GBP/CHF rally cut short

Hi, dear traders!

First, let us have a look at the factors affecting GBP/CHF. The Bank of England has started monetary tightening, which has given support to the pound sterling. The UK regulator is not as hawkish as its US counterpart, but it has already begun increasing interest rates.

The timeline of these hikes is still unclear at this point, amid the lackluster state of the UK economy. However, high inflation has forced the Bank of England to tighten its policy. The Swiss frank has benefited from market players seeking a safe haven asset, as the war in Ukraine drags on.

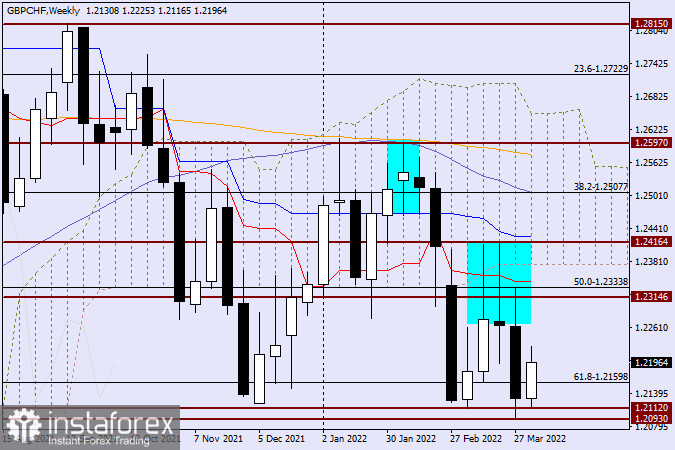

Weekly

The situation is quite ambiguous at this moment. According to the weekly chart, GBP/CHF found very strong resistance at the key technical level of 1.2600, as well as the orange 200-day EMA and the blue 50-day SMA line and reversed downwards. Earlier, the pair reached 1.2597 and formed a Doji reversal candlestick, which is highlighted on the chart. Before that, the pair reversed upwards at 1.2112 after finding support at the key level of 1.2100. However, the GBP/CHF rally was cut short. The red Tenkan-Sen line and the lower boundary of the Ichimoku cloud also served as strong resistance for the pair. This can be clearly seen on the weekly chart.

GBP/CHF bears dominated trading in the previous week. This week, the cross pair only managed to rise up to 1.2331 - the 50.0% Fibonacci level of the 1.1596-1.3070 upward movement. Previously, GBP/CHF only retraced to the 61.8% Fibo level. These attempts at reversing upwards indicate a trend reversal, and not a particularly large retracement. However, the downtrend would only be confirmed if the pair breaks below the key technical level of 1.2100. GBP/CHF tested it unsuccessfully several times before. At the time of writing, the quote bounced off 1.2116 upwards. GBP/CHF is testing 1.2200 - if it closes above it on the weekly chart, it could rise further in the future. If the cross pair forms a candlestick with a long upper shadow, it could fall even deeper, eventually testing the key support area of 1.2116-1.2100.

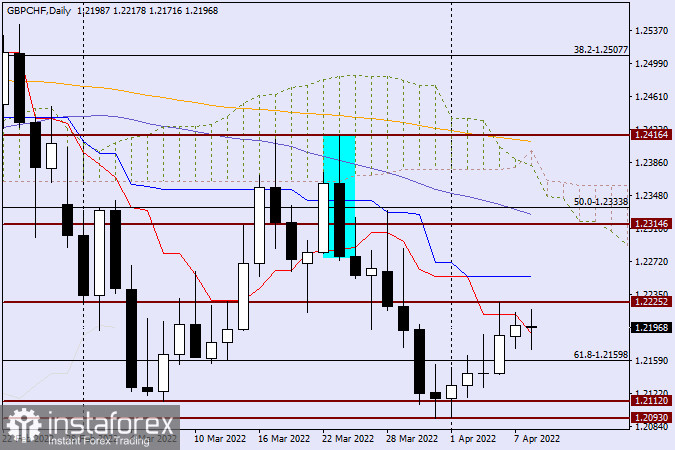

Daily

According to the daily chart, GBP/CHF bulls can barely steer the cross pair upwards - several daily candlesticks have long upper shadows. At the time of writing, the cross pair was testing the red Tenkan-Sen line. The closest resistance is at 1.2225 - the high of April 6. The pair could rise further only if it breaks through this level. The main objective for bears is pushing GBP/CHF below strong support at 1.2116-1.2093. If they succeed, the pair would fall deeper. At this point, traders are recommended to wait and observe the pair's performance near these levels.

Good luck!