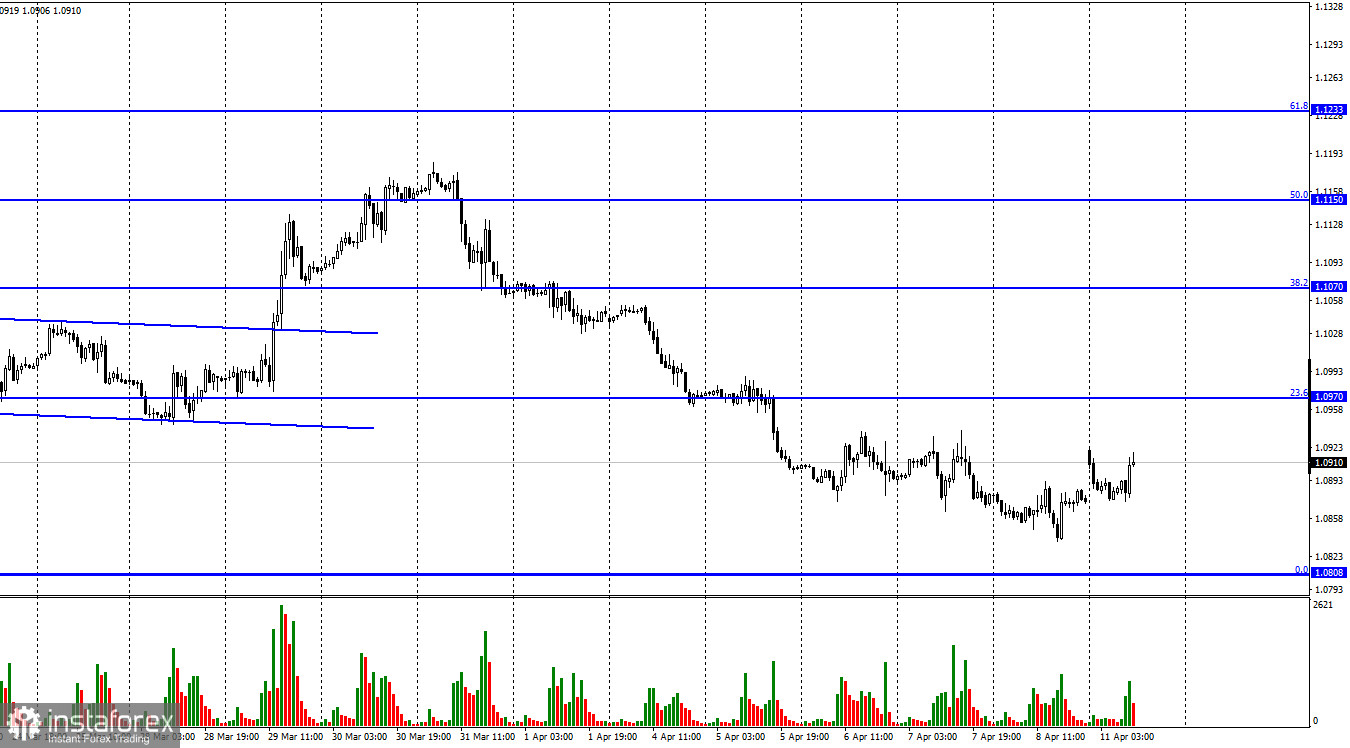

The EUR/USD pair started the day with a fall on Monday but then began a new growth. Both the fall and the growth look very weak, as the usual market noise. It is hardly possible to draw any conclusions from these movements. The European currency continues to trade near the corrective level of 0.0% (1.0808), which means the proximity of the point from which growth began at one time. The consolidation of quotes below the level of 1.0808 will increase the likelihood of a further fall in the euro currency. There will be quite a lot of interesting events this week. It all starts today, with speeches by FOMC members Michelle Bowman, Rafael Bostic, and Charles Evans. Let me remind you that the majority of Fed members support an aggressive approach to tightening monetary policy. Last week, Mary Daly, James Bullard, and several other FOMC members confirmed their intentions to raise the rate by 0.50% in May. In addition, the procedure for reducing the Fed's balance sheet may begin in May. In other words, securities that were bought up by the regulator under quantitative stimulus programs will now be sold back to the market.

Thus, these two factors already indicate a very likely further growth of the US currency. If today the biggest "hawks" Bowman, Bostic, and Evans also confirm their readiness to vote for an interest rate increase by 0.50% in May, this will further assure traders of the correctness of their approach. The Fed has a global problem now - it's inflation. It needs to be fought with all available means, and even the involvement of all the tools may not allow this indicator to return to the target level in 2022. I would also like to remind you that the neutral rate is 2.5%. This is the level at which there is no pressure on economic growth, but the fight against inflation will proceed slowly. The Fed plans to raise the rate to 3.5%, but it may take more than a year to reach this level. Meanwhile, inflation may rise to 8.5% this week, when the corresponding report is released.

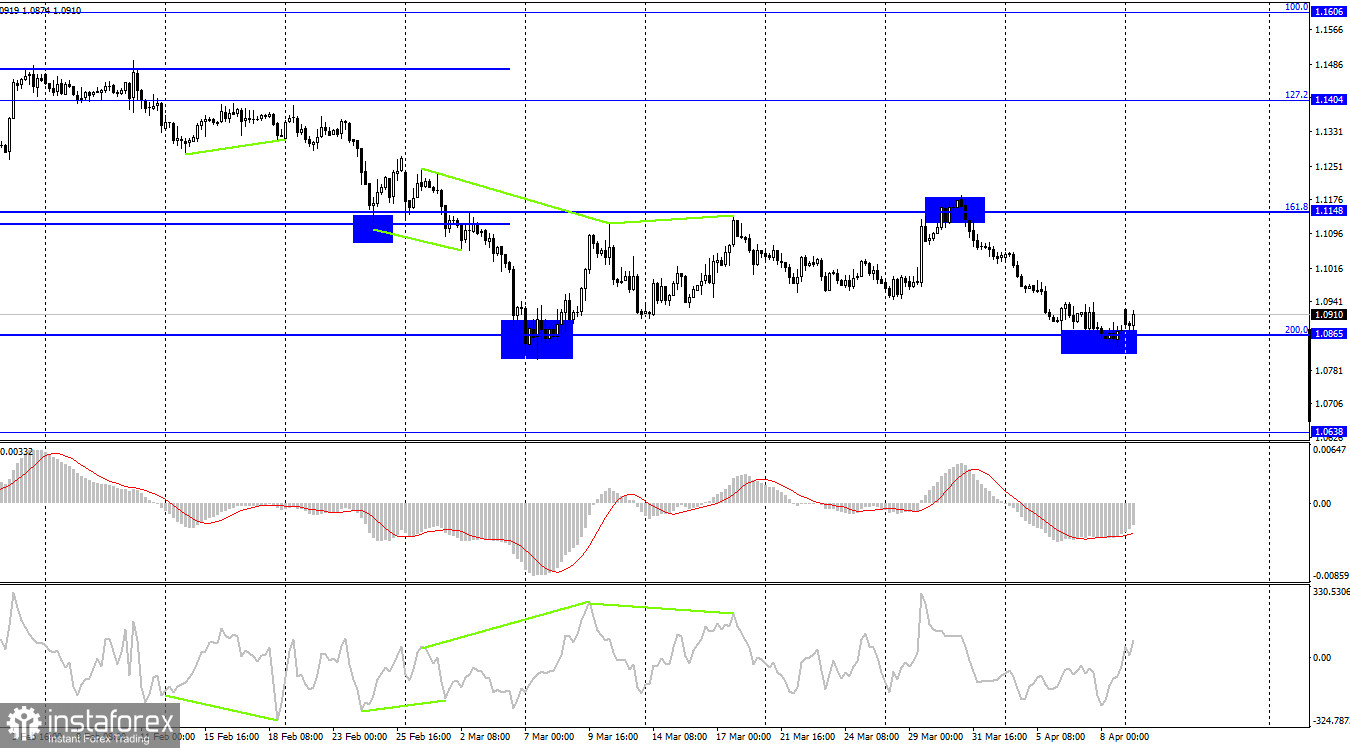

On the 4-hour chart, the pair performed a fall to the corrective level of 200.0% (1.0865) and rebound from it. A reversal was made in favor of the EU currency and a weak growth process began in the direction of the corrective level of 161.8% (1.1148). The consolidation of quotes under the Fibo level of 200.0% will work in favor of the US dollar and the resumption of the fall towards the level of 1.0638. Maturing divergences are not observed in any indicator today.

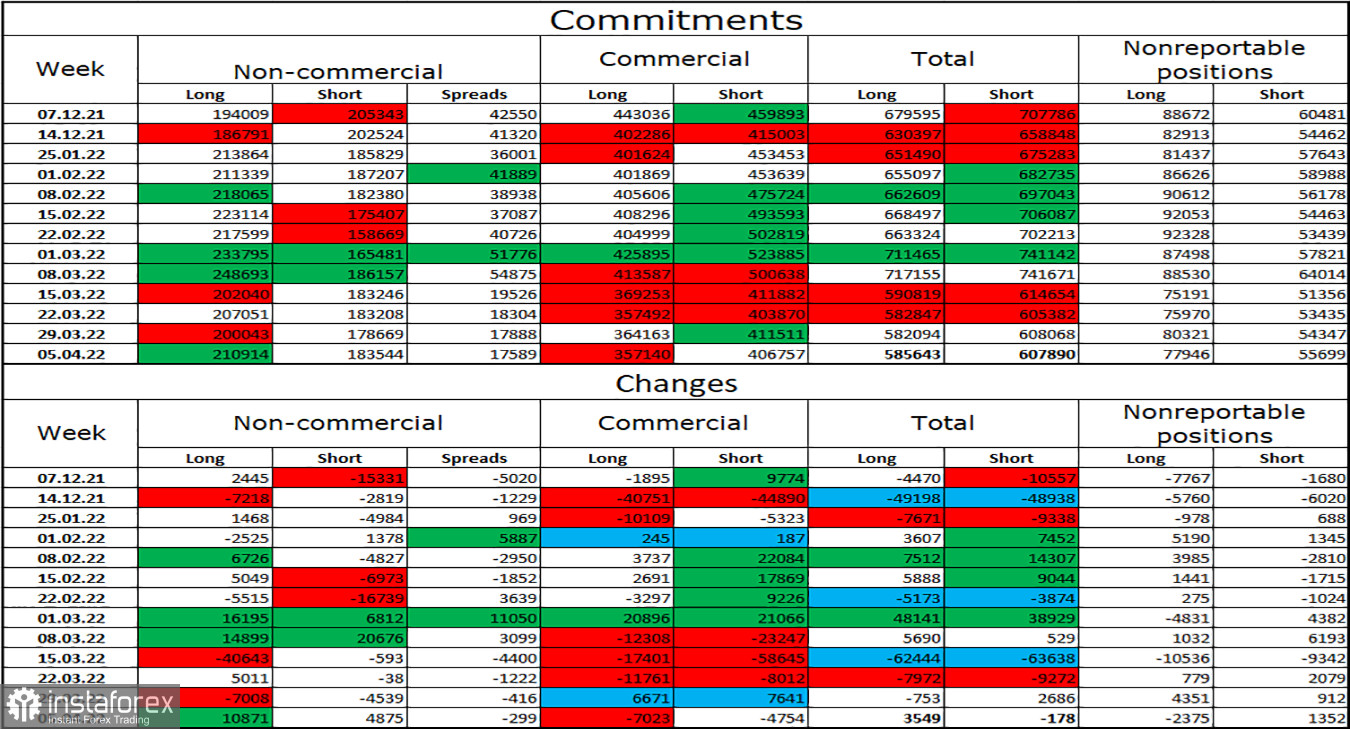

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 10,871 long contracts and 4,875 short contracts. This means that the bullish mood of the major players has intensified. The total number of long contracts concentrated on their hands now amounts to 211 thousand, and short contracts - 183 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is characterized as "bullish". In this scenario, the European currency should show growth. But it should have been showing it for several weeks, and instead, it continues to either fall or is just very low. Thus, it is impossible to draw adequate conclusions from the COT reports now. A very strong influence on the mood of traders from geopolitics and the status of the dollar as the "world reserve currency".

News calendar for the USA and the European Union:

US - FOMC member Michelle Bowman will deliver a speech (13:30 UTC).

US - FOMC member Rafael Bostic will deliver a speech (13:30 UTC).

US - FOMC member Charles Evans will deliver a speech (16:40 UTC).

On April 11, the calendar of US economic events contains three speeches by FOMC members. They can be quite important in their content for traders. In the European Union - nothing. The information background today may be average in strength.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair if a close is made under the level of 1.0865 on the 4-hour chart with a target of 1.0638. I recommend buying a pair if there is a rebound from the 1.0865 level on a 4-hour chart with targets of 1.0970 and 1.1070.