Analysis of transactions in the GBP / USD pair

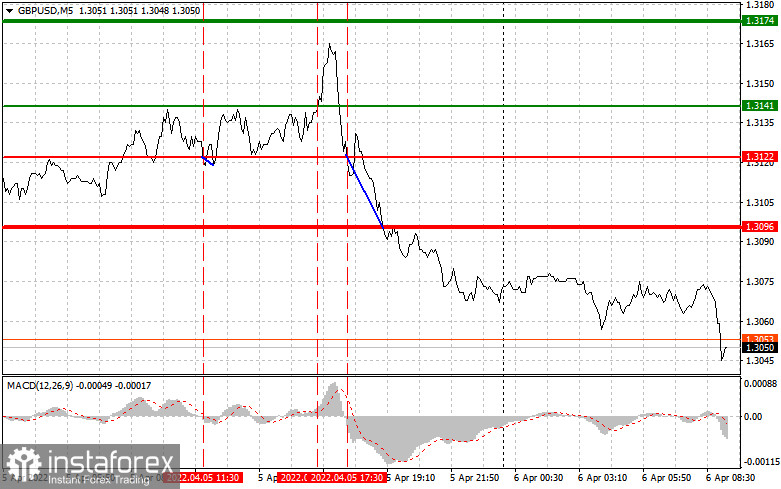

A signal to sell emerged after GBP/USD hit 1.3122. However, there was no sharp decrease even though the MACD line was starting to move below zero. The reason was the strong data on UK PMI, which limited the downside potential of the pair. Some time later, another test of this range took place. This time, the pair fell by more than 30 pips, offsetting the losses recorded in the morning.

GBP/USD rose on Tuesday, thanks to the better-than-expected PMI data on the UK services sector. The continuation of growth in activity at its maximum level indicates the full opening of the economy after the coronavirus pandemic. However, this also compares the work of the Bank of England in combating high inflation, so the increase can be viewed in different ways.

A strong PMI report from the US was also released in the afternoon, which, along with the speeches of FOMC representatives, returned the pair to the lower border of the March sideways channel.

There are no important statistics on the UK today, so the pound will most likely continue to have problems. In the afternoon, everyone will focus on the publication of the minutes of the Fed meeting, from which it will become clear how much the central bank is concerned about inflation and how they are going to react to it in the future. Hawkish protocols will strengthen the position of dollar. No less interesting will be the speeches of FOMC member Patrick Harker and Treasury Secretary Janet Yellen.

For long positions:

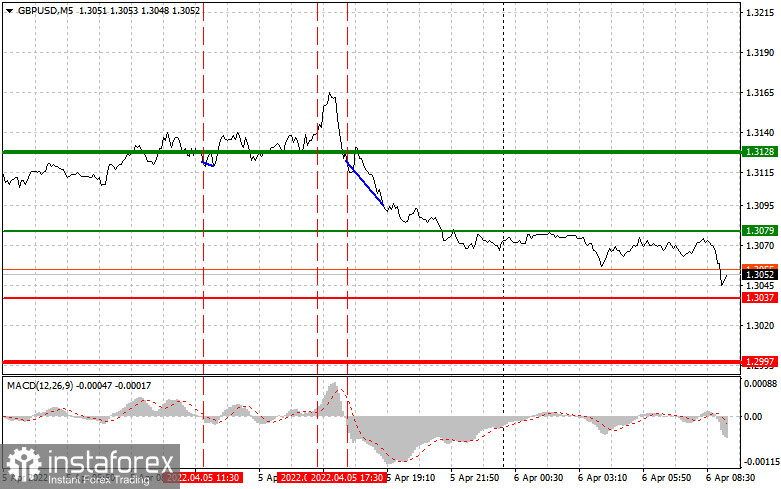

Buy pound when the quote reaches 1.3079 (green line on the chart) and take profit at the price of 1.3128 (thicker green line on the chart). A rally will occur if buyers manage to protect the lower border of the March side channel.

When buying, make sure that the MACD line is above zero, or is starting to rise from it. It is also possible to buy at 1.3037, but the MACD line should be in the oversold area as only by that will the market reverse to 1.3079 and 1.3128.

For short positions:

Sell pound when the quote reaches 1.3037 (red line on the chart) and take profit at the price of 1.2997. Pressure is likely to continue, especially since the attempt to break through 1.3079 failed. The outlook for the UK economy is also getting gloomier every day. But before selling, make sure that the MACD line is below zero, or is starting to move down from it. Pound can also be sold at 1.3079, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.3037 and 1.2997.

What's on the chart:

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.