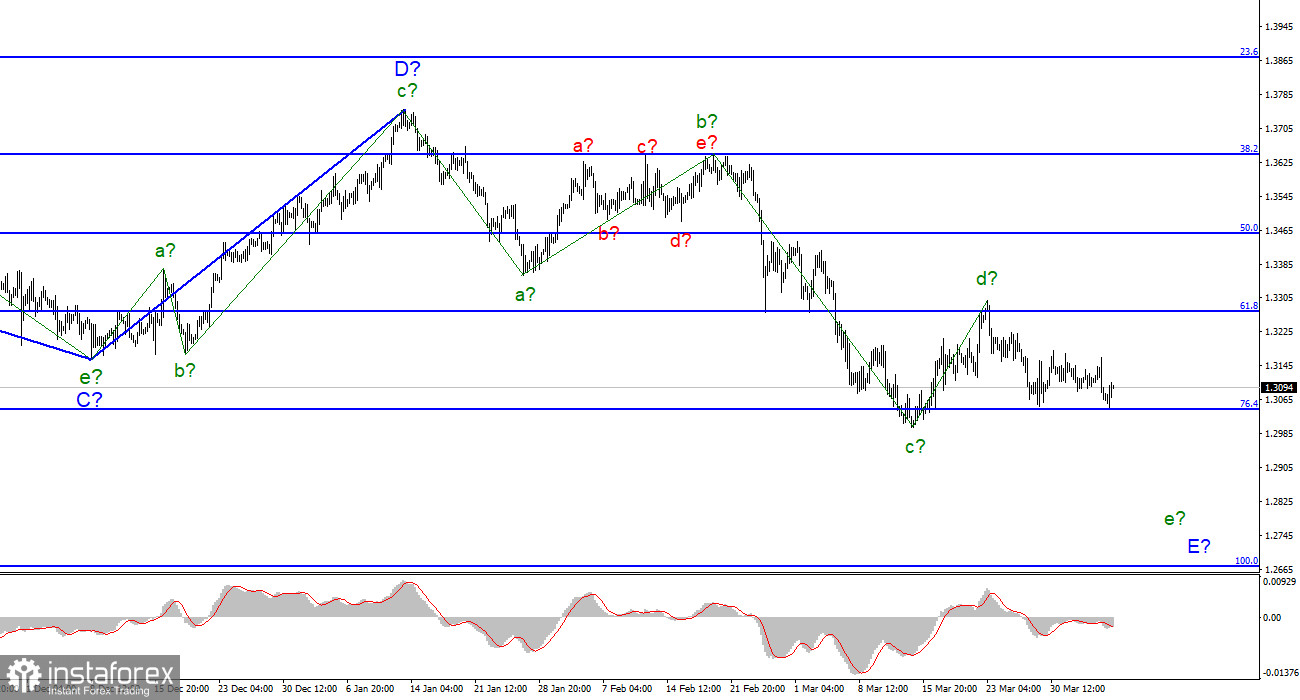

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require any additions. The expected wave d-E is completed, and there should be five waves in total inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for some time. The assumed wave d-E may take a longer, three-wave form. This is supported by the fact that wave b-E has taken a five-wave, extended form. Also in favor of this is the unsuccessful attempt to break the low wave c-E. Thus, the instrument could not break through the 76.4% Fibonacci level and the construction of a new upward wave may begin. This wave can be corrective, internal in the composition of e-E, or it can be the beginning of the wave c-d-E. In the first case, the decline in the British dollar quotes should resume in the near future, in the second case, the instrument may return to the 1.3274 mark, which corresponds to 61.8% Fibonacci. But one way or another, I expect the construction of the wave e-E.

The UK increases sanctions pressure

The exchange rate of the pound/dollar instrument practically did not move on April 6. The day before, the British dollar again declined slightly, but not too much. In general, the demand for the British currency continues to decline, but the market cannot overcome the 1.3041 mark in any way, despite the current wave marking, which suggests a further decline in the instrument. I have already said in my previous articles that a Briton and a European are in an extremely unfavorable position compared to an American. The military conflict in Ukraine primarily affects the economies of European countries. Therefore, it is not unusual for me that the euro and the pound have been falling in recent months. The Russian military completely left the Kyiv, Sumy, and Chernihiv regions. According to British and American intelligence reports, the troops will be relocated after re-equipment to Donetsk and Luhansk regions, and will also continue to attack Mariupol and Mykolaiv. Thus, the military operation may begin anew in the coming days, just in fewer areas than before. I would also like to note that missile strikes on the largest cities of Ukraine are continuing, so no one can feel safe yet.

The UK, in response to Russia's ongoing military actions in Ukraine, decided to freeze another $ 350 billion of Russian assets. This will be officially announced before the end of this week, Foreign Minister Liz Truss said. She also said that of the $ 604 billion of Russian foreign exchange reserves, more than 60% are not available to Moscow. Truss called on European countries to agree as soon as possible to stop the import of Russian oil, gas, and coal. It is already known that new NATO, EU, and G-7 summits will be held in the coming days, at which new restrictions for the Russian economy will be discussed. In particular, it is proposed to introduce restrictions on the energy and industrial sector of the Russian Federation.

General conclusions

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located near the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since wave E does not look completed yet. Wave d can take a three–wave form and lengthen - wave b turned out exactly like this, but in any case, we should consider the signals "down", and while wave d continues to build, the MACD indicator is rising.

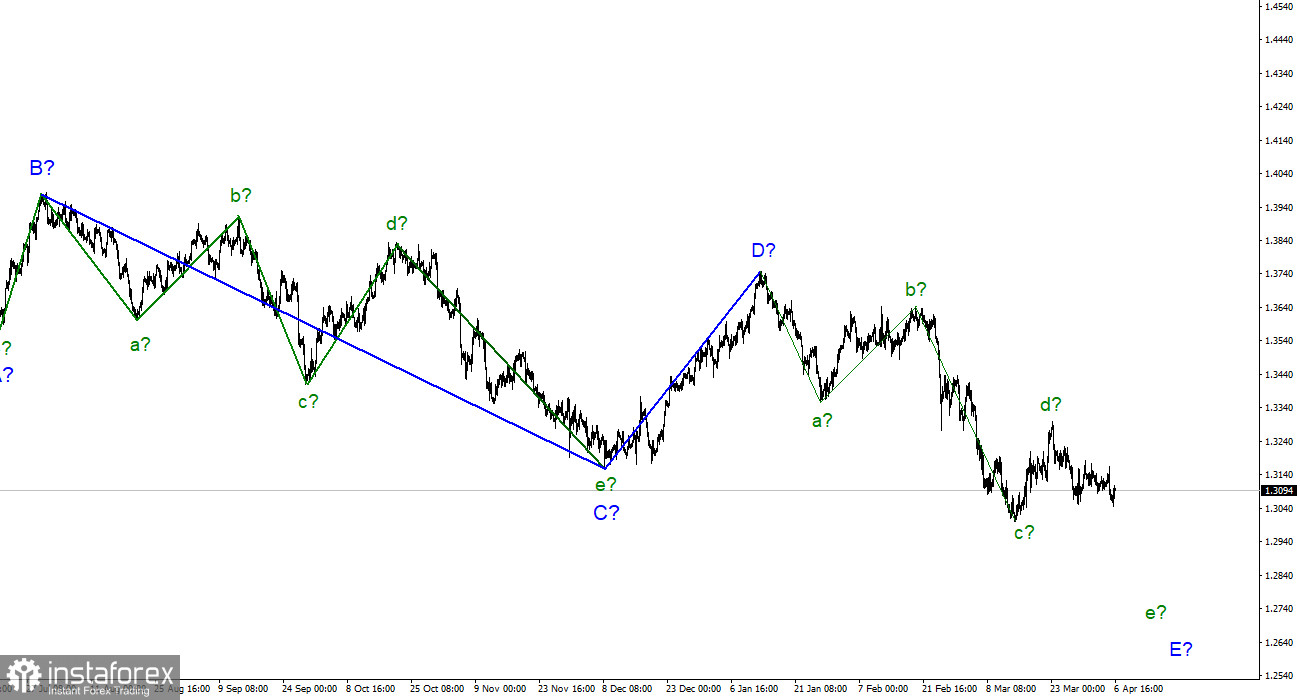

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the quotes of the British near the 27th figure.