Size matters. But in Forex, there is more emphasis on speed. Even though the Bank of England has already raised the repo rate three times, and the Fed has done so only once since the start of the cycle, the derivatives market is counting on a 250 basis point rise in US borrowing costs by the end of 2022, and the UK by 200 basis points. This circumstance, coupled with a deterioration in global risk appetite, lowered the GBPUSD quotes below the psychologically important mark of 1.3 for the first time since November 2020.

While the hawkish comments of FOMC members made investors believe in raising the federal funds rate by 50 basis points in May, and the Federal Reserve's intention to start reducing the balance sheet by $95 billion a month added fuel to the fire of the rally in Treasury bond yields and the US dollar, in the UK everything is different.

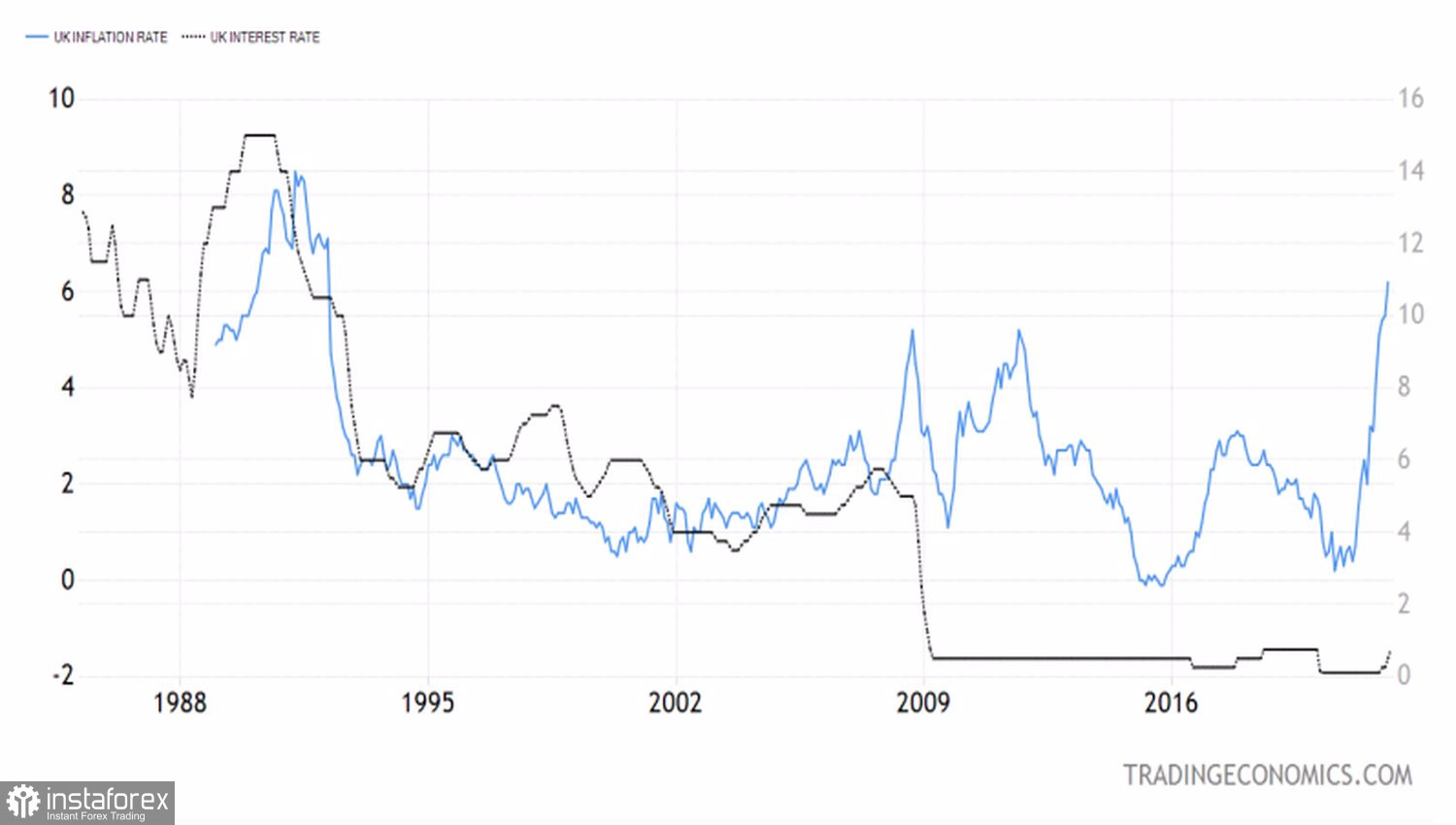

After three acts of monetary restriction in a row, BoE officials began to signal a possible pause, which took the ground from under the sterling's feet. BoE Deputy Governor John Cunliffe's speech only added fuel to the fire. Cunliffe believes that the Bank of England may not need a lengthy process of raising the repo rate to cut off the oxygen of high inflation. The derivatives market does not exclude that after several acts of monetary restriction, a series of reductions in borrowing costs may follow, as it was in the 1990s and 2000s. Back then the regulator managed to achieve a soft landing.

Dynamics of the REPO rate and British inflation

In any case, when the Bank of England acts with an eye on its own economy, and the Fed intends to throw all its forces into the fight against inflation, the attacks of the bears on the GBPUSD are becoming more persistent. Fed Chairman Jerome Powell and his colleagues will raise the federal funds rate by 50 basis points in May, according to 84% of Wall Street Journal experts. 57% of respondents predict two or more such moves by the end of 2022. The consensus estimate is for US borrowing costs to rise to 2.125% and 2.875% by the end of 2022 and 2023. Let's not forget about $2 trillion in balance sheet reduction in two years, which is equivalent to 3-4 acts of monetary restriction of 25 basis points each.

The Fed is very aggressive, which is causing 10-year Treasury yields to soar to 3-year peaks and putting pressure on the US stock market. The fall of the S&P 500 is usually associated with a deterioration in global risk appetite, which negatively affects the positions of the bulls on GBPUSD.

The intention of the Bank of England to pause and Ben Broadbent's statement that investors should follow not the comments of BoE officials, but macroeconomic statistics, increase the importance of a busy economic calendar for the pound. Releases of data on the labor market, inflation, GDP, and industrial production will help to understand whether the Central Bank intends to retreat.

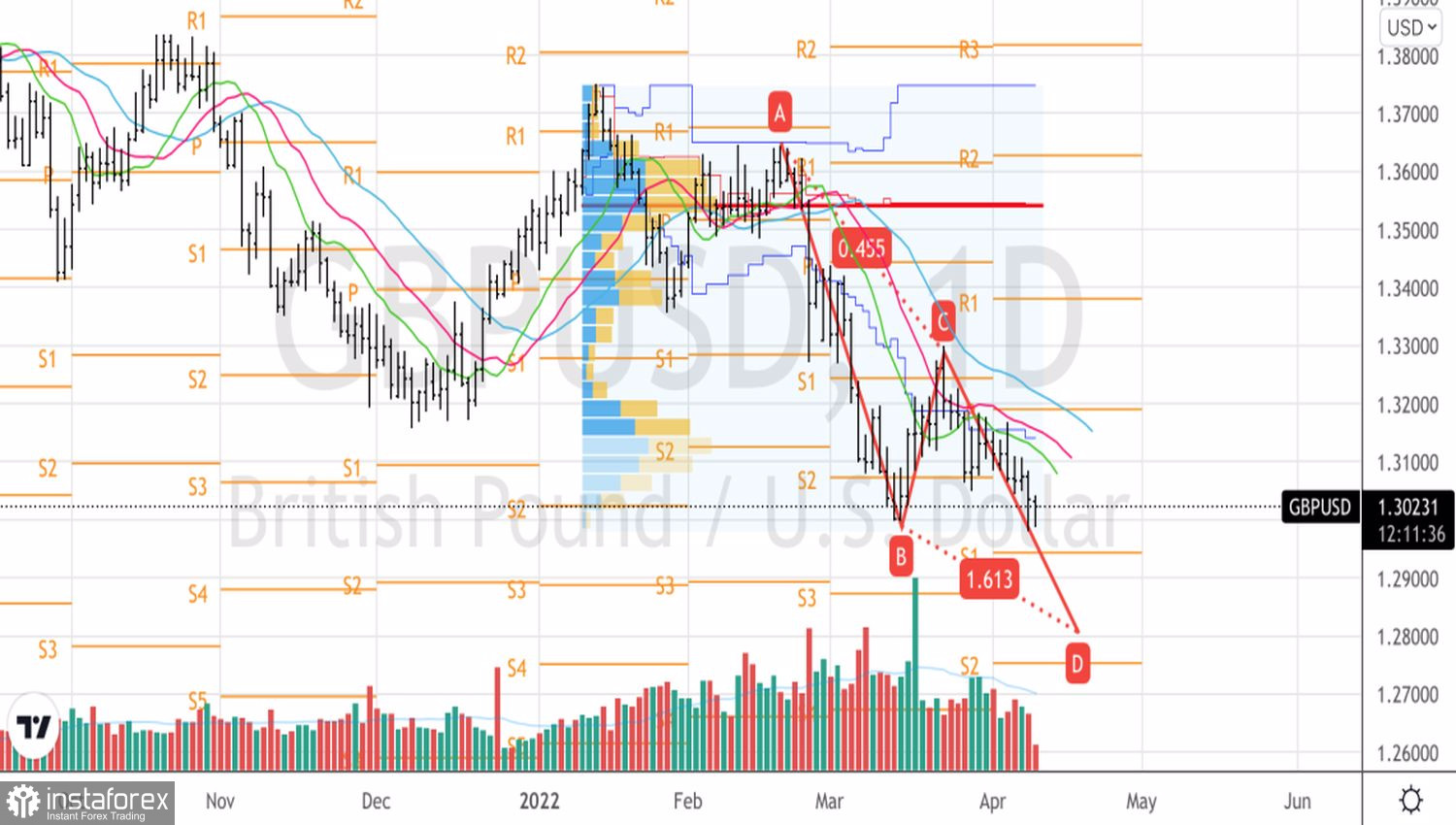

Technically, on the daily chart of the analyzed pair, the inside bar played well, allowing us to form short positions on GBPUSD on a break of support at 1.311. A drop in sterling quotes below $1.299 will activate the AB=CD harmonic trading pattern and allow us to build up shorts with a target of 161.8% Fibonacci. It corresponds to 1.279.

GBPUSD, Daily chart