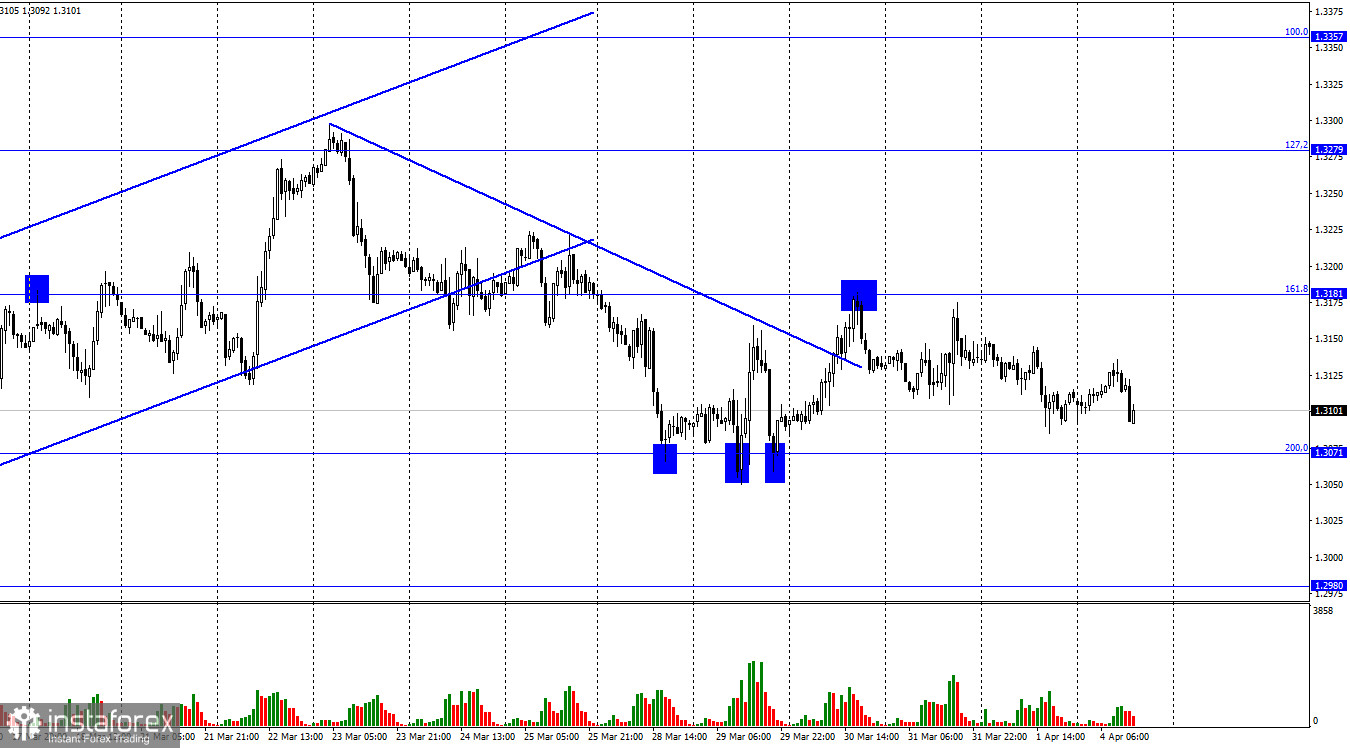

On the hourly chart on Friday, GBP/USD made a decline and continued its fall on Monday towards the Fibonacci retracement level of 200.0% located at 1.3071. A rebound from this level will benefit the pound and may push it higher towards the Fibo level of 161.8% - 1.3181. Consolidation below the retracement of 200.0% will facilitate a further decline towards 1.2980. On Friday, the US released a bunch of important macroeconomic data which was largely downplayed by the market. In the afternoon, the dollar certainly showed a slight uptrend. Yet, the positive data on nonfarm payrolls and employment should have caused a much stronger rise in the US currency. On Monday, after a short break, the pair resumed its fall, which can only be explained by the geopolitical factor. This weekend, markets realized that the chances of reaching a peace agreement between Russia and Ukraine are very low. It was also reported that Russian troops pulled back from the areas near Kyiv.

After the evidence of hostilities in Bucha, the European Council and the European Parliament are now considering a full embargo on Russian oil and gas imports. It will not be surprising to see a full ban on energy imports from Russia as soon as the end of this week. This may send new shock waves through the market, while the euro and the pound may start a new extended decline against the US dollar. It will be a difficult step to take for the EU, yet more and more European countries are calling for complete isolation of Russia. For example, this weekend, Lithuania, Latvia, and Estonia announced that they refuse to buy Russian gas and are working to block any transport routes with Russia.

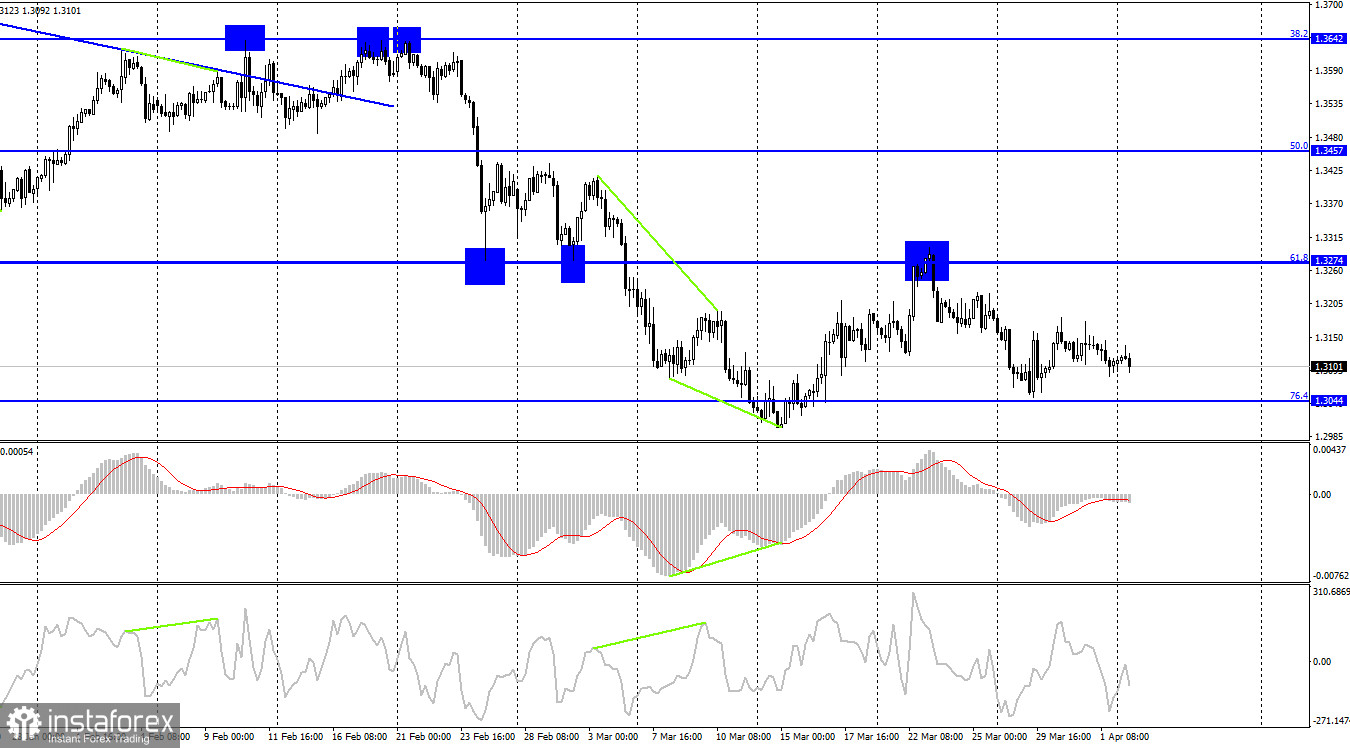

On the 4-hour chart, the pair resumed its decline towards the 76.4% retracement level at 1.3044. A rebound from this level will allow the pound traders to count on a reversal and growth towards the retracement level of 61.8% at 1.3274. Consolidation below 76.4% will facilitate a further fall to the next Fibo level of 100.0% located at 1.2674.

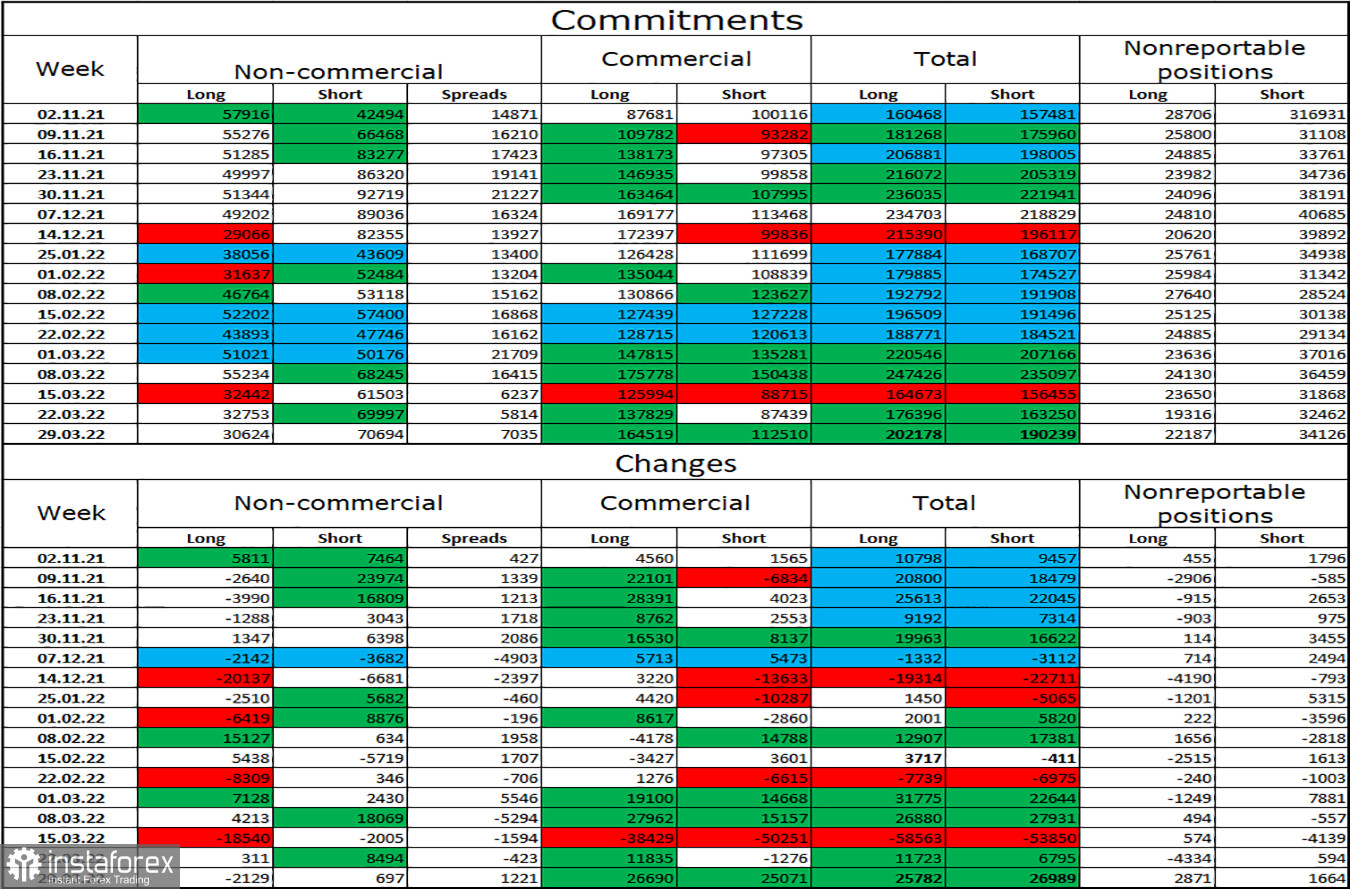

Commitments of Traders (COT) report:

The sentiment of the non-commercial group of traders has not changed much over the last reporting week. The number of long contracts decreased by 2,129, while the number of short ones went up by 697. Thus, the sentiment of major players became even more bearish. The ratio between the number of long and short contracts opened by speculators reflects the real situation in the market: there are currently 2.5 times more long contracts than the short ones. The pound is depreciating, and big market players prefer to sell it. Thus, I expect the pound sterling to continue its decline based on the geopolitical factor and COT reports.

Economic calendar for US and UK:

UK - Bank of England Governor Andrew Bailey speaks (09-05 UTC).

On Monday, the UK economic calendar shows one important event: Andrew Bailey's speech is potentially interesting for the market. Although traders may react to his statement, this is unlikely to stop the pound from a further decline.

GBP/USD outlook and trading tips:

It is possible to sell GBP with the target at 1.3071 as there was a rebound from the level of 1.3181 on the H1 chart. New short positions can be opened after a close below the retracement level of 76.4% at 1.3044 on the 4-hour chart with a target at 1.2980. I recommend buying the British pound on a rebound from 1.3071 on H1 with a target at 1.3181.