Over the past month and a half, we have seen a significant influx of investment in Bitcoin from institutions. Active accumulation of BTC began after the invasion of the Russian Federation on the territory of Ukraine and the beginning of hostilities. At the same time, it is important to note that at first, the preparatory process took place, which consisted of the acquisition of large volumes of stablecoins. In late February and early March, the share of stablecoins in the total capitalization of the cryptocurrency market reached 10%, which is typical before the start of a bullish rally.

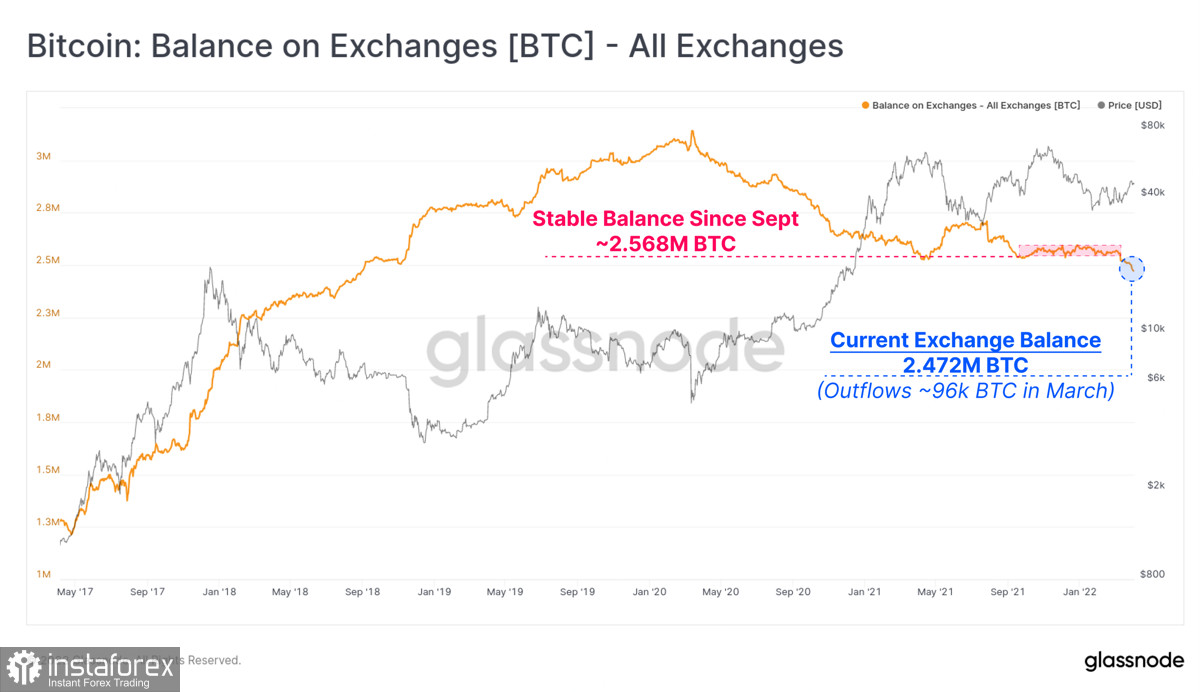

As a result, we saw an upward movement of the cryptocurrency to the $48k mark. Subsequently, the asset pulled back and as of April 6 is trading around $45k-$46k. The investments of large capital continue to grow and are led by Michael Saylor and MicroStrategy. The fintech company acquired more than 4,000 BTC at an average price of $45.7k. Bitcoin coin balances on cryptocurrency exchanges continue to fall below a three-year low, which indicates that the trend of active accumulation by large players continues.

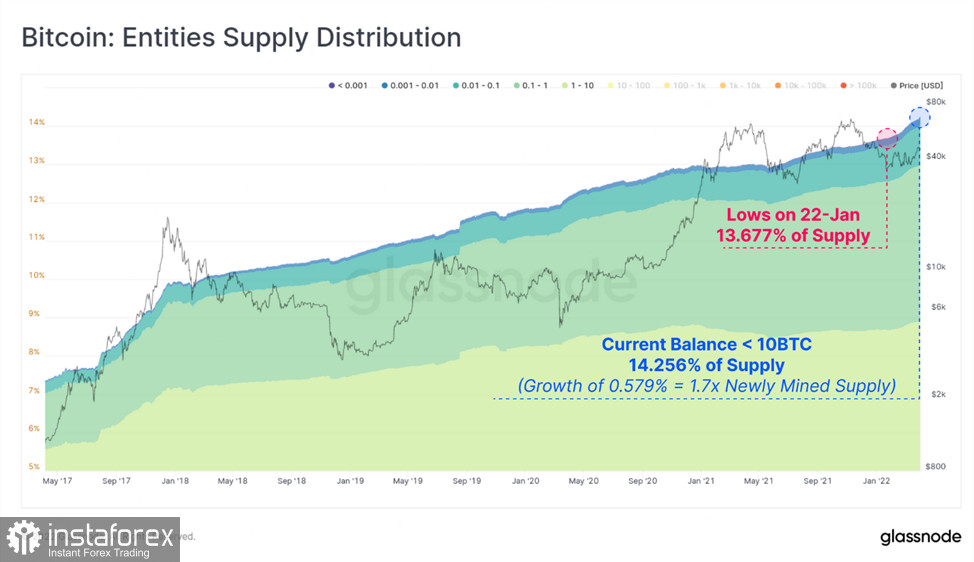

The investment activity of large companies indicates the next stage of the adoption of cryptocurrencies. On average, crypto exchanges lose more than 96,000 BTC coins per month, and soon this trend will reach a peak. When this happens, the acquisition of Bitcoin will become a difficult task due to the fact that the digital asset algorithm provides for the issue of 21 million coins. Of this number, about 19 million have already been mined, most of which are on users' wallets. At the same time, the rate of BTC outflow from exchanges reached 1800 coins per day, which is twice the rate of issue.

In the medium term, this contributes to the growth of demand for the asset due to its scarcity. In the conditions of the economic and geopolitical crisis, Bitcoin can become the main savings and reserve means. Right now, all the necessary conditions are being created for this due to the massive purchase of cryptocurrencies, as well as the development of a regulatory framework. It is likely that very soon the first cryptocurrency will reach the absolute maximum of its scarcity, which will fuel the growth of capitalization and volumes. However, more importantly, large sovereign and investment funds will see the potential of Bitcoin during its bullish movement. Taking into account the formation of the regulatory framework, the use of BTC can reach the level of the largest investment players.

The only doubt about the speed and mass of the current purchase is the "sell in May and go away" campaign, which implies unloading investment portfolios in May, before the holiday season. In 2021, there was a strong dump of the BTC/USD price amid a massive sell-off. However, the current situation is radically different from the spring of 2021.

With this in mind, we should expect the continuation of the upward movement of the cryptocurrency price in the near future due to the growth of scarcity and a combination of fundamental factors. The cryptocurrency will complete the necessary consolidation period, and technical indicators will return to the bullish zone after reaching the overbought boundaries. Most likely, this will happen this week and subsequently, the asset will continue its upward movement to the $48k-$50k area.