Bitcoin stopped its upward movement and corrected by 5% this week, returning to the zone of the winter range of fluctuations. Judging by the technical picture, the cryptocurrency is beginning to locally consolidate to resume movement towards the $45k-$48k area. However, the cryptocurrency turned out to be too dependent on other financial institutions, as well as geopolitical and economic events.

First of all, let's analyze a fundamentally important thing – the Fed meeting aimed at combating inflation. All other problems of Bitcoin are derived from the decision of the U.S. Federal Reserve. At the March meeting, it was decided to increase the key rate to the range of 0.25%–0.5%. Later, a report on this meeting appeared, stating that a quantitative tightening program may begin as early as May. Roughly speaking, it consists in withdrawing part of the funds that were issued during 2020-2021.

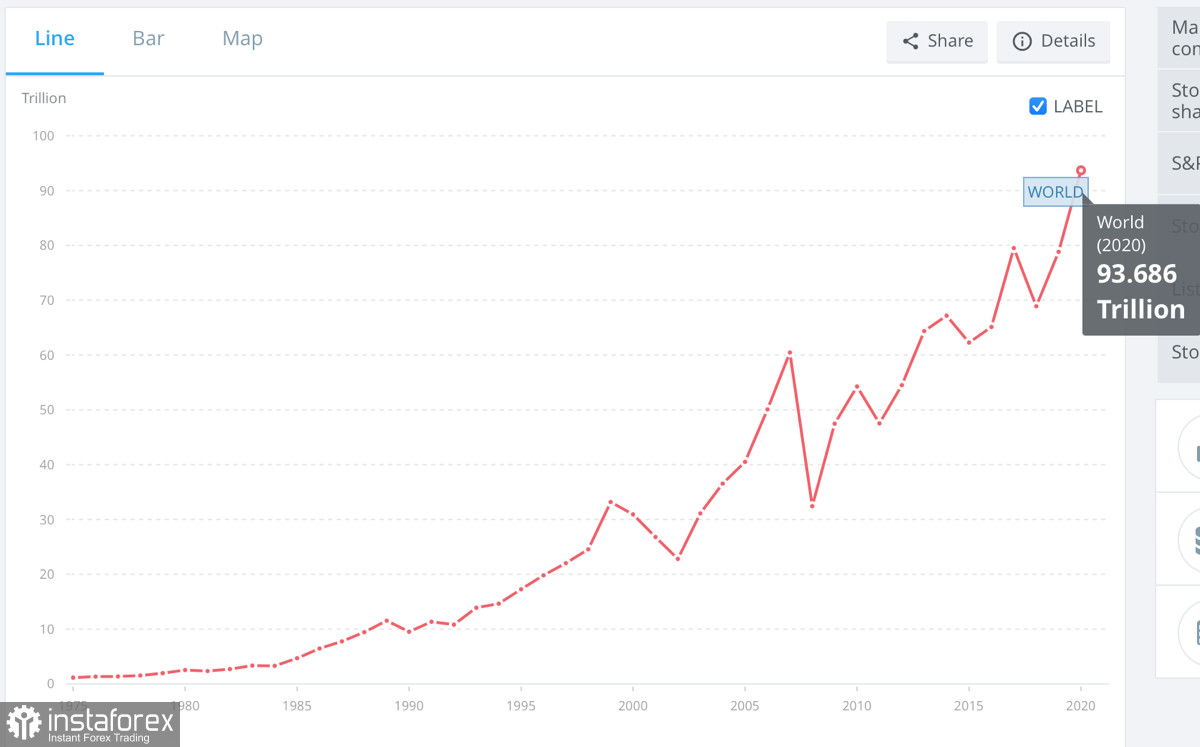

The stock market was pumped up with investments during the same period, thanks to which the market capitalization of the institution exceeded 200% of U.S. GDP. This indicates huge liquidity in the market, which will soon be abolished. The specific mechanisms are still unknown, but the market, without waiting for them, began to take actions to protect and preserve its capital. The U.S. dollar will receive the greatest positive effect from the tightening of monetary policy. Consequently, the strengthening of the USD aroused the interest of investors who began to invest in a means supported by the state with all their might.

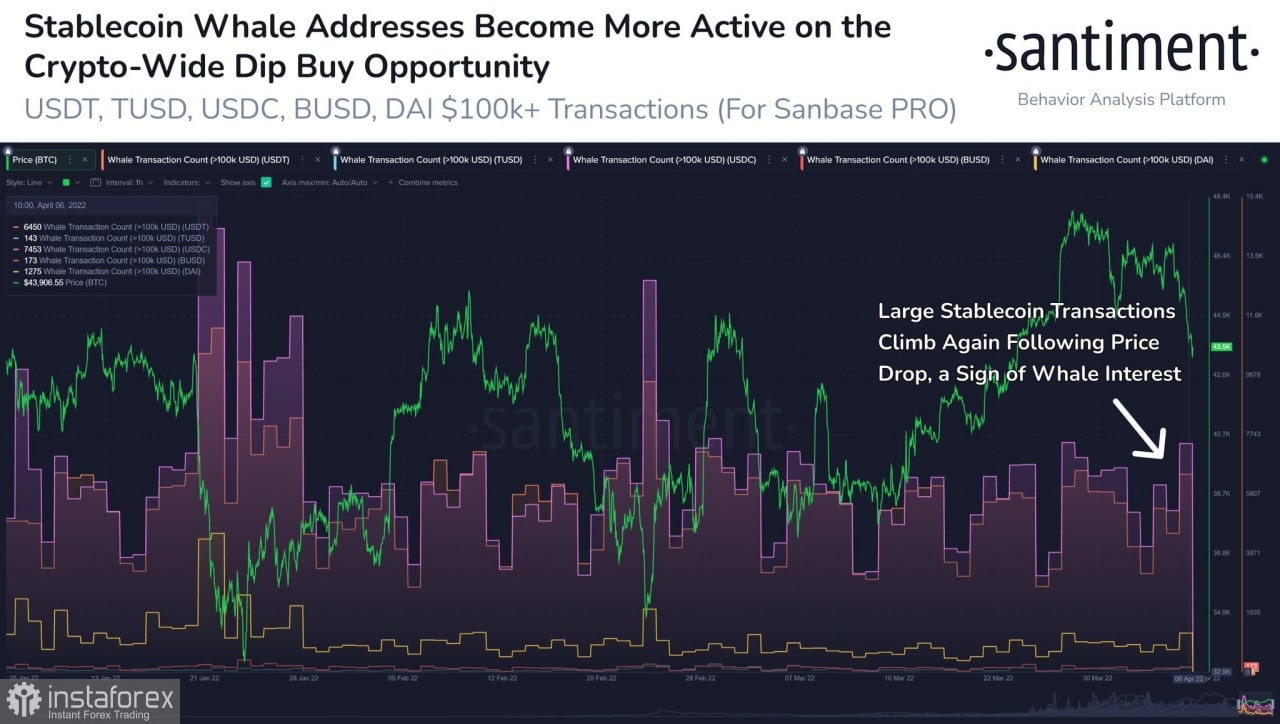

Bitcoin also felt the consequences of such a decision. The decrease in investment activity and profit fixation became possible due to the exit of the cryptocurrency from the $32k-$45k range. Many players managed to take advantage of the loophole and exit the asset at a bargain price, realizing that after tightening access to liquidity, a bullish rally in the asset should not be expected. This is also confirmed by Santiment experts, who found a sharp surge in the number of large transactions for the purchase of stablecoins among large investors. This speaks to the caution of big business regarding Bitcoin. That being said, it is important to understand that these holdings can be converted back into cryptocurrency, but given the quantitative tightening program, stablecoins are a safer investment.

Another danger for the stock market and high-risk assets is the backing of the U.S. dollar. At the current stage, the Fed will do everything to make the capitalization of Treasury bonds grow and share prices fall. This is due to the fact that USD is 67% secured by treasuries, as well as mortgage bonds. Given the correlation between Bitcoin and SPX and NASDAQ, it is clear that the current Fed policy is not playing into the hands of the cryptocurrency. However, BTC is in the process of being accepted as a reserve and deflationary asset. But before investors choose the final version of the current use of Bitcoin, it will take time for the asset to fight for the $35k-$40k area.

As of April 8, BTC/USD fell into the usual range of $42k-$44k and is trying to gain a foothold there. Buying activity and daily trading volumes have decreased, which also indicates the weakness of the coin at the current stage. In addition, the cryptocurrency failed to close above $44k. This suggests that the bears have an open path to the 0.5 Fibo level at $36.4k.

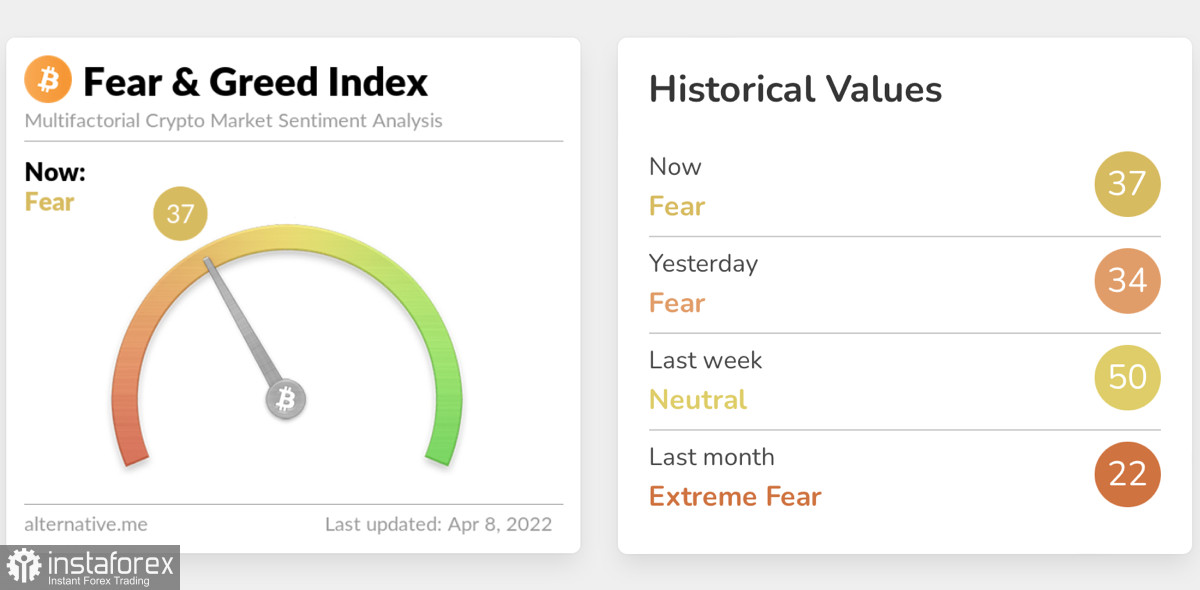

Despite the bearish signals, the support zone around $43k allows the asset to start temporary consolidation. Technical indicators have recovered near their average bullish values, which indicates an attempt to gain a foothold and resume the upward movement. At the same time, the market again plunged into the abyss of fear, and given the operational scope for the price to $36k, there is reason to believe that the price will continue to fall.