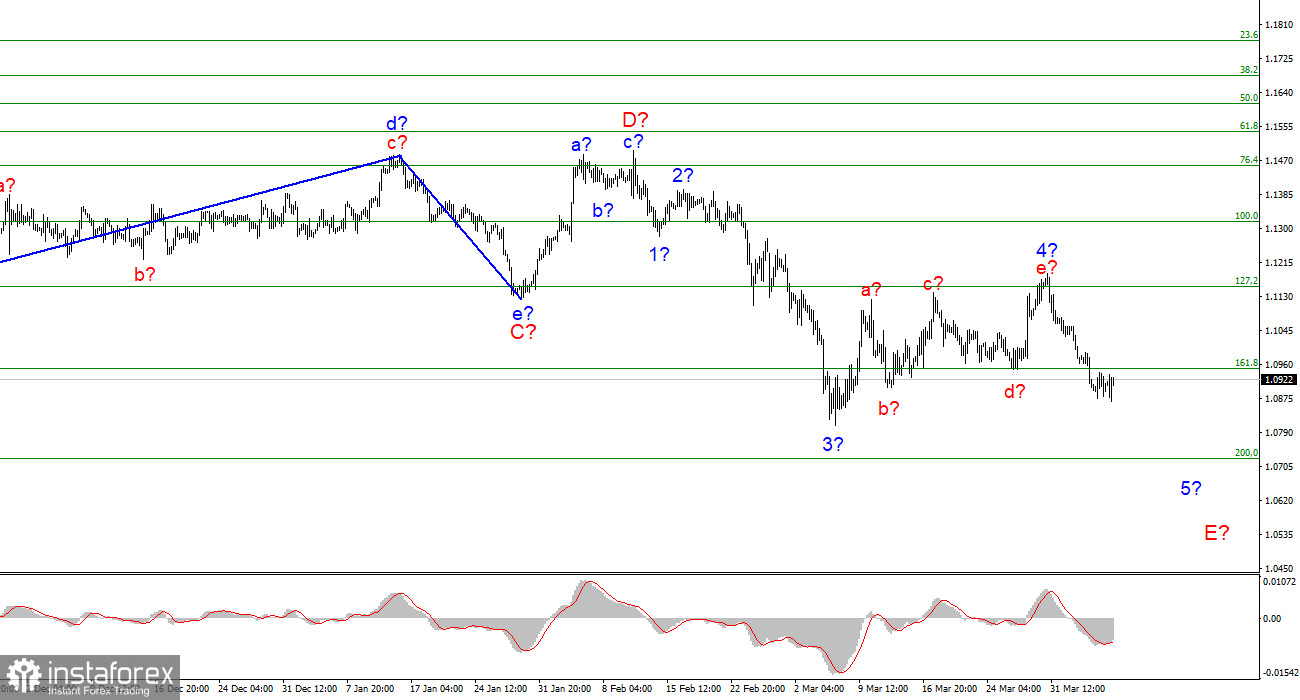

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The proposed wave 4 took a five-wave form and turned out to be completely different from wave 2. However, now this wave is recognized as complete, and the wave pattern does not require any changes. Accordingly, the instrument began constructing the proposed wave 5-E. If this assumption is correct, then the decline in the quotes of the euro currency may continue for another one or two months. At the moment, the entire wave structure of the descending trend section looks almost fully equipped, but wave 5-E is likely to also take a five-wave form. If this is the case, then at the moment the construction of only the first wave consisting of 5-E has been completed. Thus, the instrument still has a fairly strong potential for decline. The first target is around 1.0721, which equates to 200.0% Fibonacci. At the same time, much of the instrument will now depend not only on geopolitics but also on gas and oil prices and the further rupture of relations between Russia and the European Union.

The European Parliament has said its word, now it's the turn of the European Council and the European Commission.

The euro/dollar instrument failed to decline again on Thursday and even added 10 basis points at the time of writing. However, at the same time, it continues to remain within the framework of building a descending wave and a descending trend segment. Therefore, now the euro currency can only count on building a corrective wave. However, this may be hindered by the news background, which continues to pour in a continuous stream from the European Union, the United States, Great Britain, Ukraine, and Russia.

The main news of today was the resolution of the European Parliament regarding the imposition of an embargo on Russian oil, gas, nuclear fuel, and coal. 513 MEPs voted "for" the immediate imposition of the embargo, 22 voted "against" and another 13 abstained. This decision, however, does not mean that the embargo will be imposed "just a few days ago." This is just a call to the European Council to start the appropriate procedure. Let me remind you that just yesterday Ursula von der Leyen presented a new, fifth package of sanctions, which, on the one hand, is quite tough, and, on the other hand, was immediately criticized by everyone who could. It provides for a ban on Russian ships entering European ports, a complete embargo on coal from the Russian Federation, disconnection of three Russian banks from SWIFT, personal sanctions against family members of Vladimir Putin, and Sergey Lavrov. However, as it turned out a little later, the embargo on coal will begin to take effect only in August, which raises a reasonable question, why introduce it at all? What is the point of sanctions, which, as they say in the EU, are designed to stop the aggression of the Russian Federation in Ukraine, if they begin to take effect in a few months? In addition, MEPs called for Russia to be excluded from the G-20, the UN Council, Interpol, WTO, and UNESCO. US Treasury Secretary Janet Yellen made similar statements and appeals yesterday. Thus, the sanctions pressure on Moscow continues to increase while Moscow itself does not comment on this information in any way.

General conclusions.

Based on the analysis, I still conclude that the construction of wave E continues. If so, now is still a good time to sell the European currency with targets located around the 1.0721 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave marking assumes the construction of a wave 5-E, which can also turn out to be very long. In the next few days, a correction wave may begin to build, after which I expect a new decline in the instrument.

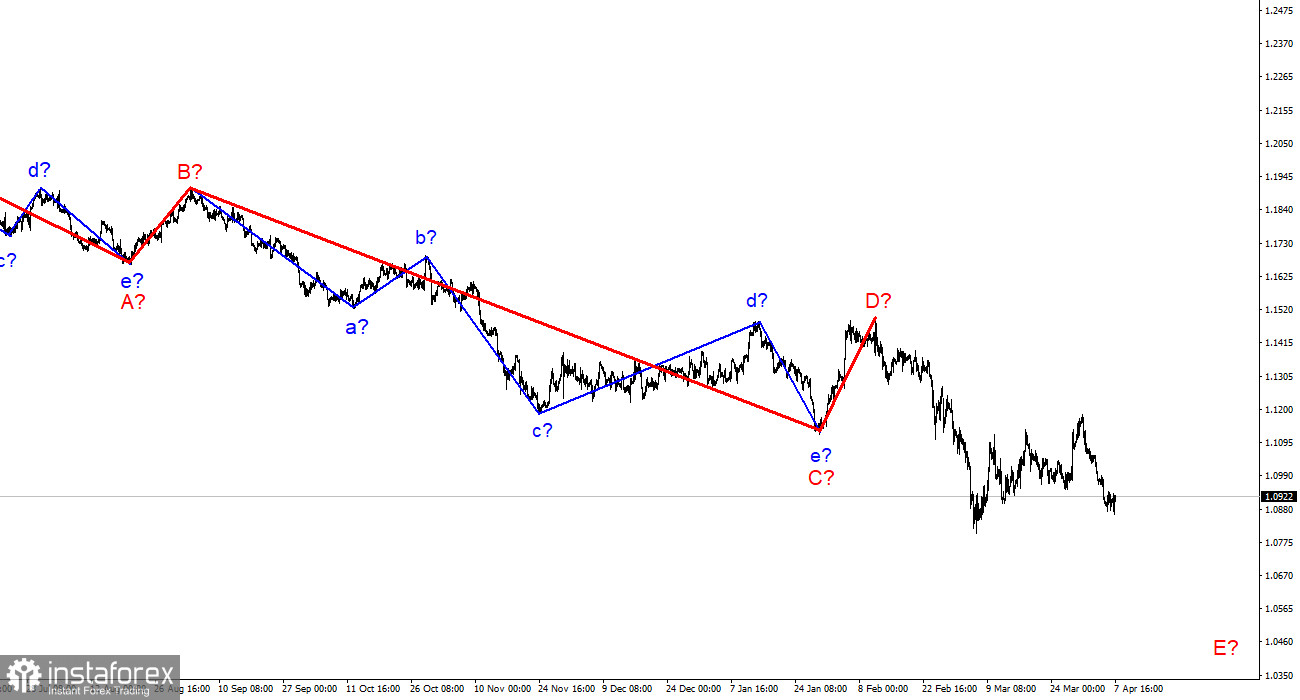

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.