Long-term holders and large investors have become the main driving force behind the current rally in Bitcoin and the cryptocurrency market. After the outbreak of the war in Ukraine, there was a gradual increase in the number of stablecoins in the total share of capitalization. Initially, this maneuver of investors could be regarded as an opportunity to save capital in a digital asset pegged to the U.S. dollar. However, there was another version, which is that stablecoin stocks are much easier to convert into a specific cryptocurrency.

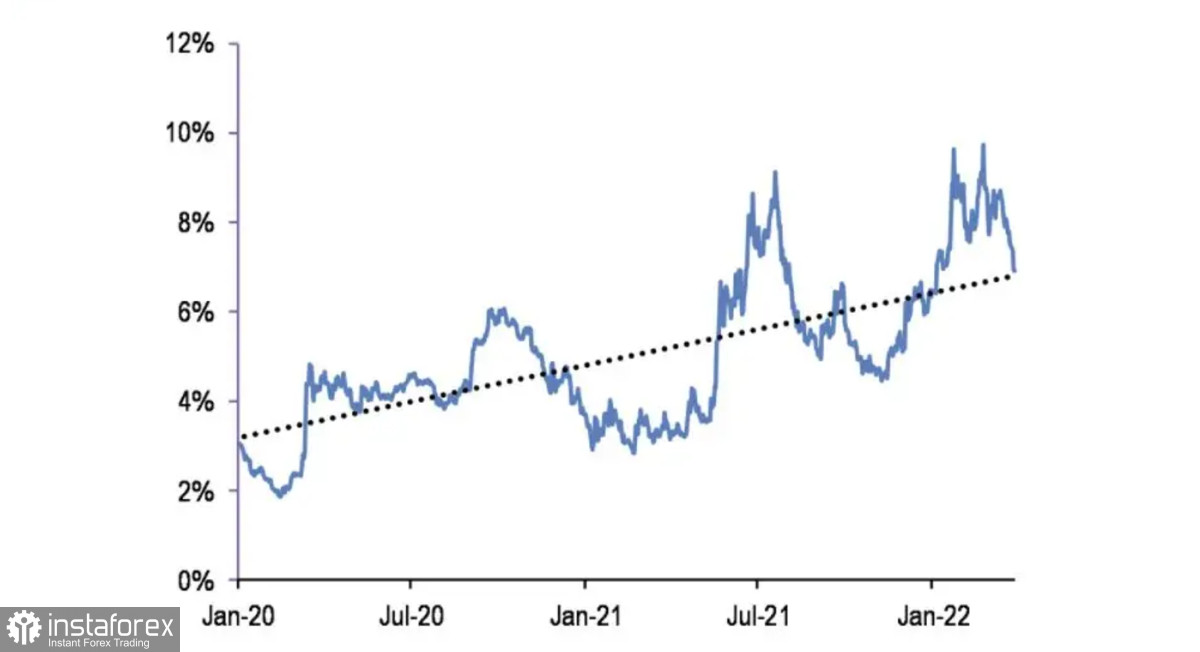

After a month, it can be stated that the main reason for the growth of the cryptocurrency market was the planned and lengthy preparation for the accumulation of stablecoins. At the peak, the share of stablecoins in cryptocurrency capitalization reached 10%+. Subsequently, some long-term holders, Russians under sanctions, as well as miners began to sell their cryptocurrency reserves for various reasons. As a result, a huge supply of BTC coins was formed on the market. Large investors and other holders turned out to be ready for this, having large stocks of stablecoins. We see the results of volume absorption in the market capitalization, which reached $2.1 trillion.

Between the end of February and mid-March, large investors accumulated about 12 million BTC, which is equivalent to $551 billion. Thanks to this, BTC/USD quotes reached a local high at $48k, and the fear and greed index reached the greed mark for the first time in several months. However, as of April 5, Bitcoin has stopped its upward movement, as has the cryptocurrency market. Faced with a strong zone of bear interest, the asset fell to the local support zone.

The altcoin market also stopped growing due to the influence of the first cryptocurrency. JPMorgan's chief strategist Nikolaos Panigirtzoglou is confident that this is due to a gradual decrease in the investment activity of buyers and a further slowdown in growth.

In other words, Panigirtzoglou believes that the growth of the cryptocurrency market has stalled. He considers the share of stablecoins in market capitalization as fuel for the growth of cryptocurrencies. According to him, when the share of stablecoins reaches 10%, the market showed active growth. As of April 5, the share of stablecoins has fallen to 7%, indicating a decrease in purchasing power. Panigirtzoglou is sure that all further growth of Bitcoin and the market will be limited due to the lack of necessary liquidity.

There is some truth in the words of the JPMorgan expert, but I would like to note that the market still has not lost its potential for growth. In addition to stablecoins, which have apparently become liquidity from the outside, the market has its own reserves. First of all, this can be seen from the indicators of funding rates, which are in neutral positions. Given the bullish sentiment, keeping rates at average values indicates the presence of shorts, which is the "fuel" for a further price rally. In addition, market participants continue to take profits locally when BTC reaches $48k. With this in mind, there is a period of consolidation and additional accumulation before further upward movement.

We see the same thing on the Bitcoin charts. The cryptocurrency has been in a consolidation phase since March 28. Buying activity really declined, and the asset failed to break through the $48k milestone. Despite this, BTC is fixing in the $46k area and consolidating the price for a further assault on $48k. Technical indicators point to continued flat dynamics over the next few days with the possibility of a second decline to $44k. This is hinted at by a local bearish crossover on the MACD and the stochastic oscillator. Therefore, in the near future, we should expect a local decrease for additional liquidity collection and a retest of $48k.