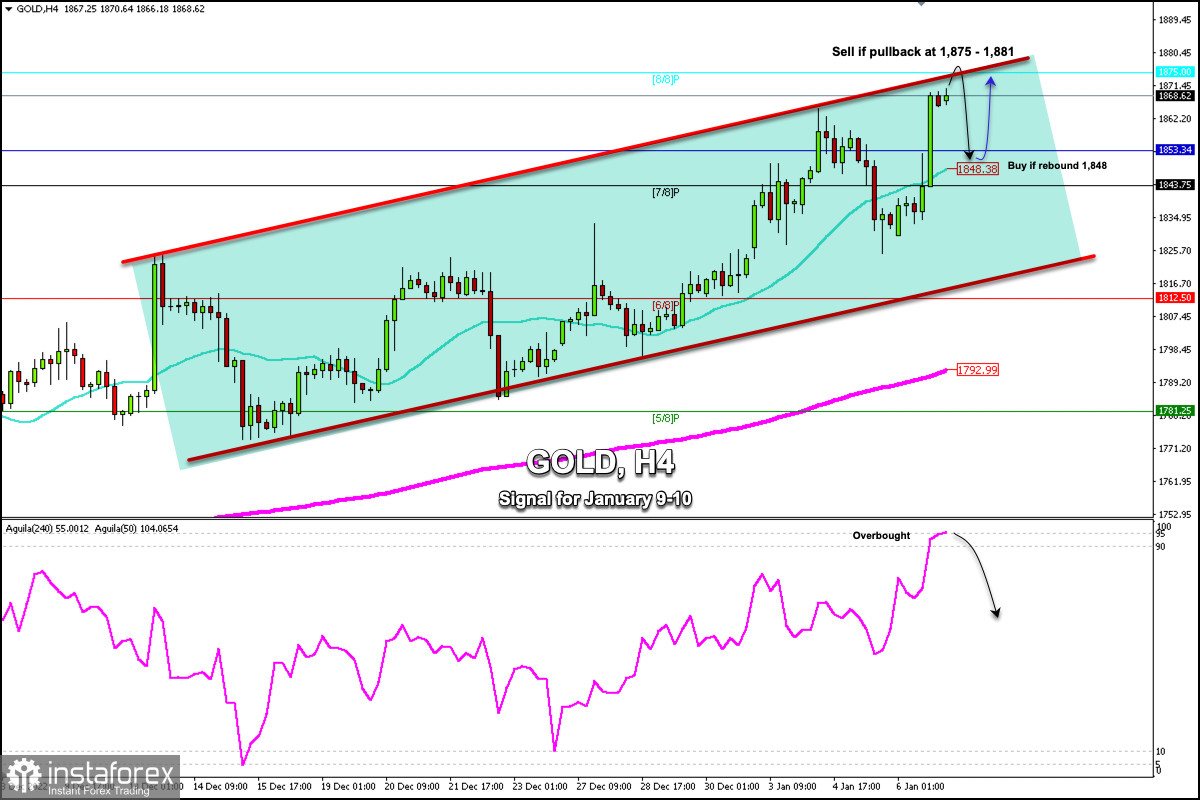

Early in the European session, Gold (XAU/USD) is trading around 1,868.62 with a strong bullish bias. It is currently trading below the 8/8 Murray and above the 21 SMA and 200 EMA.

We can see that it is reaching extremely overbought levels. The price is likely to continue its rise and could reach the resistance zone of 1,875 and could even reach 1,881 where the weekly resistance is located.

NFP figures were released on Friday, these increased by 223,000 in December, compared to the market expectation of 200,000. This data had already been assimilated by the market during the first days of last week.

Therefore, the market reaction went against the statistics. This week, the US dollar and Treasuries could have a recovery and this could put pressure on the XAU/USD pair and we could expect a fall towards the 21 SMA located at 1,848.

The eagle indicator has reached the extremely overbought zone of about 95 points, which suggests that a technical correction is likely to occur in the next few hours. This outlook could be confirmed only if gold trades below 1,881.

In case gold consolidates above 1,875 (8/8 Murray), there is a strong probability that it will continue to rise and reach the psychological level of $1,900 and could even reach +1/8 Murray located at 1,906.

Our trading plan for the next few hours is to wait for a strong rejection around 1,875 - 1,871. In case gold fails to consolidate above this level, it could be seen as an opportunity to sell with targets at 1,860 and 1,848.

The eagle indicator is in the extremely overbought area. Therefore, any technical bounce below 1,881 will be seen as a signal to sell.