Analysis of trades and tips for trading EUR

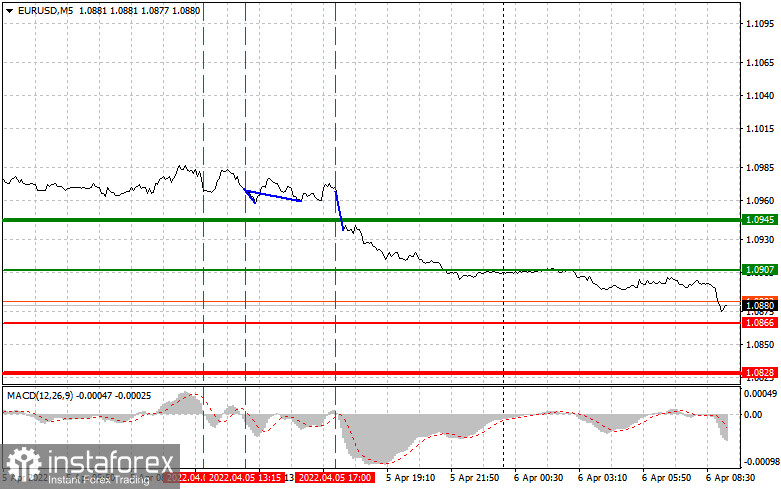

The price tried to break through 1.0968 at a time when the MACD indicator had just started to move down from the zero level. It was a confirmation of the correct entry point in the short positions on the euro. However, the upbeat eurozone PMI indices data limited the pair's downward potential. As a result, the pair rose and traders had to close short positions. In the middle of the day, there was a similar entry point in short positions on the euro at 1.0968. However, traders could take advantage of it only in the afternoon after the price reached 1.0968. It was a confirmation of the correct entry into the market based on the MACD indicator. As a result, the pair fell down by more than 30 pips to the nearest support level of 1.0945.

As I have noted above, strong data on PMI indices for the services sector in Germany, France, Italy, and the eurozone boosted the euro. However, the US revealed similar reports. It spurred demand for the US dollar, triggering a sell-off of the euro/dollar pair in the afternoon. The euro also weakened following the hawkish speeches of FOMC members Lael Brainard and John Williams. The Fed's aggressive approach to monetary policy will be the main catalyst for a further rise in the US dollar. Today. the macroeconomic calendar is uneventful in the first half of the day. So, traders are only expecting data on factory orders in Germany, as well as the euro area producer price index. The reading may approach new yearly highs. However, volatility is likely to be low after the release of these reports as they will show the February figures. Naturally, market participants are not interested in them. The speech of ECB Vice President Luis de Guindos will be in the limelight. If he makes cautious statements about the prospects of the eurozone economy, it may affect the euro. ECB Executive Board member Fabio Panetta will also deliver a speech. In the afternoon, speculators are anticipating the publication of the FOMC meeting minutes. They will show whether the Fed is concerned about inflation and how it is going to react to it in the future. Hawkish rhetoric will only strengthen the US dollar. The speeches of FOMC Member Patrick T. Harker and Treasury Secretary Janet Yellen will also be in the spotlight

Buy signal

Scenario No.1: today, it is recommended to open long positions on the euro when the price reaches 1.0907 (the green line on the chart) with an upward target of 1.0945. At the 1.0945 level, it is better to close log positions and open short positions, keeping in mind a 20-25 pip correction in the opposite direction from the given level. The euro is unlikely to rise significantly today. However, it may advance amid the de-escalation of geopolitical tensions and positive statements by ECB policymakers. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started to grow from it.

Scenario No.2: it is also possible to go long today if the price approaches 1.0866. At this moment the MACD indicator should be in the oversold area. It will limit the downward potential of the pair. It may also trigger an upward reversal. The pair is expected to jump to the opposite levels of 1.0907 and 1.0945.

Sell signal

Scenario No.1: it is recommended to open short positions on the euro if it hits the level of 1.0866 (the red line on the chart). The target level will be located at 1.0828. It is better to close short positions at this level and open long ones, keeping in mind a 20-25 pip correction in the opposite direction from the given level. The euro may also drop amid weak data on the eurozone and geopolitical woes. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario No.2: it is also possible to sell the euro today if the price touches 1.0907. At this moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also trigger a downward reversal. The pair is expected to nosedive to the opposite level of 1.0866 and 1.0828.

Description of the chart:

What's on the chart:

The thin green line shows the entry point where you can buy a trading instrument.

The thick green line is the estimated price where you can place a Take profit order or lock in profit manually as the price is unlikely to rise above this level.

The thin red line is the entry point where you can sell the instrument.

The thick red line is the estimated price where you can place a Take profit order or lock in profit manually as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions when entering the market. It is best to stay out of the market before the release of important fundamental reports. It will help avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan like the one I presented above. Relying on spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.