The European Union finally adopted the fifth package of sanctions against the Russian Federation, which means that the coal issue was finally put to rest. Such that the single European currency instantly began to lose its positions. Pulling the pound. After all, Brussels has essentially imposed an embargo on the supply of Russian coal. At the same time, what Europe will replace it with is still not clear. Consequently, the European Union only exacerbates the existing problems with energy resources, which are already causing serious harm to the European economy, jeopardizing the very prospect of its existence. But after a while, a slight rollback began to be observed. As for the single European currency, and for the pound. And the whole point is in one small paragraph, which says that the embargo will be introduced from August. So the European Union has a couple more months to find an alternative to Russian coal supplies. This point is only a postponement of the inevitable. It is quite obvious that Russian companies will now inflate prices for European buyers, guided precisely by European sanctions.

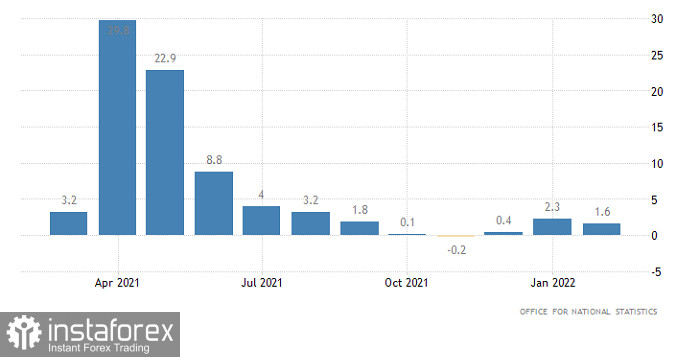

So it is not surprising that after a slight rebound, the trend towards the weakening of the British currency resumed. Moreover, this is facilitated by its own British statistics. Industrial production growth slowed down from 3.0% to 1.6%. And this data is only for February. Consequently, by the end of March, a decline will be recorded. And quite noticeable. It is clear that this does not add optimism to the pound. Probably the only thing that now somewhat softens the negative consequences for the pound is the revision of previous data, since it was previously assumed that the growth rate of industrial production was not 3.0%, but only 2.3%. But frankly, because of this revision, the scale of the slowdown looks much more impressive.

Industrial production (UK):

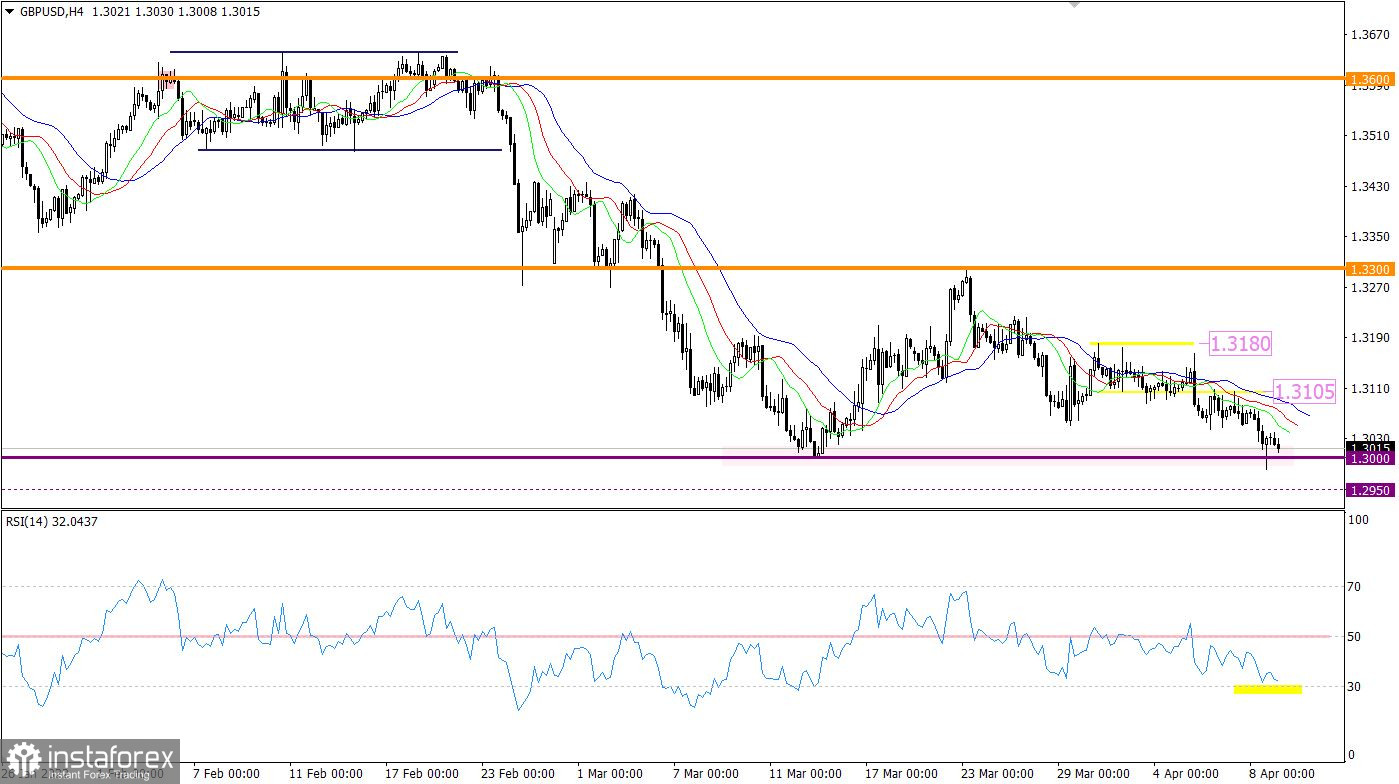

During the downward movement, the GBPUSD currency pair reached the psychological level of 1.3000, which earlier in history played the role of a support. This move indicates a high interest of traders in short positions, which in the long term will accelerate the downward move.

The RSI technical instrument moves within the oversold zone in a four-hour period; there is no intersection of the 30 line from top to bottom. This suggests that short positions are not overheated by bears.

The MA moving lines on the Alligator H4 and D1 are directed downwards, which confirms the signal to sell the British currency.

On the trading chart of the daily period, there is a complete recovery of dollar positions relative to the corrective move.

Expectations and prospects:

A signal about the prolongation of the medium-term downward trend will come from the market the moment the price stays below 1.2950 for at least a four-hour period. Until then, the risk of a price rebound from the support level of 1.3000 remains, which will lead to a local rollback.

Comprehensive indicator analysis gives a sell signal in the short, intraday and medium term due to the rapid downward movement.