Following a stellar first quarter, gold started off pessimistic in April, with prices dropping $30 amid rising bond yields. But analysts are keeping a close eye on 2-year and 10-year Treasury yields and what the inversion could mean for gold.

Friday's main event was not the long-awaited employment report, but the inversion of the 2-year and 10-year Treasury yield spreads. Many market participants saw this as a sign that a recession is just around the corner.

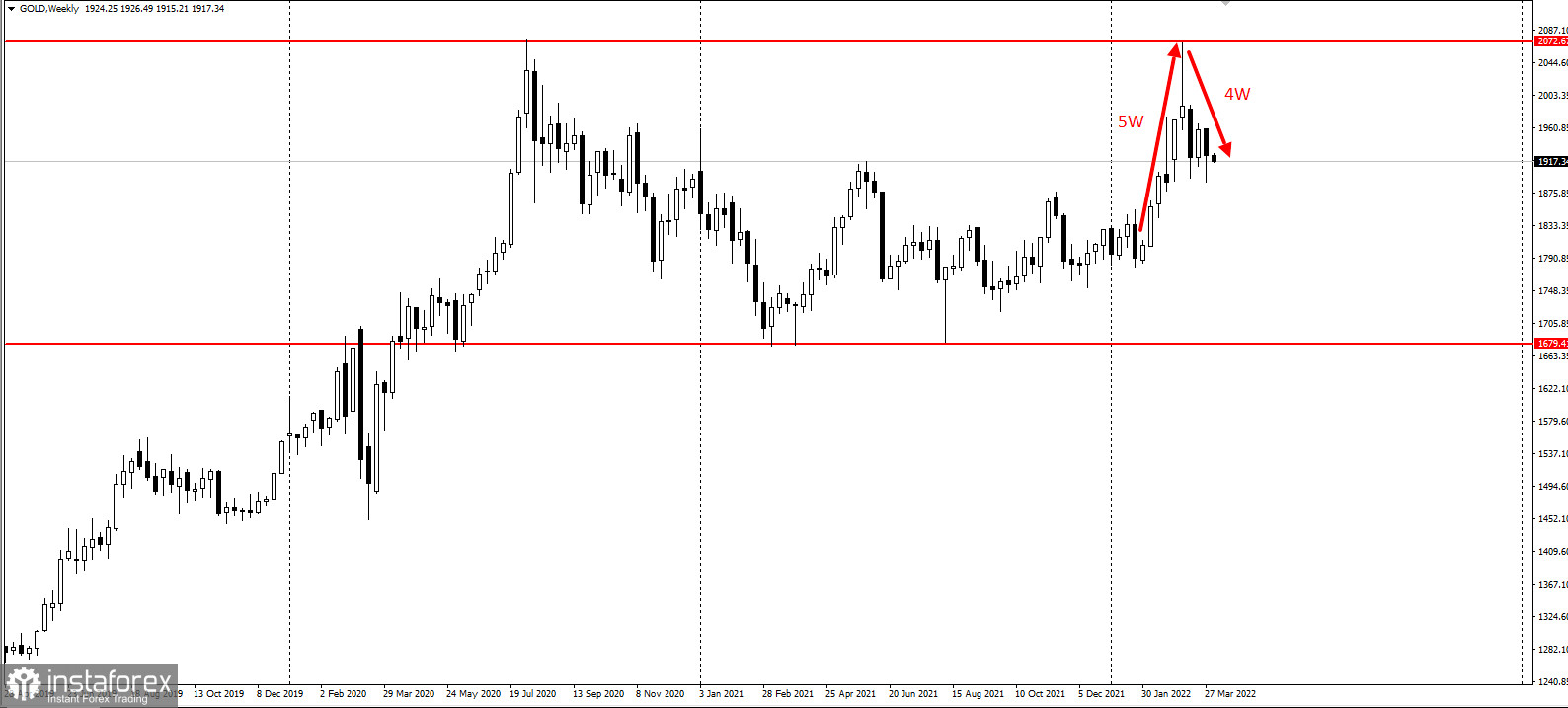

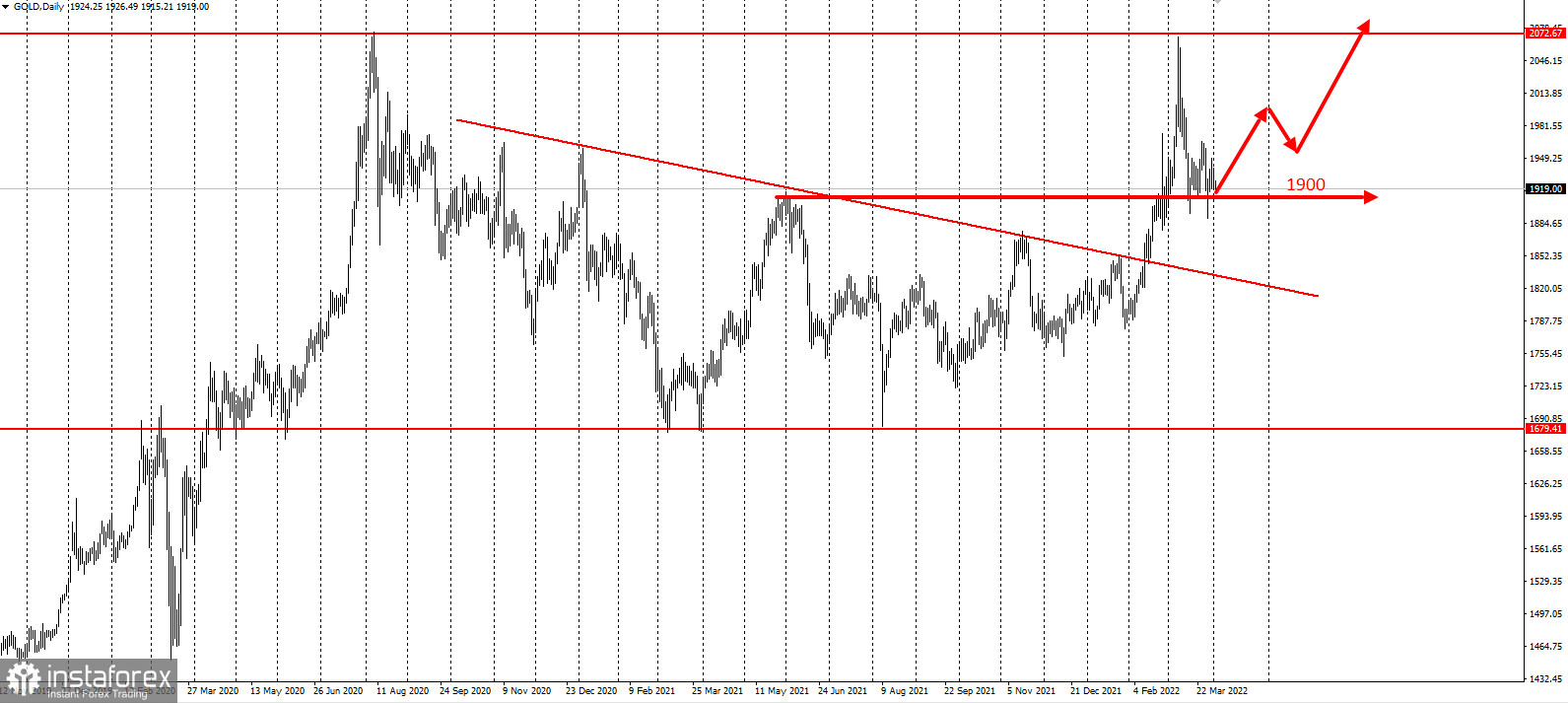

Back in Q1, gold prices were up 6%, thanks to the biggest gains since the third quarter of 2020. Many expect that this will continue in the second quarter, with $2,000 as the main target level. Analysts also predicted that prices will stay above $1900 because unemployment in the US will not allow it to go beyond that level. This means that the bullish momentum is not broken, and the probability of its continuation is much higher than that of a reversal.

According to DailyFX strategist Michael Boutros, yield curve inversion is a red flag, but it's not a timing tool. For gold, this should mean more attractiveness due to risk aversion, but so far, the sentiment has not escalated into broader trading. That is why despite the signs of declining risk, gold prices on Friday were driven by the metal's reaction to higher bond yields and a stronger US dollar.

There is also a lot of volatility in the Treasury bond market during this period of time due to expectations of a rate hike by the Fed. Bonds with lower yields are not very attractive, so there is an inversion.

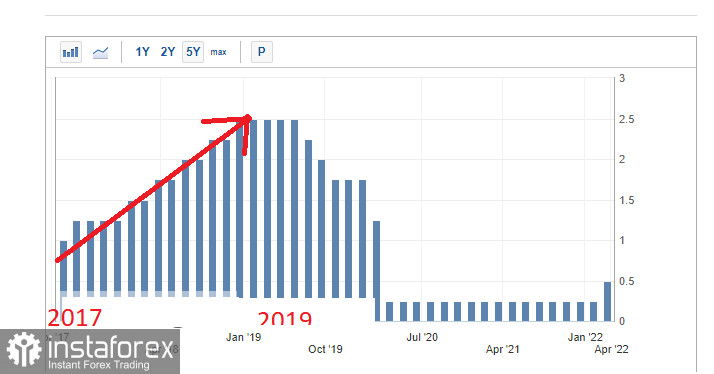

As such, a strong price movement may be seen on Wednesday, after the release of the Fed's minutes of meeting. In March, Powell hinted that the second round of rate hike may be similar to the 2017-19 season, but would likely take place at a faster pace.