Analysis of trades and tips on trading GBP

On Friday, there was only one sell signal on the pound sterling at the very beginning of the European session. The pound/dollar pair made an attempt to test 1.3054 at a time when the MACD indicator has just started to decline from the zero level. It generated another sell signal within the trend. As a result, the pair lost 30 pips. More patient traders could wait for the price to drop by another 50 pips to 1.2980. There were no other entry points.

The pair ended last week on a pessimistic note due to strong US macroeconomic data and the weakening of the pound sterling. Today, the UK revealed some economic figures which turned out to be worse than expected. The GDP report for February 2022 was rather discouraging. It has once again confirmed that the economy is going through very hard times. The decline in the Manufacturing PMI was offset by an increase in Services PMI. At the time of writing this article and after the release of the UK data, a sell signal has already appeared according to scenario No. 1. The macroeconomic calendar for the US is empty this afternoon. However, FOMC members Michelle Bowman, Rafael Bostic, and Charles Evans are scheduled to deliver speeches. Yet, they will hardly say anything new. This is why the pressure on the US dollar may increase only if their rhetoric becomes dovish.

Buy signal

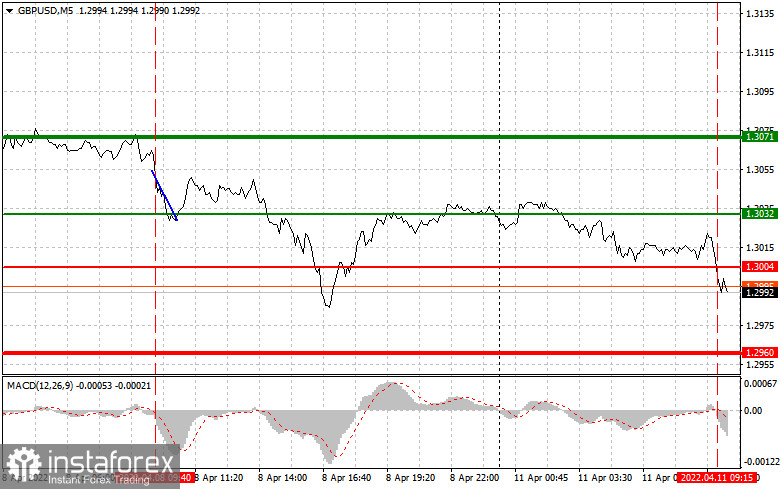

Scenario No.1: it is recommended to open long positions on the pound today if the price reaches 1.3032 (green line on the chart) with an upward target of 1.3071 (thicker green line on the chart). I would advise closing long positions at 1.3071 and opening short ones, keeping in mind a 20-25 pip correction in the opposite direction from the given level. The pair is unlikely to rise in the first half of the day, especially after weak economic data and a strong bear market. Important! Before opening long positions, make sure that the MACD indicator is above the zero level and it has just started to climb from this level.

Scenario No.2: it is also possible to buy the pound sterling today if the price approaches 1.3004. At this moment the MACD indicator should be in the oversold area, which will limit the downward potential of the pair. It may also trigger an upward reversal. The pair is excepted to grow to the opposite levels of 1.3032 and 1.3071

Sell signal

Scenario No.1: it is recommended to open short positions on the pound sterling today only if the price hits 1.3004 (the red line on the chart). It will lead to a rapid decline of the pair. The key level of sellers will be 1.2960. I would advise closing short positions at this level and opening long ones, keeping in mind a 20-25 pip correction in the opposite direction from the given level. If the price returns to weekly lows, it may strengthen the bear market. As a result, the pair may fall even lower. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from this level.

Scenario No.2: it is also possible to sell the pound sterling today if the price drops to 1.3032. At this moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also trigger a downward reversal. The pair is expected to decrease to the opposite levels of 1.3004 and 1.2960.

Description of the chart:

What's on the chart:

The thin green line shows the entry point where you can buy a trading instrument.

The thick green line is the estimated price where you can place a Take profit order or lock in profit manually as the price is unlikely to rise above this level.

The thin red line is the entry point where you can sell the instrument.

The thick red line is the estimated price where you can place a Take profit order or lock in profit manually as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important! Novice traders need to make very careful decisions when entering the market. It is best to stay out of the market before the release of important fundamental reports. It will help avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that to make a profit, beginners should have a clear trading plan like the one I presented above. Spontaneous trading decisions based on the current market situation are a losing strategy of an intraday trader.