Euro and pound grew on Wednesday because of two reasons. The first one is that the European Union clearly does not intend to impose sanctions on Russian energy supplies, which was so actively discussed on Tuesday. After all, if Europe decided to limit the import of Russian coal, this would put the European economy in an even more difficult position. Fuel prices are already incredibly high, and inflation does not seem to have plans to slow down. If supply is also reduced, then both of these problems would only get worse. It could also lead to the shutdown of many industrial enterprises, which are already not working at full capacity.

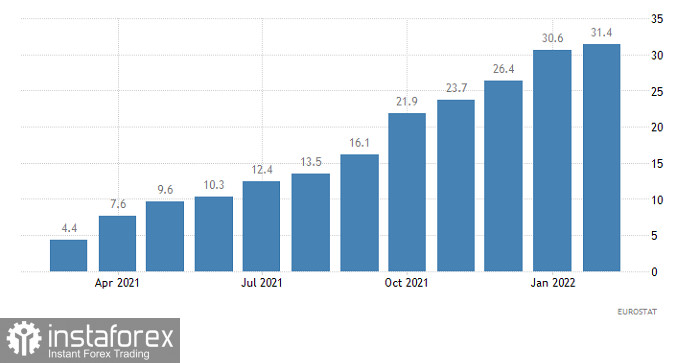

The second reason is the increase in macroeconomic statistics. EU PPI reportedly rose from 30.6% to 31.4%, against a forecast of 36.0%.

Producer price index (Europe):

But by the start of the US session, quotes rolled back to their original positions.

Talking about today, it is extremely unlikely that there will be the same scenario. At best, during the European session, euro and pound will stand still, if not decrease. The main reason is the upcoming retail sales report in the Euro area, the growth rate of which may slow down from 7.8% to 6.2%. But if the figure comes out noticeably better, then euro and pound will grow.

Retail sales (Europe):

In the afternoon, the US will release data on jobless claims, but there is little chance that it would affect the market. After all, the number of initial appeals should increase by only 3,000, while the number of repeated requests will rise by only 8,000. These changes are extremely insignificant, so traders will most likely ignore them. But there is still a possibility that real data will differ from the forecasts.

Number of retries for unemployment benefits (United States):

In any case, EUR/USD, during an intensive downward movement, dropped to 1.0900, where a local stagnation arose. This means that downward interest is still present despite the reduction in the volume of short positions. Further decline will occur if the pair remains below 1.0875.

As for GBP/USD, it broke through 1.3100/1.3180, which led to a local acceleration. But after a while there was a rollback to the previously passed flat border. In this situation, 1.3050/1.3060 serves as a variable support, so keeping the price below it will lead to a subsequent decline towards 1.3000. Otherwise, the stagnation may drag on.