Everything comes to an end

Here is a technical review of another major currency pair, USD/JPY. As I have repeatedly mentioned in my previous articles, the dollar/yen pair is among those instruments that quickly and appropriately react to the macroeconomic reports from the United States. At the same time, the pair completely downplays the data from Japan. At least, this is what happens most of the time. Let's start our analysis with a review of the past week's trading.

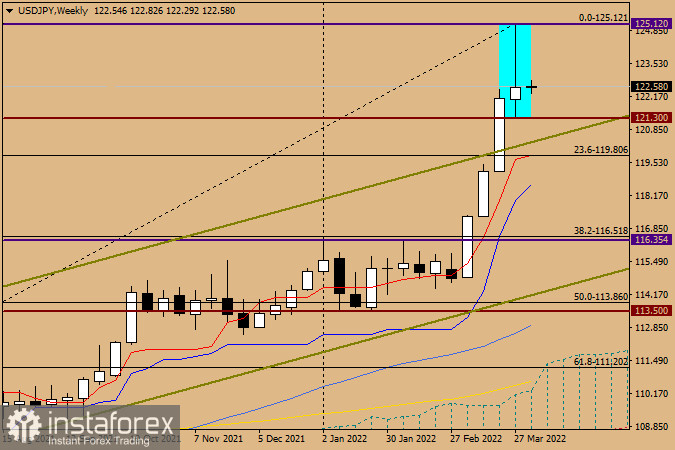

Weekly chart

As can be clearly seen on the weekly chart, the dollar/yen pair is trading within an uptrend, showing impressive gains in recent weeks. Yet, there are signs that the upward movement has come to an end. If we look at the last weekly candlestick, we can see that it has almost no body but has a very long upper shadow. This candlestick looks like a reversal pattern called Gravestone. However, it also has a small lower shadow, which questions the Gravestone pattern. One thing is for sure – this is a reversal candlestick. First of all, it appeared right after rapid growth at the very end of the upward movement. Secondly, the pair faced very strong bearish resistance when trying to break above the psychological and key technical level of 125.00. The closing price of last week at 122.54 clearly demonstrates how strong a pullback from the level of 125 was. In my opinion, it was not even a pullback but rather an obvious reversal of the quote. Moreover, the last candlestick clearly shows that the upside momentum is fading, and the pair is ready to start a downtrend.

I am wondering whether the market needs a stronger signal to start the downside movement. But anything can happen in trading, so let's not rule out the continuation of the uptrend and a close above the previous high of 125.12. If this happens, then the reversal candlestick pattern highlighted on the weekly chart will be canceled, thus indicating a new round of purchases. Here, I would like to point out one important thing. When a strong reversal signal is formed against the current trend and then the market cancels it, the trend becomes even stronger and continues with renewed vigor. Yet, the dollar bulls will need to make a huge effort to develop such a scenario, while the US currency will have to be in high demand across the board. In my opinion, the last candlestick gives a clear reversal signal, suggesting that the uptrend on USD/JPY has come to an end. However, this may not be the end of the bullish trend but rather a signal of a correction which may turn out to be very deep and extended over time.

Daily chart

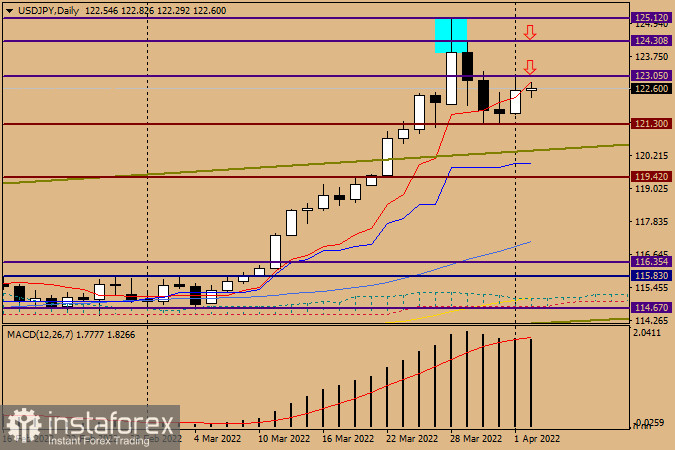

On the daily chart, the candlestick of March 28, which was formed a week ago, has a rather long upper shadow. I suppose that this candlestick marked the beginning of the downside reversal of the pair. On Friday, mixed data on the US labor market provided support to the US dollar, which is quite natural. You can read more about the results of the US labor reports in other articles by the author. At the moment of writing, the dollar/yen is trying to extend its growth from Friday and is testing the red Tenkan line of the Ichimoku indicator. If today's session closes above this line, the quote may continue the rise to the highs reached on April 1, at 123.05. In case of a breakout, the pair may head towards the price zone of 124.00-124.35.

As far as I see it, such a rally, or any attempts to continue it, signals the agony of the USD/JPY bulls. Everything that has a beginning has an ending. Therefore, it would be reasonable to assume that the uptrend is canceled, and the pair is ready to move in the opposite direction. Perhaps, this will take some time, and bulls may still try to stay afloat. For this purpose, I put the arrows on the daily chart to mark great selling opportunities at 123.00 and 124.00-124.35. However, this is just my recommendation, and it stays up to you to decide whether to follow it or not. I will monitor the trajectory of the USD/JPY pair more closely now to adjust our current analysis if necessary.

Good luck!