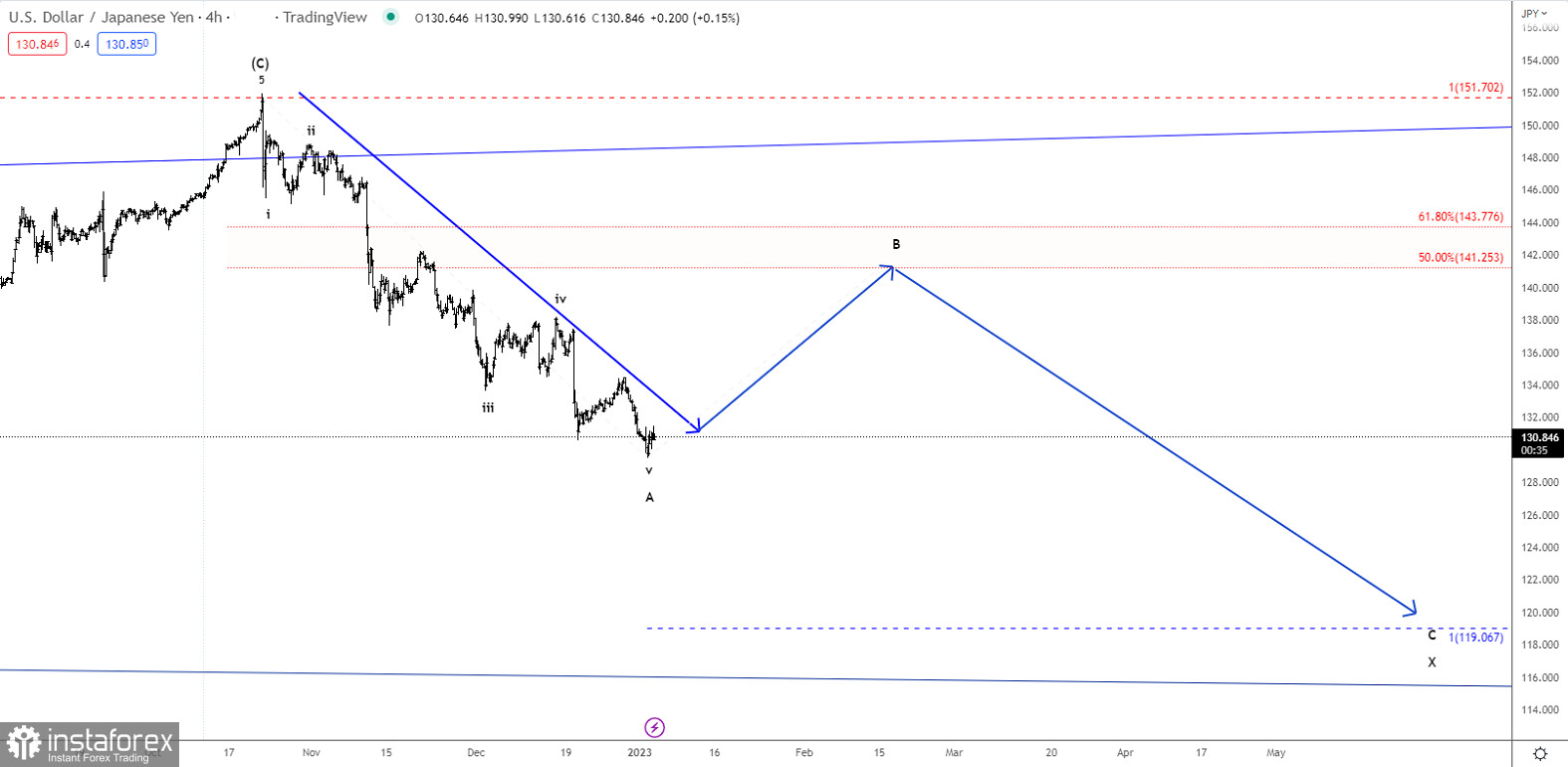

USD/JPY has completed wave A with a test of 129.50. Wave B has taken over for a rally towards 141.25 in the days/weeks ahead. In corrective waves, the B-wave is always the hardest to predict in terms of shape, as all possible combinations are possible. This also means that wave B could make a new low below 129.50 before rallying higher towards the ideal target at 141.25.

Let us be clear, we are not saying that wave B will make a new low. Wave B could be a simple zig-zag moving nicely higher from here. What we are saying is that all possible options within the wave theory are realistic in B-waves, which makes them almost unpredictable and very hard to trade.