On Wednesday, the EUR/USD pair struggled to grow during the day, but all these attempts failed after the minutes of the Fed meeting in March were released. The US dollar immediately started rising again and is continuing its rally. Yesterday, the European markets were closed and could not react to the minutes. As a result, the pair falls towards the correctional level of 0.0% at 1.0808. Earlier this week, several Fed Monetary Committee members held speeches and made decisions regarding the monetary policy changes. In particular, Mary Daly and Lael Brainard stated that the interest rate should be increased more aggressively, They also noted that the decision to reduce the Fed's balance sheet may be made as early as in May. Yesterday's Fed minutes confirmed these statements. It showed that quite a few Fed members would welcome a 0.5% rate hike at once and possibly more than once during 2022. The minutes also included information about the amount of $95 billion by which the Fed could reduce its bloated balance sheet each month.

In my view, this is the most hawkish stance the FOMC members could take. On second thought, what other measures could the Central Bank take to curb inflation? Should they raise interest rates to several points at once and sell off a couple of trillion dollars worth of bonds right away? In that case, the stock market would get a real shock and there could be another black Monday or Thursday. Thus, the Fed is balancing between a quick and aggressive tightening of monetary policy and a soft impact on the stock market. However, its actions result in the US dollar continuing to rally. The US also continues to impose sanctions against the Russians and the Russian Federation. Yesterday it was reported that Lavrov and Putin's family members are under sanctions. Also, in the coming days, the US government may approve the Lend-Lease Act. This is a program that worked during World War II, which allowed the US to quickly and without red tape transfer various weapons to the allies, for which they could pay much later. The Act has already been approved by the US Senate.

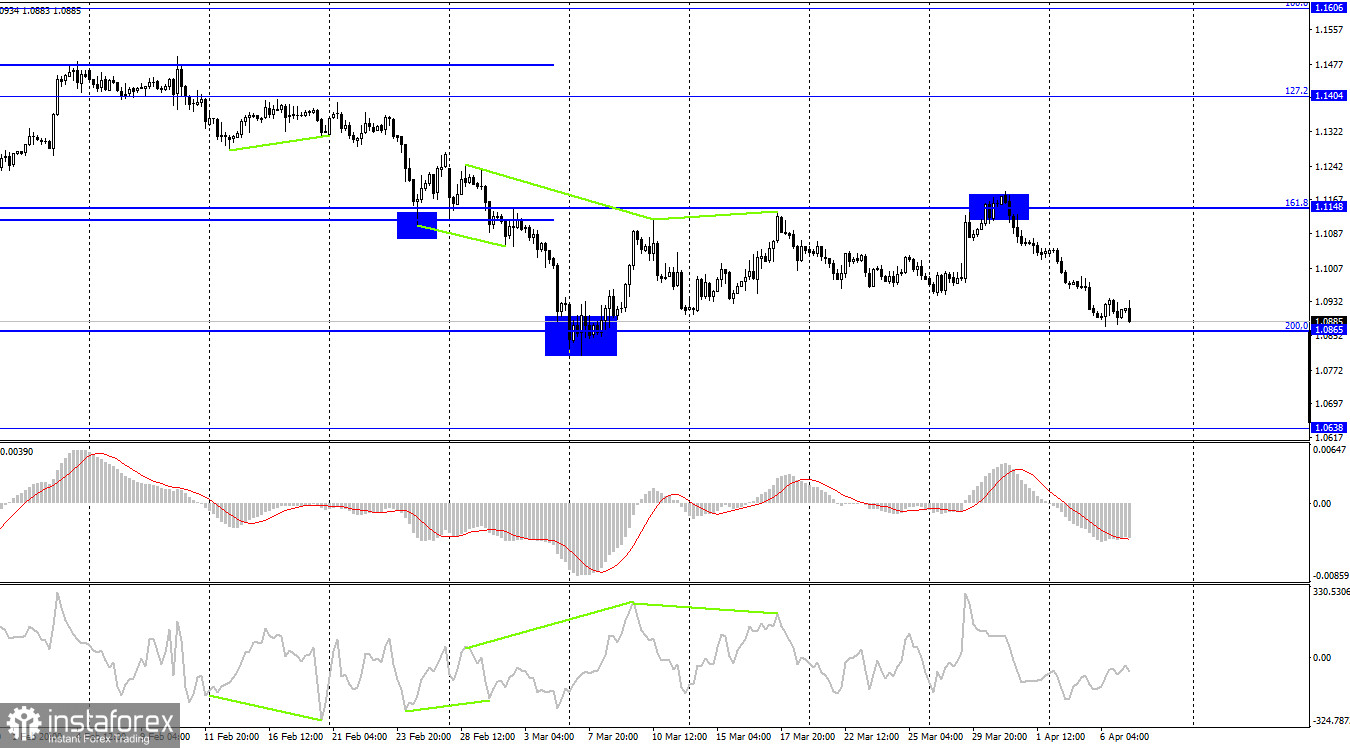

On the 4-hour chart, the pair fell to a correctional level of 200.0% at 1.0865. If the pair rebounds from this level, it may reverse in favor of the European currency and we can see some growth towards the correctional level of 161.8% at 1.1148. If the pair fixes below 1.0865, it may decline towards the next level of 1.0638. Today, the indicators show no divergences.

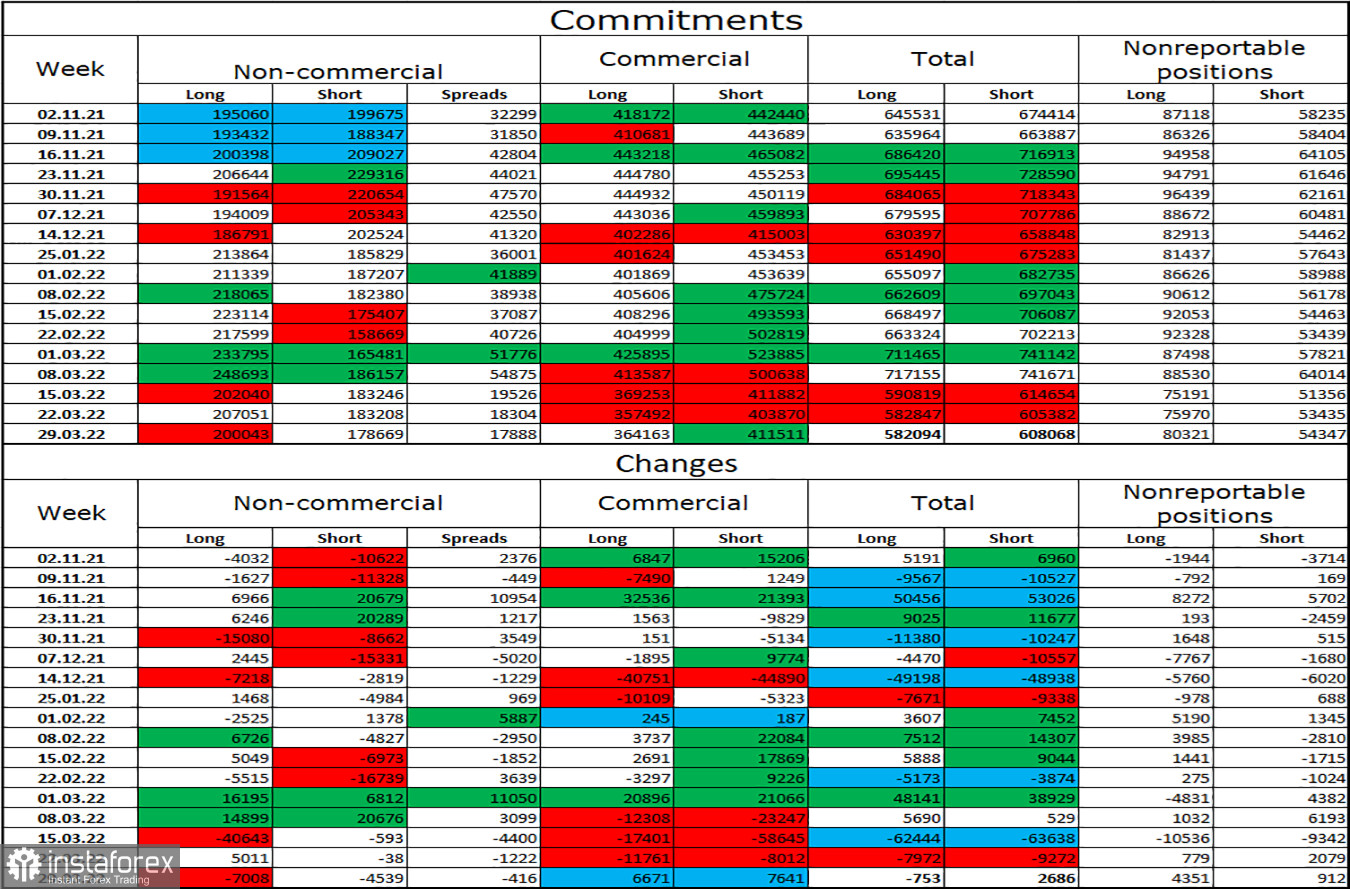

Commitments of Traders (COT) report:

During the last reporting week, traders closed 7,008 Long contracts and 4,539 Short contracts. This means that the bullish sentiment of the big players has weakened a bit, but the changes, in general, are insignificant for the second week in a row. The total number of Long contracts is now at 200,000, and Short contracts at 178,000. So, on the whole, the Non-commercial traders' sentiment is bullish. In this case, the European currency should grow. And it is expected to show some growth, if not for the background information, which now supports only the US dollar. We can observe the bullish sentiment of the big players persisting, but the currency is falling. Thus, geopolitics is now a priority and the worse the situation in Ukraine, the deeper the euro will fall.

Economic Calendar for the US and the EU:

EU - Retail Sales (09-00 UTC).

US - Unemployment Claims (12-30 UTC).

US - Treasury Secretary Janet Yellen Speaks (14-30 UTC).

On April 7, the US and EU economic calendars are nearly empty of important events. There will be another speech from Janet Yellen, who yesterday said absolutely nothing about the economy. The news flow may have little or no effect on traders' sentiment today.

EUR/USD forecast and recommendations for traders:

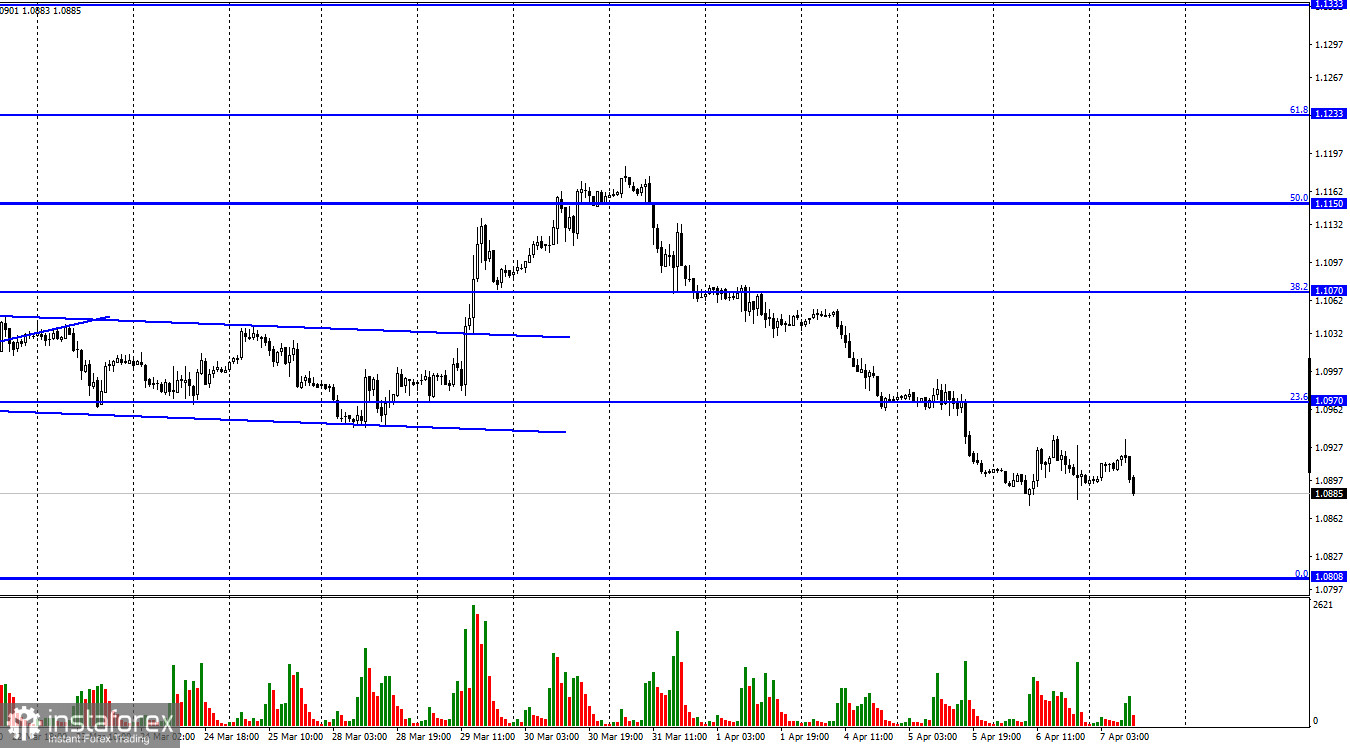

Traders may sell the pair with the target at 1.0808 on the hourly chart if a consolidation below 1.0970 is performed. At the moment, the positions can be kept open. It would also be better to buy the pair if there is a rebound from 1.0865 on the 4-hour chart with the targets at 1.0970 and 1.1070.