zero level, confirming the accuracy of the sell entry point. Eventually, the pair went down by about 30 pips. No more entry points were created afterward.

Data on the manufacturing PMI in the UK came as surprise to market participants. The figure was revised slightly lower, which should have a positive impact on the economy. Nevertheless, investors are more interested in the services PMI because the UK is a services-oriented economy. Meanwhile, labor market statistics in the US came in mixed, logging a decrease in unemployment and a steep fall in NonFarm Payrolls. The BoE's representatives Catherine L Mann, a member of the Monetary Policy Committee, and Jon Cunliffe, Deputy Governor for Financial Stability, will deliver speeches today. Governor Bailey's speech will be of primary importance because his recent statements have triggered a fall in the pound. Therefore, it would be wise to sell the pound if SELL Scenario 2 plays out. No significant macro events able to trigger market jitters are expected during the North American session. US factory orders will be of little interest to traders.

Buy signal

Scenario 1: You could go long today when the price reaches 1.3132 (the green line on the chart), with the target at 1.3174 (the thicker green line on the chart). You should consider closing long positions at around 1.3174 and selling the pound, allowing a 20-25 correction. The pound is unlikely to show growth in the first half of the day, especially after speeches by the BOE representatives. Important! Before buying the instrument, make sure the MACD is above zero and just starts moving up from this level.

Scenario 2: Likewise, long positions could be opened today if the quote touches 1.3107 when the MACD is in the oversold zone. This could limit the pair's downside potential and lead to an upward reversal in the market. The price may head either towards 1.3132 or 1.3174.

Sell signal

Scenario 1: You could go short today when the price updates the 1.3107 level (the red line on the chart). If so, the pair may go down to the key target at 1.3070 where you should consider closing your positions and buying the euro, allowing a 20-25 pips correction. It would be wise to sell the pound from key resistance levels based on Scenario 2. The UK's economic perspective is getting gloomier every day. Therefore, the pound is unlikely to show significant growth at the current lows. Important! Before selling the instrument, make sure the MACD is below zero and just starts to move down from this level.

Scenario 2: Likewise, short positions could be opened today if the price reaches 1.3132 when the MACD is in the overbought zone. This could limit the pair's upside potential and lead to a downward reversal in the market. The quote may go either to 1.3107 or 1.3070.

Indicators on the chart:

The thin green line indicates a buy entry point.

The thick green line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to grow above this level.

The thin red line indicates a sell entry point.

The thick red line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to fall below this level.

MACD: when entering the market, it is important to pay attention to the overbought and oversold zones.

Remember that novice forex traders should be very careful when deciding to enter the market. Before the release of important fundamentals, you should stay out of the market in order to avoid sharp fluctuations in the rate. If you decide to trade during news releases, make sure to always place a stop-loss order to minimize losses. Without it, you may quickly lose your entire deposit, especially if you do not use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.