GBP/USD bears made another attempt to storm the 29th figure. This is not the first attempt. Last Friday, traders updated the multi-month price low, reaching 1.2981. The last time the pair was in this price area was in November 2020. However, back then GBP/USD bears could not gain a foothold below the 1.3000 mark due to bulls being active. To date, the situation is similar. At least, traders are still unable to settle within the 29th figure. After the price overcomes the key support level, bears take profits, the downward momentum begins to fade, and bulls seize the initiative. At the same time, bearish sentiments clearly prevail in the pair. Over the past three weeks, the pound has declined by 300 points, albeit with impressive corrective pullbacks. However, these rollbacks allowed the GBP/USD bears to enter short positions at a more favorable price, thereby exerting background pressure on the pound. As a result, bears stopped at the threshold of a key and psychologically important level of support. If they push through the 1.3000 mark, they will be within the price range of 1.2850-1.2990. Otherwise, bulls will try to break through to the borders of the 31st figure.

Contradictory data on the growth of the British economy did not become a catalyst for the growth or decline of the pair. The pound first fell to 1.2988, but then renewed the intraday high, reaching the target of 1.3056. After that, the price froze in the middle of this situational range. Traders could not decide on the vector of their movement.

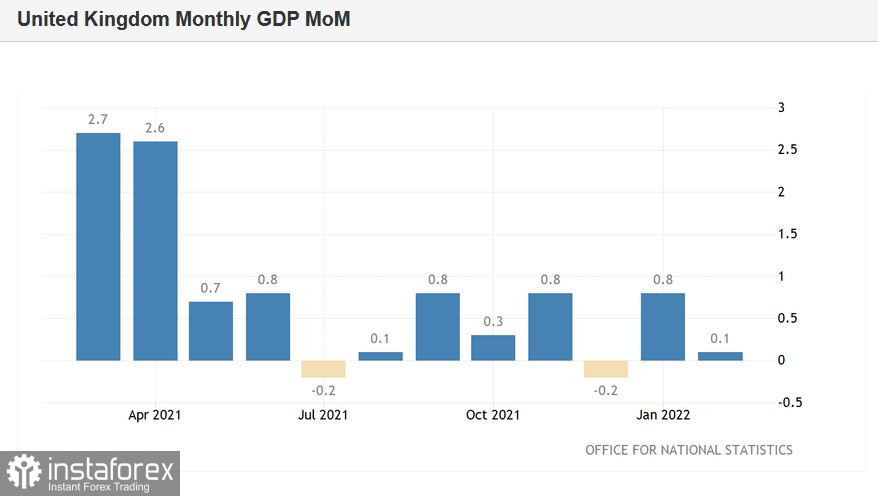

On a monthly basis, GDP grew by just 0.1% in February (up from 0.8% in January). According to most experts, the growth should have been more impressive, so this component came out in the red zone. In annual terms, the indicator increased by 1.0%, exceeding the forecast values (0.8%). Indicators of industrial production showed a contradictory result: on a monthly basis, the indicator fell by 0.6% (against a growth forecast of up to 0.3%), while on an annual basis it increased by 1.6%, with a growth forecast of up to 2.1%. A similar situation has developed in the processing industry: with a growth forecast of up to 0.3%, production decreased by 0.4% (on a monthly basis). And in annual terms, on the contrary, with a growth forecast of up to 2.9%, the indicator immediately rose to 3.6% (although in January it was at around 5.6%). In the construction sector, both indicators came out in the red zone - both in annual and monthly terms. But in the service sector, the indicators showed a positive result.

As you can see, the results are indeed very contradictory - they could be interpreted both in favor and against the British currency. On the other hand, there is nothing catastrophic in today's release. Therefore, the reaction of the market was also contradictory: at first, the bears pushed the price below the support level of 1.3000, and then the GBP/USD bulls organized another counterattack. As a result, the parties converged on "neutral territory", at the base of the 30th figure.

And yet, in my opinion, the priority remains for the downward scenario. First of all, due to the pressure of the American currency. The pound will not be able to contain the onslaught of dollar bulls. Including "thanks" to the indecisive rhetoric of the head of the English central bank. Not so long ago, the head of the Bank of England, Andrew Bailey, questioned the advisability of raising interest rates at the May meeting. In the course of his recent speeches, he several times pointed to the "current unstable situation" that could affect the decisiveness of the members of the central bank. Therefore, the market increasingly began to sound the idea that at the next meeting of the British central bank may disappoint supporters of a strong pound. While dollar bulls are already supported by the US Federal Reserve. Many members of the Fed, during their recent speeches, allowed the option of a 50-point rate hike not only at the May meeting, but also at the June meeting. The minutes of the Fed's March meeting released last week also speaks of a high probability of this scenario.

The external fundamental background similarly contributes to the further decline of the GBP/USD pair. The tension around Taiwan, the protracted and so far fruitless negotiations between Russia and Ukraine, the impending energy crisis in Europe - all these factors, to one degree or another, play on the side of the safe dollar.

Nevertheless, it is quite risky to open short positions on the pair now. Traders approached a rather powerful price barrier, which could not be overcome impulsively. Therefore, it is advisable to enter short positions only after the GBP/USD bears settle below the lower line of the Bollinger Bands indicator on the daily chart, that is, below the key target of 1.3000. The bears, in turn, need an additional informational occasion for the development of a further offensive. Therefore, at the moment it is best to take a wait-and-see position for the pair until the bears have overcome the most important support level.