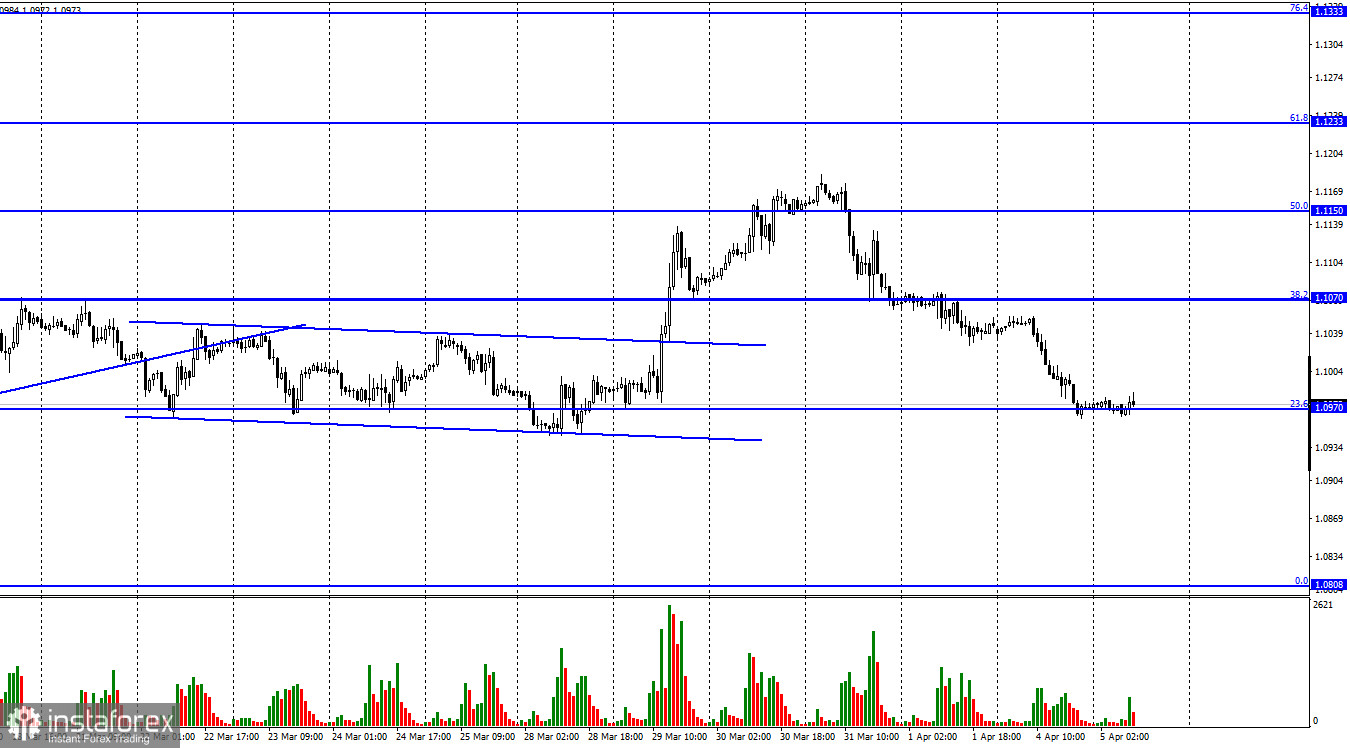

Hello, dear traders! On Monday, the EUR/USD pair extended losses and reached 1.0970, the Fibonacci retracement level of 23.6%. A rebound from this level will allow us to count on an upward reversal of the euro and the pair's growth towards 1.1070, the Fibonacci level of 38.2%. In case of price consolidation below the 1.0970 mark, the likelihood of a further decline towards the next retracement level of 0.0% - 1.0808 - will increase. Yesterday's macroeconomic calendar was bereft of any important releases. As for geopolitics, in recent days, the world community has been worried about the events in the cities of Bucha, Gostomel, and Irpin. But the Kremlin has officially denied allegations that its troops killed civilians. However, it seems that no one in the world believes in it.

Yesterday, it was reported that the European Union would consider a new package of sanctions against Russia, including increased tariffs on Russian gas and oil. These restrictions will force European countries to abandon Russian energy as soon as possible and switch to alternative sources, in particular to green ones. The European currency reacted negatively to this news. Market participants are aware that Europe is dependent on Russian oil and gas, and any sanctions against the oil and gas sector will inevitably lead either to a decrease in imports or to higher energy prices, which have already broken all records in recent weeks. The imposition of tariffs on energy imports means that oil and gas prices will become even higher, and Europeans will have to pay more. Thus, traders believe that the European economy will face new problems. It is likely to experience a significant slowdown in the coming months and quarters.

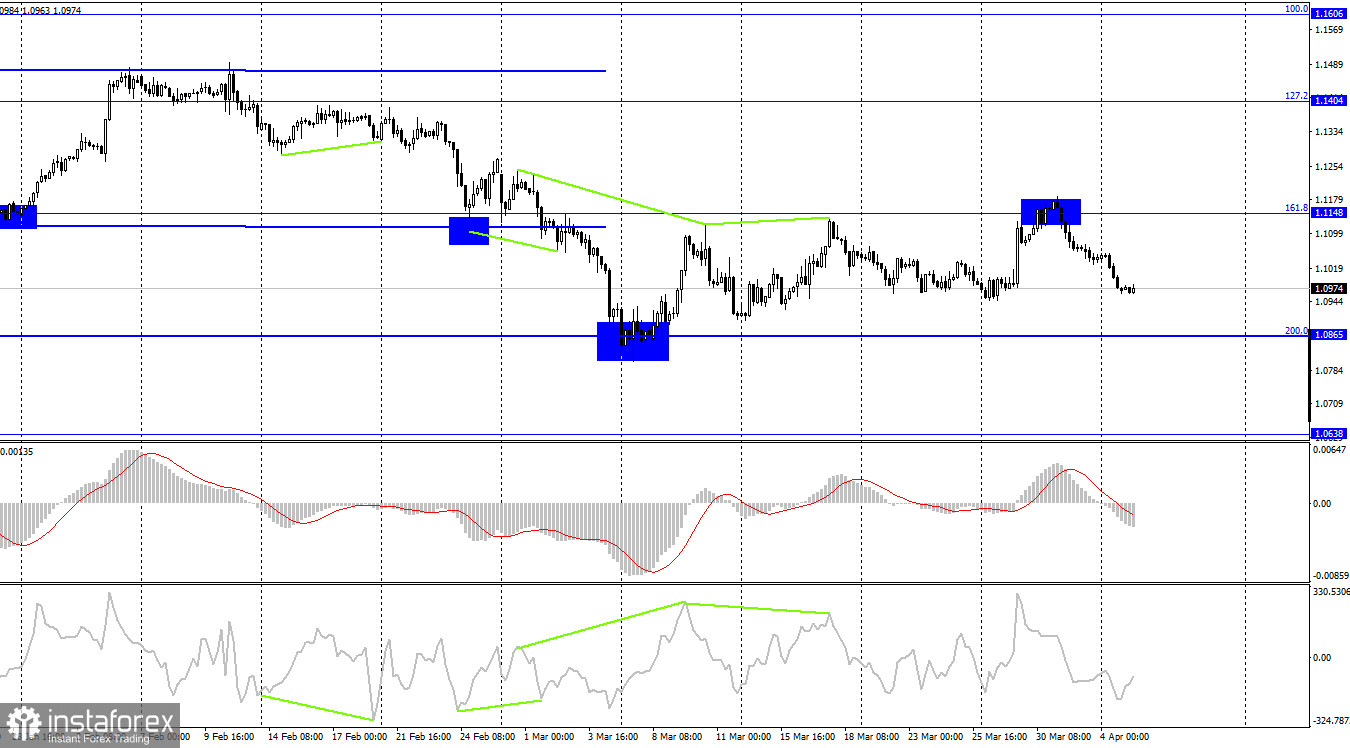

On the 4-hour chart, the euro/dollar pair bounced off 1.1148, the 161.8% retracement level, and continued to fall to 1.0865, the 200.0% Fibo level. Today, there are no emerging divergences according to technical indicators. A rebound from the 200.0% level will lead to a new rally towards 1.1148. If the price fixes below the level of 1.0865, the pair will most likely continue to slide to the 1.0638 mark.

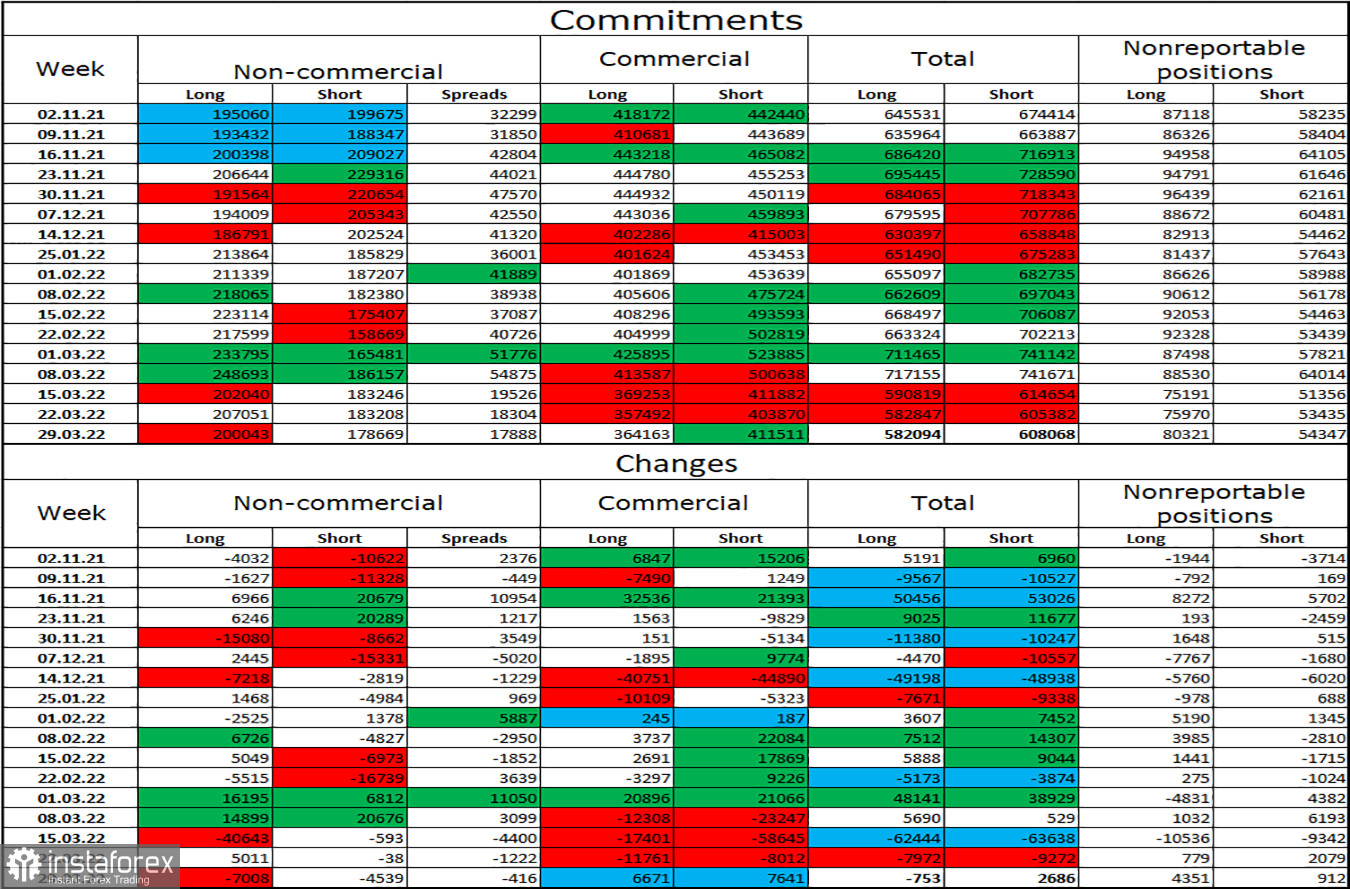

Commitments of Traders (COT):

Last week, speculators closed 7,008 Long contracts and 4,539 Short contracts. This means that bullish sentiment of major players has eased slightly. The total number of Long contracts is currently 200k. The number of Short contracts is 178k. Thus, sentiment among non-commercial traders is mainly bullish. In this case, the European currency should gain value. However, it is coming under pressure from the news flow, which now supports only the US dollar. We are now witnessing a situation in which the mood of major players remains bullish, but the currency is losing value. Thus, geopolitics is now of the greatest importance. The worse the situation in Ukraine will be, the deeper the euro will fall.

News calendar:

The EU - the services PMI.

The US - the ISM survey's measure of services industry.

These PMIs may have an impact on traders' mood, but this impact is unlikely to be severe. Thus, the dynamics of the pair will hardly change significantly today.

EUR/USD forecast and trading recommendations:

Short positions will become relevant if the price fixes below 1.0970 on the hourly chart. In this case, the level of 1.0808 can be seen as a target. In case of a rebound from the 1.0970 mark on the hourly chart, I recommend opening long positions on the pair with a view to reaching the target levels of 1.1070 and 1.1150.