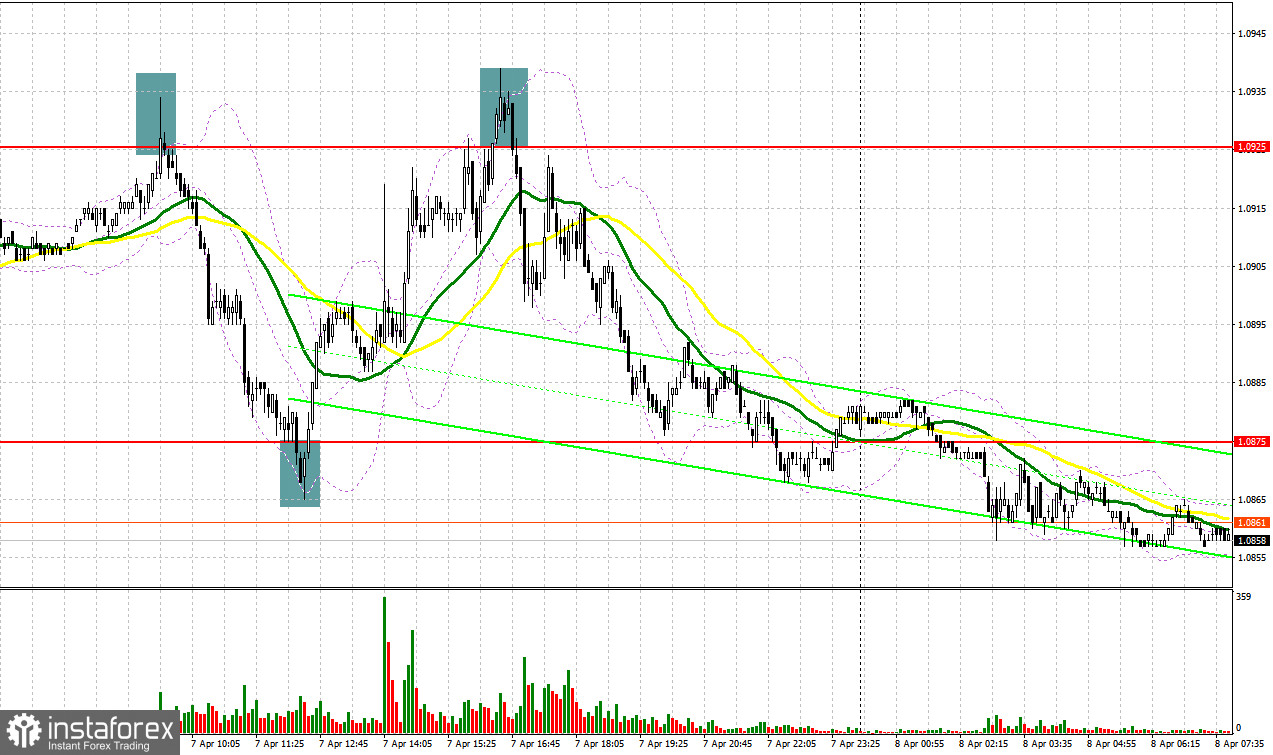

Yesterday, traders received several perfect signals to enter the market. Let us focus on the 5-minute chart to find out where it was possible to open positions. Earlier, I asked you to pay attention to several important levels. In the first part of the day, the euro showed an unsuccessful rise above the resistance level of 1.0925. A false break of this level formed a good short signal. As a result, the pair slumped to 1.0875, where it was recommended to lock in profits. Thus, the pair advanced by about 50 pips. In addition, a false break of 1.0875 and strong data from Germany and the eurozone led to a buy signal. As a result, bulls managed to return the pair to 1.0925, gaining another 50 pips. An unsuccessful break of 1.0925 and high activity among traders from the US gave a sell signal, thus causing a drop to 1.0875.

Conditions for opening long positions on EUR/USD:

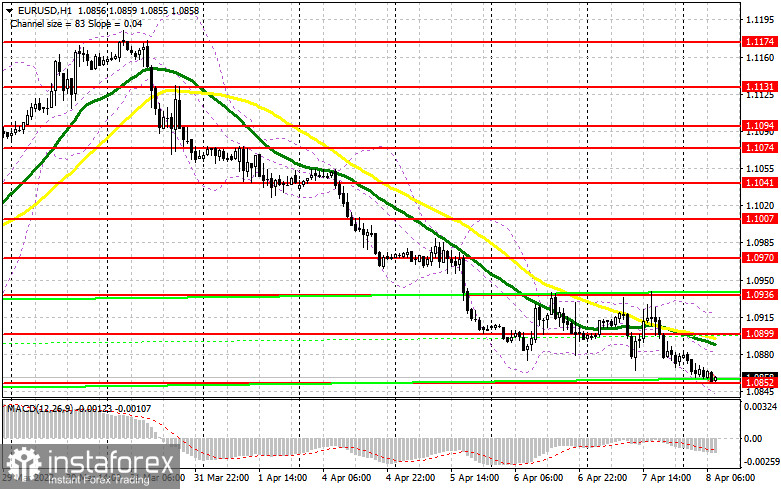

Strong data on the US labor market reminded investors about the resilient US economy and attractiveness of the greenback. The Fed's announcement about a more aggressive rise of the key interest rate encouraged traders to buy the US dollar. The absence of good news about the Russia-Ukraine talks as well as investors' pessimistic attitude towards risk assets will hardly allow the euro to show even a minor rise. Today, there will be no statistical report that will be able to alter the market sentiment. Thus, only buyers of the US dollar will lock in profits at the end of the trading week. The pair has approached the nearest support level of 1.0852. Only a false break of the level will give the first signal to buy the euro. To slacken the decline, the pair should rise, whereas bulls should show activity near 1.0899.A downward test of the level will give an additional signal to open long positions. At the same time, strong data on Italy's retail sales and hawkish comments provided by Member of the Executive Board of the ECB Fabio Panetta will enablethe pair to recover to 1.0936. If the price exceeds this level, it may climb to the highs of 1.0970 and 1.1007. If the pair continues falling and buyers fail to protect 1.082, it will be better to avoid opening buy orders. It will be possible to buy the asset after a false break of the low of 1.0810. Traders may also go long from 1.0772 or lower – from 1.0728, expecting a rise of 30.35 pips within one day.

Conditions for opening short positions on EUR/USD:

Yesterday, bears did not allow the euro/dollar pair to go above 1.0935. The pair is likely to go on falling since bears are fully controlling the market. It seems that the pause in the bearish trend, which was indicated several days ago, has already finished. Today, sellers should protect the resistance level of 1.0899. A false break of this level will put the euro under pressure again and give a sell signal with the target at the intermediate support level of 1.0852. To continue falling, the pair should hit fresh lows every day. It is not a problem at the moment. In case of weak data from the eurozone and dovish announcements made by the ECB, the pair is likely to upwardly break 1.0852, forming a sell signal. If the predictions come true, the pair will decline to the lows of 1.0810 and 1.0772, where it is recommended to lock in profits. If the single currency rises in the first part of the day, only a false break of 1.0899 will give the first signal to sell the asset. However, if bears fail to protect this level nothing special will happen. The euro will skyrocket only amid positive news about the Russia-Ukraine talks. However, we will hardly receive encouraging information in the near future. Thus, it will be wise to open short positions after a false break of 1.0936. It is also possible to go short from 1.0970 or higher – from 1.107, expecting a decline of 25-30 pips.

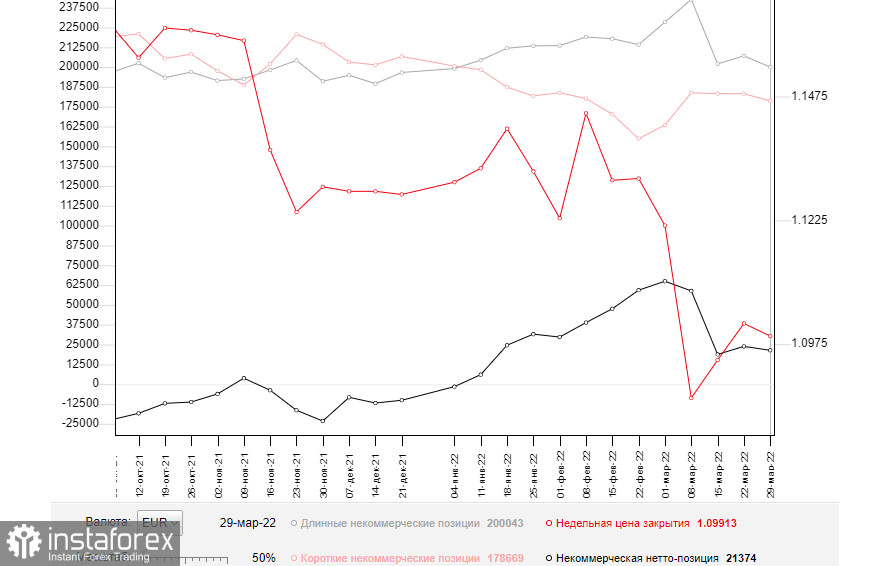

Commitment of Traders Report

The COT report from March 29 unveiled a decrease in both short and long positions. Notably, the number of buyers who left the market exceeded the number of sellers who decided to stop trading. This fact points to pessimism among market participants caused by the current geopolitical situation. Meanwhile, a risk of higher inflation in the eurozone is the key issue for the ECB. Importantly, inflation has already jumped to 7.5%. Last week, Christine Lagarde several times emphasized the regulator's intention to switch to a more aggressive approach to the QE tapering and key interest rate hike. Against this background, the euro has a good mid-term prospect for growth. At present, the single currency is significantly oversold against the greenback. However, the absence of positive results in the Russia-Ukraine talks and a rise in the geopolitical tension have a negative influence on the euro. Economic problems in the eurozone provoked by extremely high inflation and responsive measures taken by Russia (including payments for gas in rubles) are likely to continue exerting pressure on the euro in the short term. That is why traders will hardly see a considerable increase in the pair. According to the COT report, the number of long non-commercial positions slid to 200,043 from 207,051. At the same time, the number of short non-commercial positions slumped to 178,669 from 183,208. Since a drop in the number of short positions turned out to be more significant, the overall non-commercial net position declined to 21,374 from 23,843. The weekly close price also dropped to 1.0991 from 1.1016.

Signals of indicators:

Moving Averages

Trading is conducted below 30- and 50-day moving averages, which indicates a further drop in the euro.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the euro rises, the upper limit of the indicator located at 1.0925 will act as resistance. In case of a drop, the lower limit of 1.0845 will act as a support level for the euro.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.