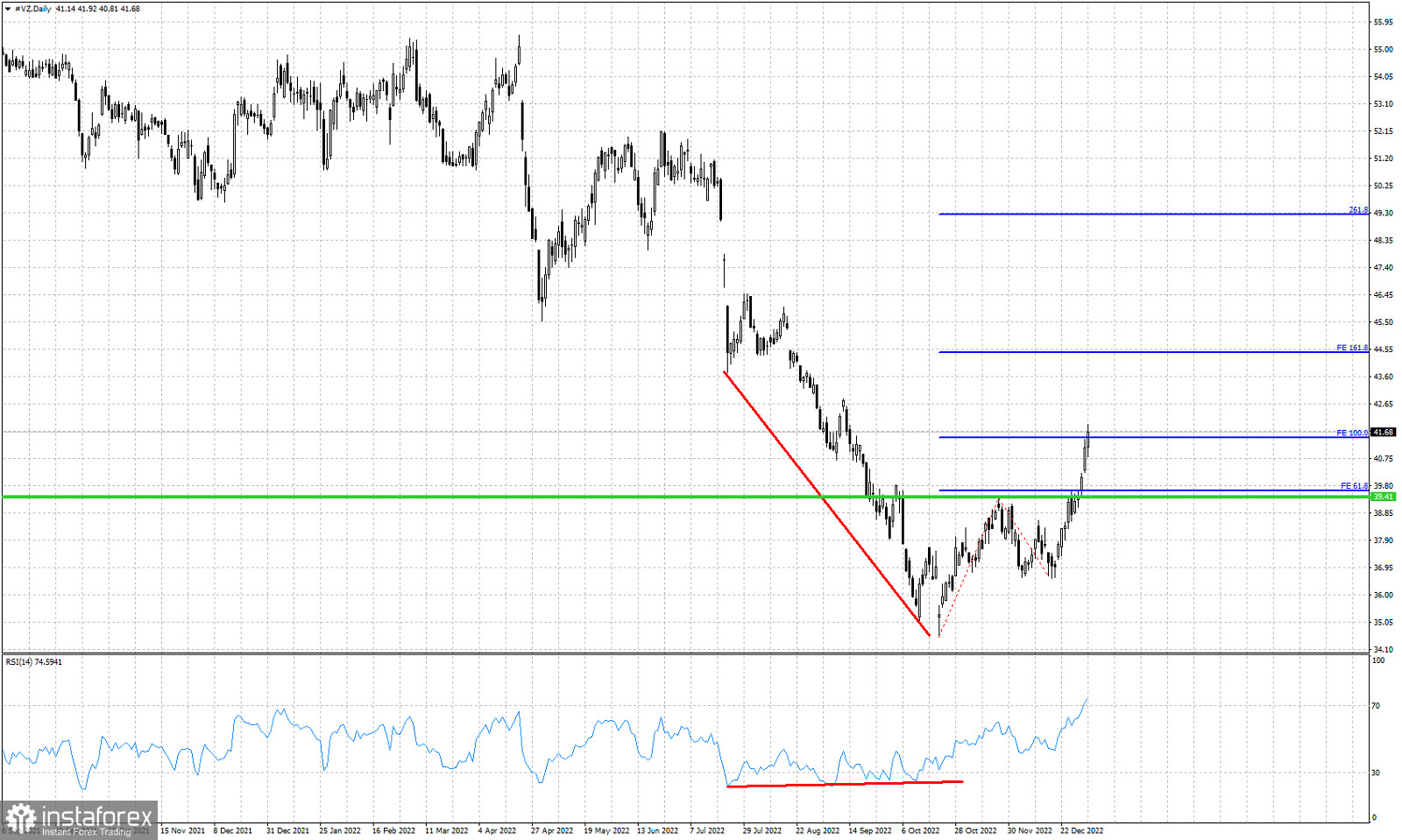

Green line -horizontal resistance (broken)

Red lines- bullish divergence

Blue lines- Fibonacci extension targets

In our last analysis on VZ stock price we noted that there was a bullish pattern in play. We mentioned that a break above the horizontal resistance of $39.40-$39.50 would be a bullish signal with $41.45 the first target. After the break out our 100% extension target has been reached. Support remains key at $36.57 and as long as we trade above this level, bulls have hopes for higher highs. Previous resistance at $39.50 is now support. It would be a sign of weakness if price were to break back below this level. Traders who entered long when price broke above the $39.50 resistance, should protect their positions at break even.