Given the content of the report of the United States Department of Labor, it is only surprising that the pound's decline on Friday was more of a symbolic nature. And so, 460,000 new jobs were not created outside of agriculture, but 431,000. But even this is still almost twice as much as is necessary to maintain a stable unemployment rate. Which by the way decreased from 3.8% to 3.6%, with a forecast of 3.7%. And it looks like it will continue to decline. There are practically no doubts about this. And apparently, the pound was supported by the single European currency, the decline of which also turned out to be rather modest. However, this appears to be just a temporary phenomenon. Macroeconomic data is clearly in favor of the US dollar. Europe, on the other hand, cannot boast of such figures. As it is much worse. And the dynamics is rather exclusively negative. Whereas in the United States, macroeconomic statistics are more often encouraging than disappointing. So there is no doubt that the pound will gradually lose its positions against the US dollar.

Unemployment rate (United States):

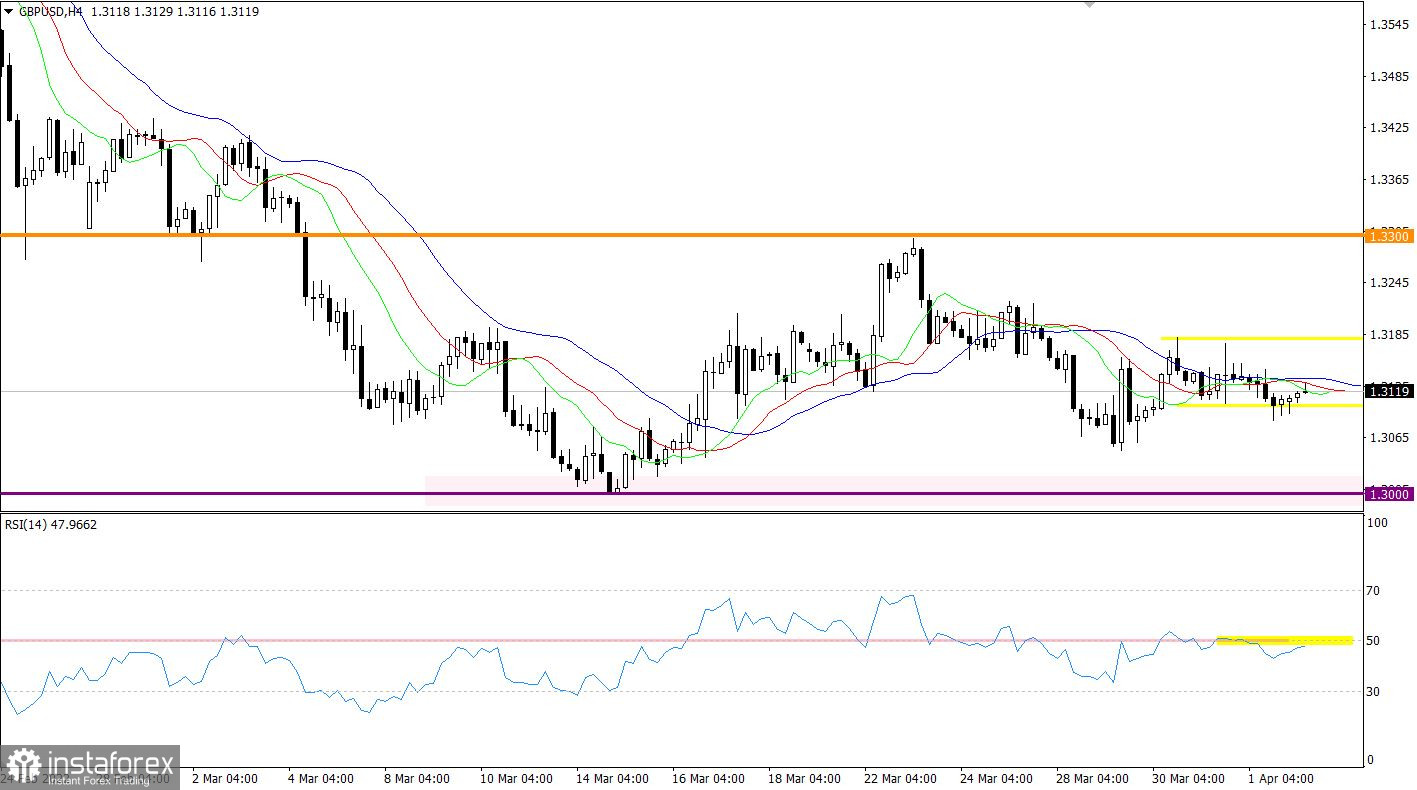

The GBPUSD currency pair continues to move in the 1.3105/1.3180 range, despite the bears' attempts to overcome its lower limit. Long-term price movement in a closed range leads to the process of accumulation of trading forces, which can lead to acceleration in the market.

The RSI technical instrument is moving along the middle line 50 in a four-hour period, which indicates a stagnation. RSI D1 is moving in the lower area of the 30/50 indicator, signaling the high interest of traders in a downward move.

The Alligator H4 indicator has a lot of crossovers between the moving MA lines, which confirms the signal of stagnation. Alligator D1 signals a downward trend, MA moving lines are directed downwards.

Expectations and prospects:

In this situation, traders are still considering the trading tactics of breaking through one or another flat border. In this regard, long positions will be valid after keeping the price above 1.3185 in a four-hour period, and short positions would be valid after keeping the price below 1.3100 in a four-hour period.

Complex indicator analysis has a variable signal in the short-term and intraday periods due to stagnation. Indicators in the medium term give a sell signal due to a downward trend.