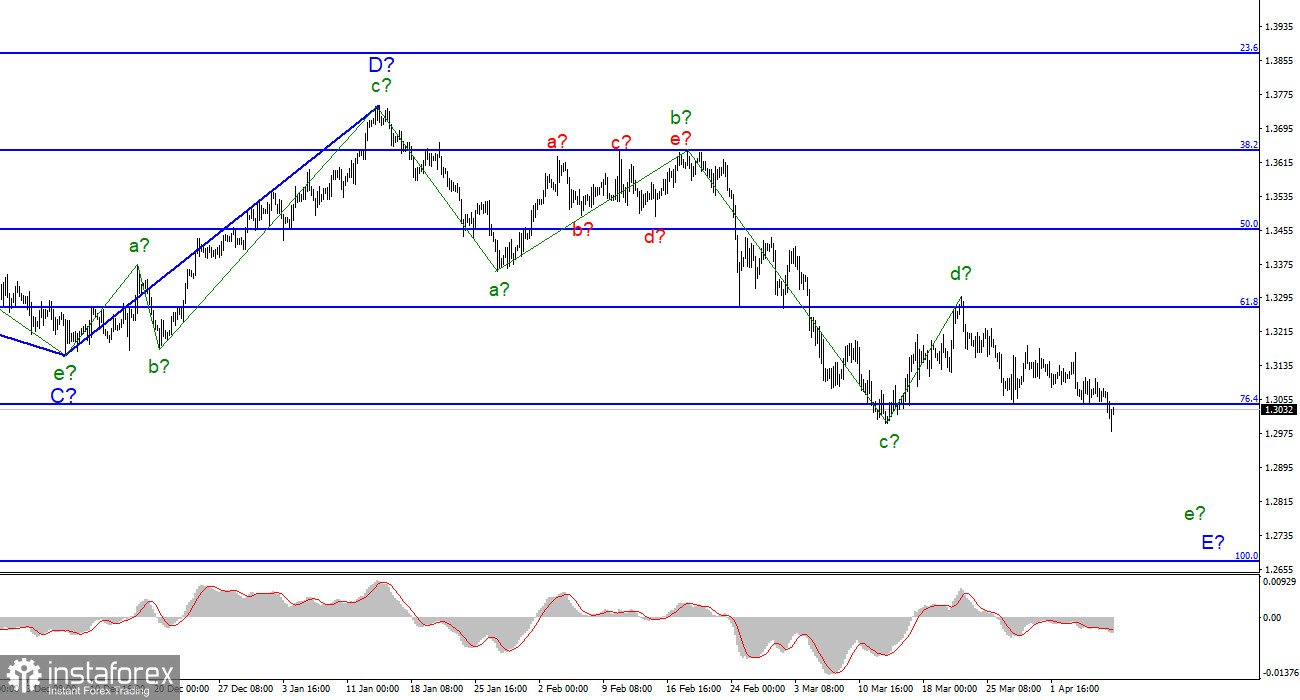

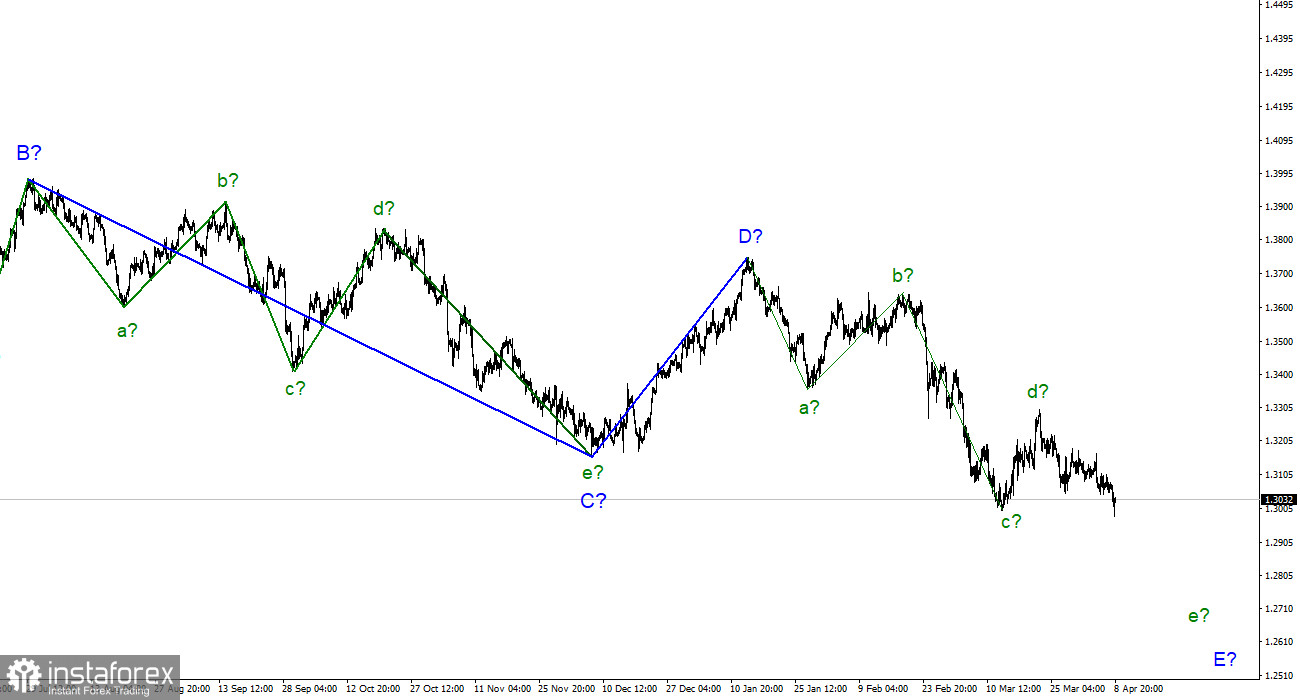

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require any additions. The expected wave d-E is completed, and there should be five waves in total inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for some time. Wave d-E can still take a longer, three-wave form. This is supported by the fact that wave b-E has taken a five-wave, extended form, as well as an unsuccessful (so far) attempt to break through the low wave c-E. However, taking into account the fact that the instrument has descended to the low of wave c-E, I think that wave d has completed its construction. If this is true, then the decline in quotes will continue, and a successful attempt to break through the 76.4% Fibonacci level indicates that the market is ready for new sales. In general, the wave pattern still looks very organic and no adjustments and additions are required.

Why are Kyiv and Moscow no longer negotiating?

The exchange rate of the pound/dollar instrument decreased by 40 basis points on April 8. Thus, the construction of the downward wave continues, although there was practically no news background on Friday. Nevertheless, there are now a very large number of important topics for the market that should be followed very carefully. I would like to mention today the topic of the Russian-Ukrainian negotiations on a ceasefire and the establishment of peace. In short, it looks like there will be no peace agreement. If a couple of weeks ago the market received excellent news in the form of "progress in negotiations", then a couple of days after this event it became clear that the number of unresolved issues and issues in which there is no progress exceeds the number of "progressing points" at times. At the moment, Kyiv and Moscow are "holding consultations" via video link, but it is already clear to many that negotiations have been stopped. Why are they stopped?

On the one hand, everything is clear. Neither Kyiv nor Moscow will give up Donbas and Crimea. Kyiv for very obvious reasons, Moscow - because in this case, all its 8-year activity in Ukraine will become meaningless. It is unclear how to negotiate peace if no one backs down from their positions. In addition, each of the parties wants to approach the next stage of negotiations (if it takes place at all) with the maximum number of trumps in their hands. For example, Kyiv can approach it with the whole four liberated regions of Ukraine. At the moment, Russian troops are concentrated only in the East and South-East of Ukraine, and in the coming days, according to Western media, they will try to expand the borders of the DPR and LPR, as well as advance in the South towards Mykolaiv and Odesa. Thus, Ukraine has new trump cards in the negotiations, and Moscow will try to get new trump cards in a new offensive. Since there is now some lull, which both sides use to strengthen their positions and pull up reserves, there is simply no sense in a new stage of negotiations. However, no matter what trump cards both sides come up with, it is still unclear how to solve the issue with Crimea and Donbas? I think this issue is unsolvable.

General conclusions.

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located around the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave e-E does not look complete yet.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.