EUR/USD

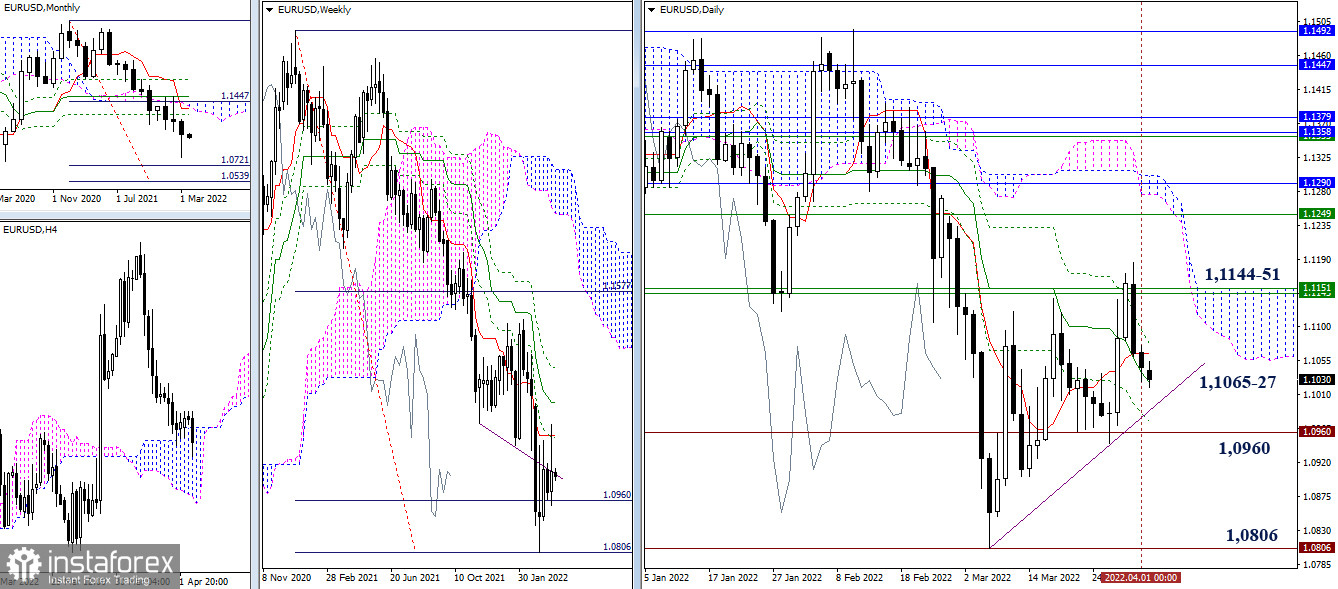

A long upper shadow formed last week as bulls failed to test weekly resistance around 1.1144–51. At the moment the pair is in the zone of attraction and influence of the daily Ichimoku cross (1.1065–27). Multidirectional last shadows of the week and month can now lead to slowdown and the development of uncertainty. In this situation, the most important landmarks retain their location and significance. For bulls, this is still overcoming 1.1044–51 (weekly Tenkan + Fibo Kijun) and then the resistance area 1.1249 – 1.1290 (weekly medium-term trend + monthly Fibo Kijun + daily cloud). And for bears, the levels of the weekly target for the breakdown of the cloud (1.0960 – 1.0806) are still important to strengthen their position.

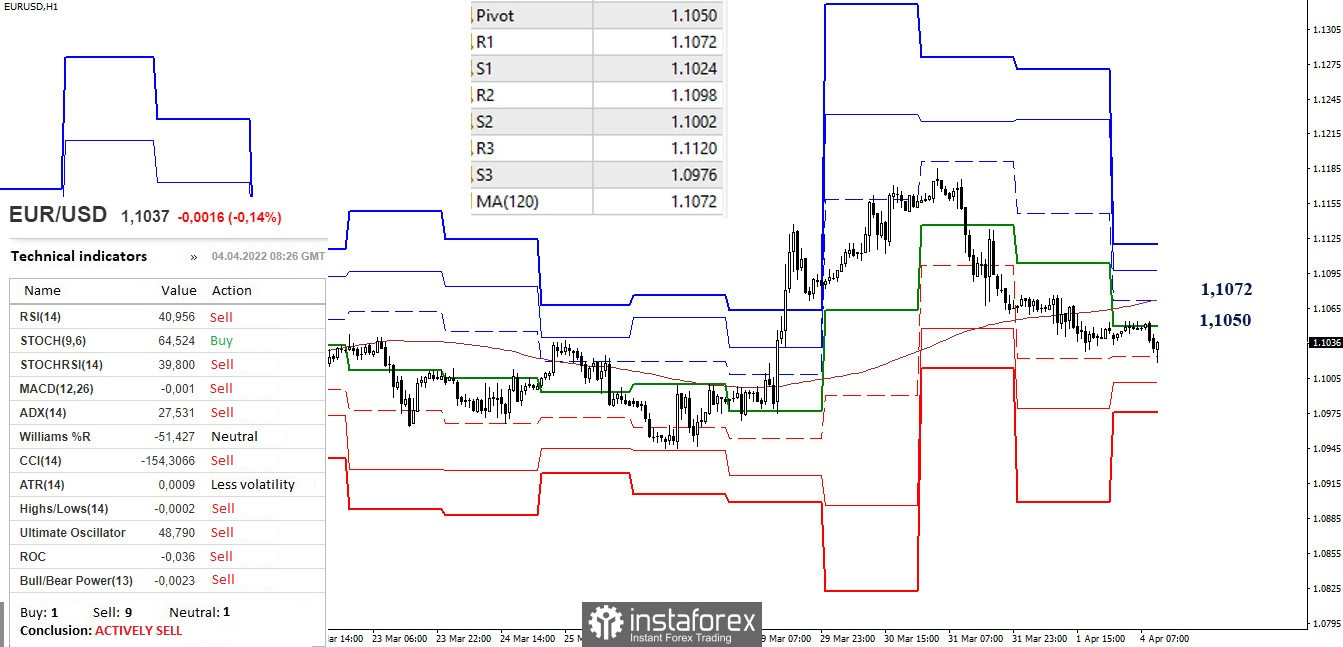

Bears have recently taken over the main advantage on the lower timeframes. If they manage to hold the situation, then the passage of S1 (1.1024) will open the way to further supports of the classic pivot points S2 (1.1002) and S3 (1.0976). If the opponent manages to regain the key levels of the lower timeframes, today they are located at 1.1050 (central pivot point) and 1.1072 (weekly long-term trend), then the balance of power will change again. The next upward targets within the day can be noted at 1.1098 and 1.1120 (resistance of the classic pivot points).

***

GBP/USD

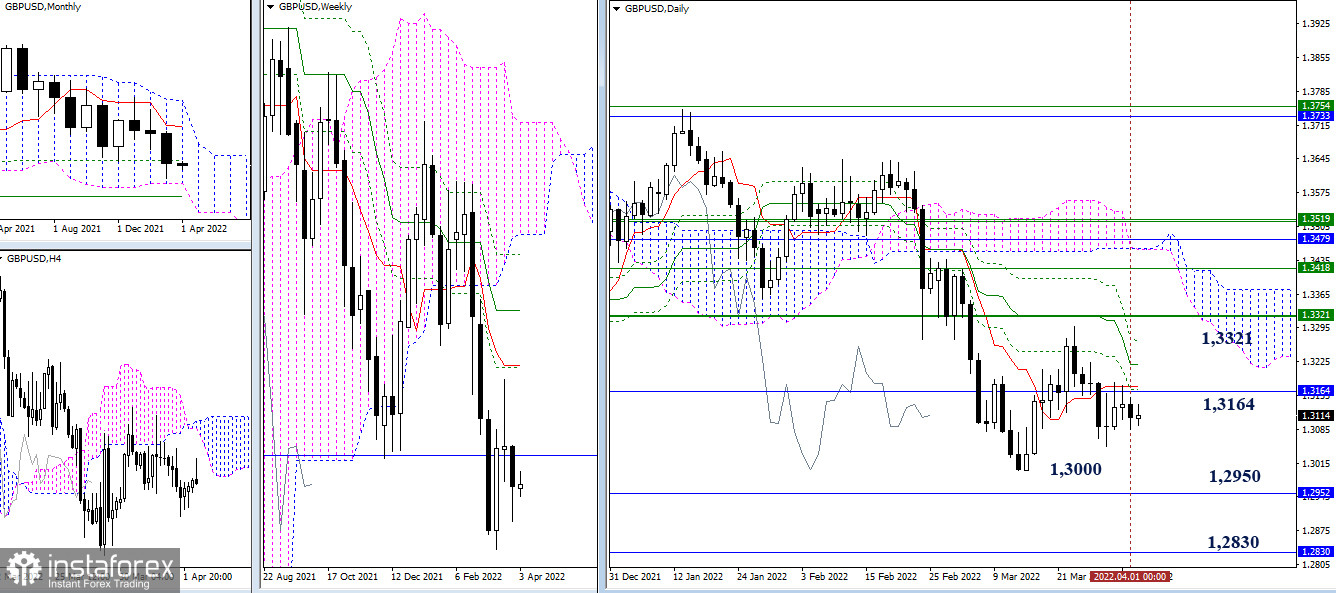

The pound continues to reflect on possible options. In the daily time period, consolidation has been forming in recent days, so the situation in its conclusions and expectations has not changed. It is still important for bears to restore the downward trend (1.3000), followed by a drop to monthly supports at 1.2950 and 1.2830. And the most important milestones for bulls remain at 1.3164 (monthly Fibo Kijun) and 1.3321 (weekly levels).

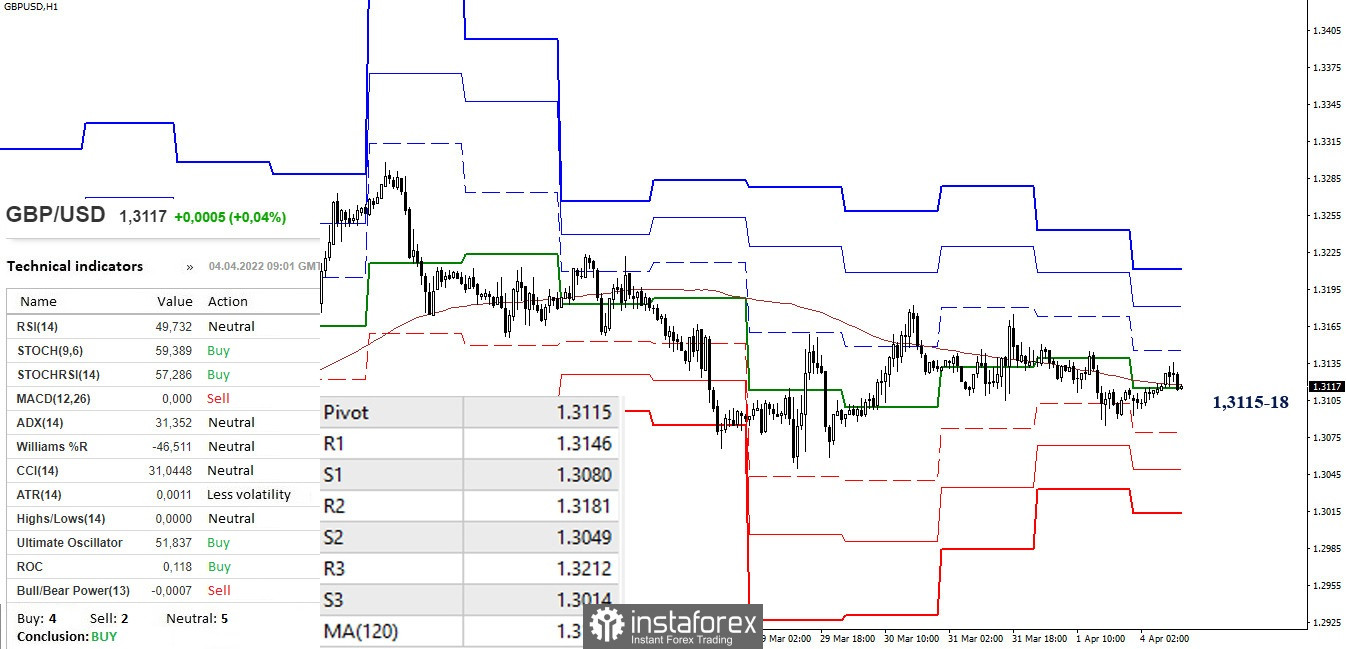

The uncertainty of the higher timeframes is well-read at the lower timeframes. The pair is tied to the key levels, which today combine their efforts in the area of 1.3115–18 (central pivot point + weekly long-term trend). The reference points for the upward movement within the day are the resistance of the classic pivot points (1.3146 – 1.3181 – 1.3212). While the reference points for the implementation of the decline are the support of the classic pivot points (1.3080 – 1.3049 – 1.3014).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)