In the morning article, I highlighted several important levels and recommended taking decisions with these levels in focus. Now let's look at the 5-minute chart and try to figure out what actually happened. The euro was unable to climb above the resistance level of 1.0925 in the first half of the day. A false breakout at this level gave an excellent entry point into short positions. As a result, the pair dropped to 1.0875 where I recommended profit-taking. The gain totaled about 50 pips. However, a false breakout at 1.0875 and positive reports revealed by Germany and the eurozone led to a buy signal. At the time of writing this article, the pair has grown by more than 40 pips, which indicates a high risk appetite. Technical indicators have not changed significantly for the second half of the day as well as the trading strategy.

What is needed to open long positions on EUR/USD

Now, traders are awaiting with bated breath the publication of the ECB meeting minutes. They will signal the future course of action of ECB policymakers. Judging by their last speeches, many ECB members became more hawkish. This is why there is a likelihood of a rate hike to curb rising inflation. The ECB is likely to take more aggressive measures as due to the protracted response in the US, the CPI index almost reached 8.0%. Analysts are sure that the figure will rise higher. Today, the macroeconomic calendar for the US lacks any crucial reports. So, there will be no surge in volatility. It is better to open long positions only if the pair declines to the morning support level of 1.0875. However, given the probability of a hawkish stance of the ECB observed recently, the bulls could push the price above 1.0925. Besides, the March meeting minutes may once again confirm the hawkish rhetoric of the ECB. If the pair moves down following the US upbeat initial jobless claims and consumer lending reports as well as the dovish tone of the ECB minutes, only a false breakout of 1.0875 will give the first entry point into long positions. As I mentioned in my morning article, in order to see a slowdown in the bearish trend, bulls need to show energy at the 1.0925 level. A breakout and a downward test of this level will give an additional buy signal. So, the pair may recover to 1.0970. Notably, moving averages are passing in the negative territory at 1.0925. The breakout of this level is a very important task for bulls. If the price consolidates above 1.0970, the bulls will diminish the bears' stop orders. Therefore, the price could easily approach the highs of 1.1007 and 1.1041. If the pair falls further and bulls show no activity at 1.0875, it is better to cancel long positions. The optimal scenario will be to wait for a false breakout of a low located at 1.0843. It is possible to open long positions on the euro immediately for a rebound only from 1.0810 or even a lower low around 1.0772, keeping in mind an upward intraday correction of 30-35 pips.

What is needed to open short positions on EUR/USD

The bears completed all the tasks with flying colors. However, the price failed to consolidate at the weekly lows. Apparently, sellers are running out of steam. It may lead either to the pair entering the sideways channel or to a small upward correction. Bears should not allow the current correction to become an upward one. The primary task of sellers for the second half of the day is to defend the nearest resistance level of 1.0925. Only a false breakout at this level will put pressure on the euro. As a result, we will see a sell signal. The price may decrease within the trend to a large support level of 1.0875 which it had already broken this morning. Therefore, there is no reason to worry. In the case of the ECB dovish minutes and strong US data, a breakout and an upward reverse test of 1.0875 will give a sell signal. It will open a road to the lows of 1.0843 and 1.0810 where I recommend profit-taking. If demand for the euro remains high in the afternoon, a false breakout of 1.0925 will provide a sell signal. However, if bears show no energy at this level, the situation will hardly change considerably. This level has already been broken. So, it is better to refrain from opening new short positions. EUR/USD may rise only amid positive news on the negotiations between Russia and Ukraine. However, the parties cannot agree on the date. This is why the talks will not happen in the near future. It is recommended to open short positions after a false breakout at 1.0970. It is also possible to sell EUR/USD immediately for a rebound from 1.1007 or even a higher high around 1.1041, keeping in mind a downward intraday correction of 20-25 pips.

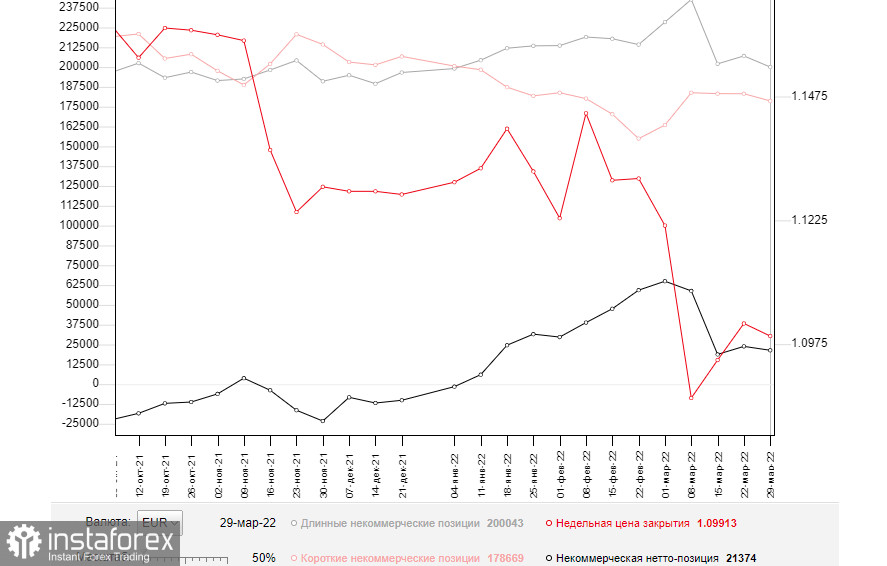

COT report

The COT report for March 29 logged a decrease in both short and long positions. Notably, the number of buyers who left the market exceeded the number of sellers who decided to stop trading. It indicates pessimism among market participants caused by the current geopolitical situation. Meanwhile, the risk of higher inflation in the eurozone is the key issue for the ECB. Importantly, inflation has already soared to 7.5%. Last week, Christine Lagarde stressed the regulator's intention to shift to a more aggressive stance on the QE tapering and key interest rate hike. Against this background, the euro has a good mid-term prospect for growth. At present, it is significantly oversold against the greenback. However, the lack of positive changes in the negotiations between Russia and Ukraine and growing geopolitical tensions have a negative impact on the euro. The economic problems in the eurozone amid high inflation and Russia's retaliatory sanctions (including the payment for gas in rubles) will continue to put pressure on the euro in the short term. Therefore, traders will hardly see a considerable increase in the pair. According to the COT report, the number of long non-commercial positions dropped to 200,043 from 207,051. At the same time, the number of short non-commercial positions decreased to 178,669 from 183,208. Since a drop in the number of short positions turned out to be more significant, the overall non-commercial net position fell to 21,374 from 23,843. The weekly close price also dwindled to 1.0991 from 1.1016.

Signals of technical indicators

Moving averages

EUR/USD is trading below 30- and 50-period moving averages. It means that the euro is likely to continue its downward movement.

Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rise, 1.0925 will act as resistance.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.