The EUR/USD currency pair continued to trade lower on Monday. Our fears about the flat on the first trading day of the week were not justified. Thus, Friday still falls out of the overall picture of what is happening and it is still unclear why volatility was shown equal to 48 points on the day when record inflation was published in the European Union, and unemployment and labor market data were published in the United States? However, this is already in the past, and we should deal with the movements and events of Monday. If you start with the technical picture, then you should immediately note: that everything is going according to plan. In our previous articles, we said that the entire section from March 7 looks like a correction. After three turns of this correction, it is time to resume the downward trend, which, as we see, is happening now. What are the grounds for this? The bases are above the roof.

The first is geopolitics. As we said several times last week, it is completely unclear where the optimism about the possible signing of a peace agreement between Russia and Ukraine in the near future came from. The military conflict continues, and the redeployment of Russian troops cannot be called a "withdrawal of troops." Moreover, this weekend several military experts and Western intelligence agencies said at once that the Kremlin was going to redirect its troops to the Donbas to completely capture the Donetsk and Luhansk regions. It is there that serious battles are expected in the near future. Also, rocket attacks continue to hit critical infrastructure in the territory of Ukraine. The negotiations, as we expected, rested on the issues of ownership of the Crimea and Donbas. Thus, there is no reason for optimism. Second is the difference in the monetary policies of the ECB and the Fed. There is not much to say here, since this factor has been fully analyzed by us many times already. Third, the strengthening of the US dollar on Monday could be a belated reaction of traders to the American statistics on Friday. Although the number of Non-farms turned out to be below forecasts, we believe that 431,000 new jobs are a very good indicator. As a result, the euro currency has no grounds for growth now.

New shocks for risky currencies are coming this week.

In addition to all of the above, this week the European Union may introduce a new package of sanctions against the Russian Federation. As you know, any sanctions against the Russian Federation are not only the problem of the Russian Federation itself. As we have already said, in the modern world, all countries are tied to each other, and even North Korea imports some goods. Thus, the refusal to cooperate with the Russian Federation or any sanctions restrict business activity in those countries that impose these restrictions. Therefore, whether sanctions are deserved or not, it does not matter now. The point is that any sanctions will contribute to the intensification of the conflict between the West and the Russian Federation. Consequently, there will be economic consequences for the European Union itself, which occupies the most unfavorable position among all the opposing countries of the Russian Federation on the world political map.

The states are fine, they are far away and practically do not depend on Russia in any way. But the European Union imports a huge amount of hydrocarbons from Russia. However, after the Russian troops left the Kyiv region, international experts and journalists saw a very unpleasant picture of the destroyed cities of Bucha, Irpin, and Gostomel, which the EU cannot ignore. Germany, Poland, Estonia, Latvia, Lithuania, Italy, and France called for increased sanctions and pressure on the Kremlin. And this week, the European Union will consider the possibility of banning Russian ships from using European ports, as well as refusing to supply oil, coal, and gas. Interestingly, the most furious position is taken by Italy, which is most dependent on energy supplies from the Russian Federation. Nevertheless, it can be stated that Europe's patience is running out and the issue of imposing an embargo is already a matter of time. Naturally, under such conditions, the euro and the pound cannot show anything other than a fall against the dollar. The EU economy will face not only a food crisis and an additional burden on the budget due to several million migrants from Ukraine, but it will also face an energy crisis. Therefore, very few traders want to buy euros now.

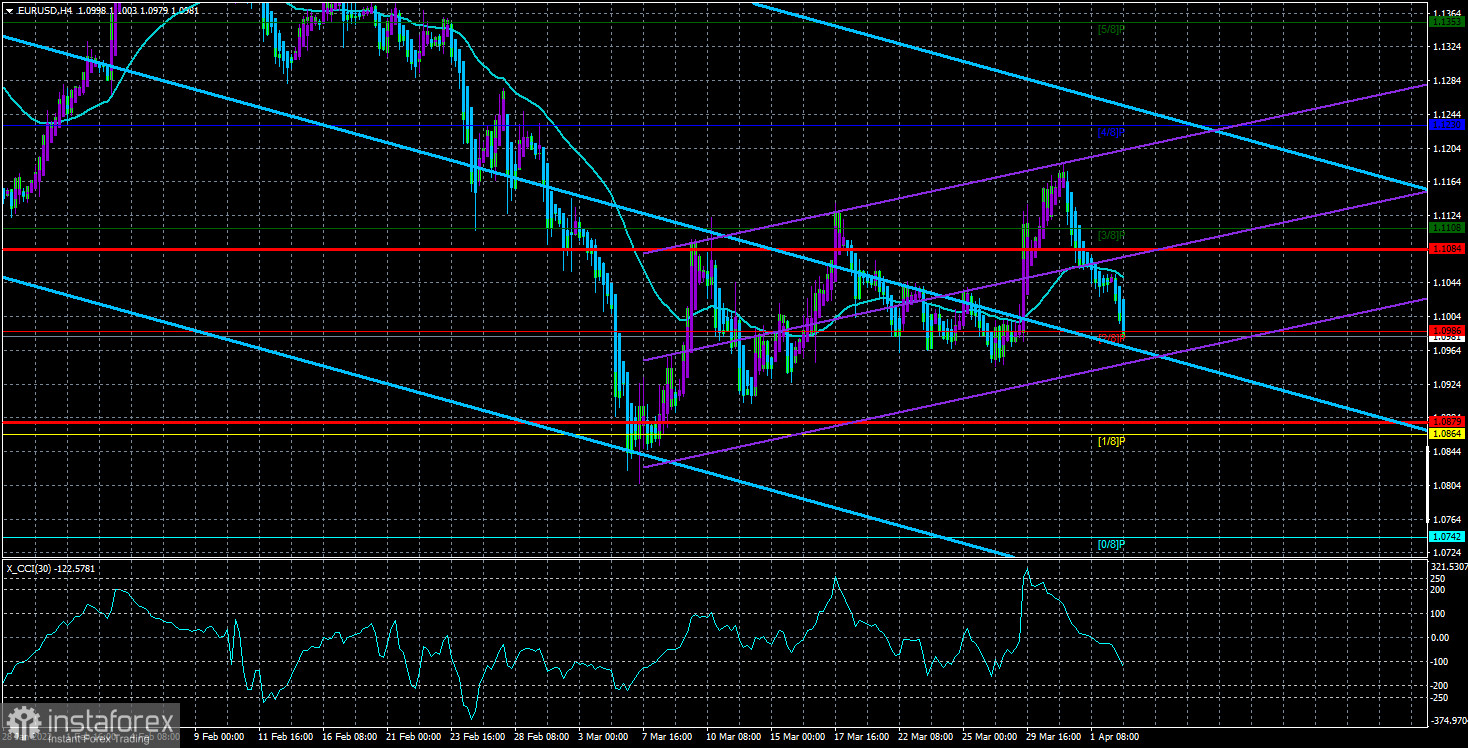

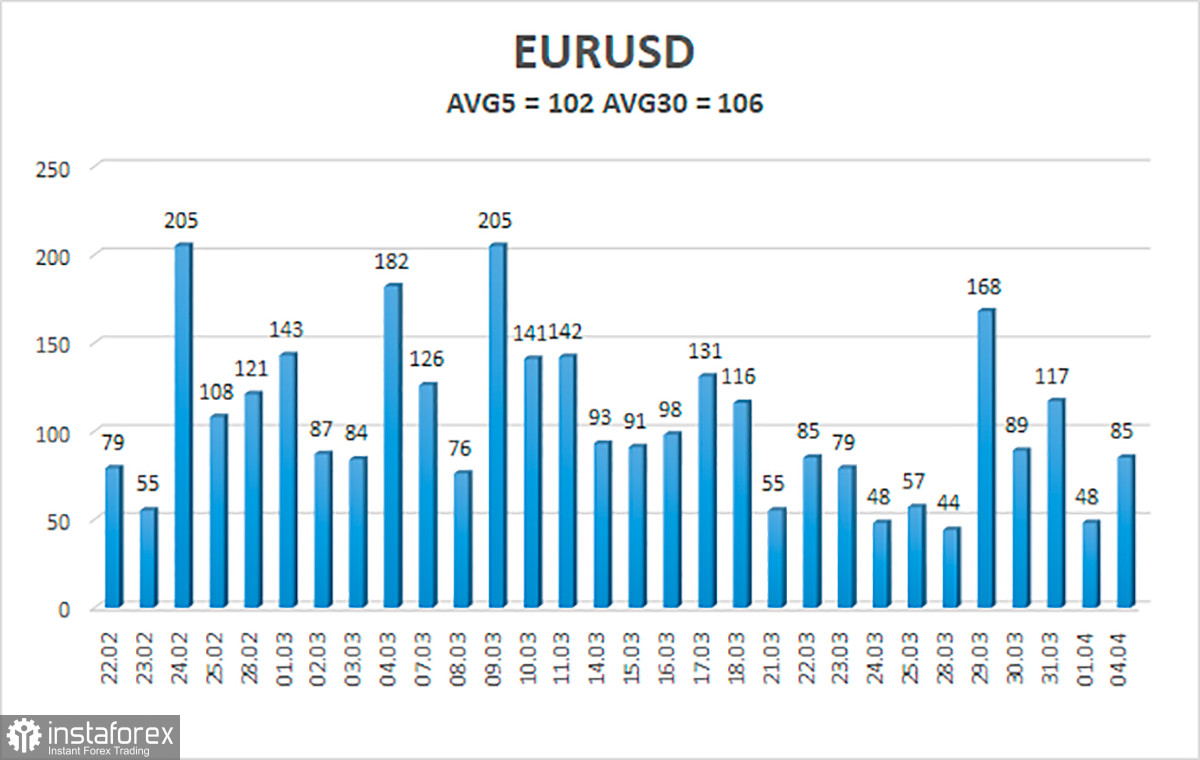

The volatility of the euro/dollar currency pair as of April 5 is 102 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0879 and 1.1084. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now we should stay in short positions with targets of 1.0879 and 1.0864 until the Heiken Ashi indicator turns upwards. Long positions should be opened with targets of 1.1108 and 1.1230 if the pair is fixed back above the moving average.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.