Key factor - today's closing price

Hi, dear traders!

As forecast yesterday, EUR/USD moved downwards. Today's session will show whether it will lead to a downtrend or not.

The EU is set to intensify sanctions against Russia for its war against Ukraine. This week, the European Union would consider banning Russian ships from docking in European ports, as well as limiting energy imports from Russia, such as oil and natural gas. These measures will backfire on the European economy - it is very unlikely that the EU can find a different energy exporter in the near future.

On Wednesday, the FOMC is set to publish its March meeting minutes. Earlier, the Federal Reserve agreed on raising the Fed funds rate by 25 basis points. However, USD declined against other major currencies afterwards. Traders expected a more hawkish policy from the Federal Reserve, such as a 50 point hike or reducing the balance sheet. The release of the FOMC meeting minutes will shed more light on the regulator's monetary policy plans. The Fed's position is undoubtedly hawkish, but how far do they plan to go?

Today's key data releases are services PMI in Germany and the eurozone, as well as US trade balance and ISM services PMI data. Furthermore, several FOMC board members, such as Neel Kashkari, Lael Brainard, and John Williams, are set to speak today.

Daily

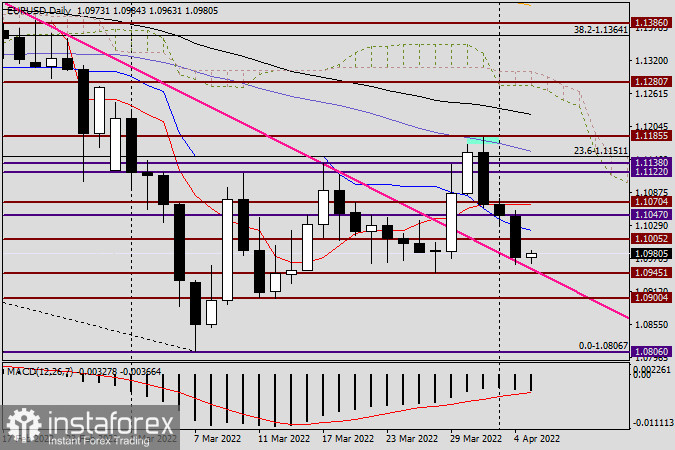

On the technical side, EUR/USD retraced to the broken pink resistance level at 1.1495-1.1138 yesterday. The pair could reverse upwards afterwards - if it does so, it could climb into the strong technical area of 1.1000-1.1020. The blue Kijun-Sen line of the Ichimoku cloud also lies in this area. If EUR/USD slides down below the pink resistance line, it could perform a false breakout above this level, pushing the pair down even further. Usually, the pair moves strongly into the opposite direction after a false breakout. Today's closing price of EUR/USD will be an important factor for the pair's performance.

H1

According to the H1 chart, EUR/USD is trying to reverse upwards off the pink resistance line. The blue 50-day MA, the black 89-day EMA, and the orange 200-day EMA lines all lie in the 1.1020-1.1040 area. Taking into account the key historical and psychological level of 1.1000, short positions can be opened in the 1.1000-1.1040 area. Bullish traders willing to take risks can open long positions right now via a market order. In this situation, a stop-loss order should be placed below the support level of 1.0945, and a take-profit order should be set near 1.1020.

Good luck!