Currency markets practically froze in anticipation of the publication of important economic data from the United States and Germany. Today, numbers on consumer inflation are expected to be released, which may significantly change the alignment of forces in the currency markets.

Germany's consumer price index is expected to grow immediately to 7.3% from 5.1% on a yearly basis, which will be the strongest one-time growth in at least the last 22 years. On a monthly basis, the strongest increase in inflation is also expected. According to the consensus forecast, March inflation numbers should jump immediately to 2.5% from the February growth rate of 0.9%.

The rise in inflation in Germany is due to a strong increase in energy prices, inflationary expectations associated with the upcoming food crisis, and other problems. But we are interested in how the ECB will react to a strong rise in consumer prices. If earlier the regulator shrugged off following monetary principles – the need to raise rates to curb inflation, fearing the dumping of the country's economy into a large-scale recession, now it will be simply impossible to do so. If the data turns out to be in line with expectations or even higher, it will no longer be possible to ignore.

How will the euro react to the strong growth of inflation in Germany?

Logically, the ECB's rate hike amid inflation should support the euro if we consider the EURUSD pair, but it is not that simple here as the same activity is also expected from the Fed. Futures on federal funds rates show that the US Central Bank may immediately raise rates by 0.50% at the May meeting, and not by the previously assumed 0.25%, also against the background of increased inflationary pressure in America. The consumer price index in the US should also demonstrate an increase.

Assessing the overall picture, we believe that a strong rise in inflation in Germany may provoke a local increase in the EURUSD pair, but its growth is likely to be limited. And only if the US data show a slowdown in inflationary pressure, the pair can get significant support.

Forecast of the day:

The GBPUSD pair may resume falling towards 1.2890 after breaking through 1.2995 on the back of rising inflation in the US.

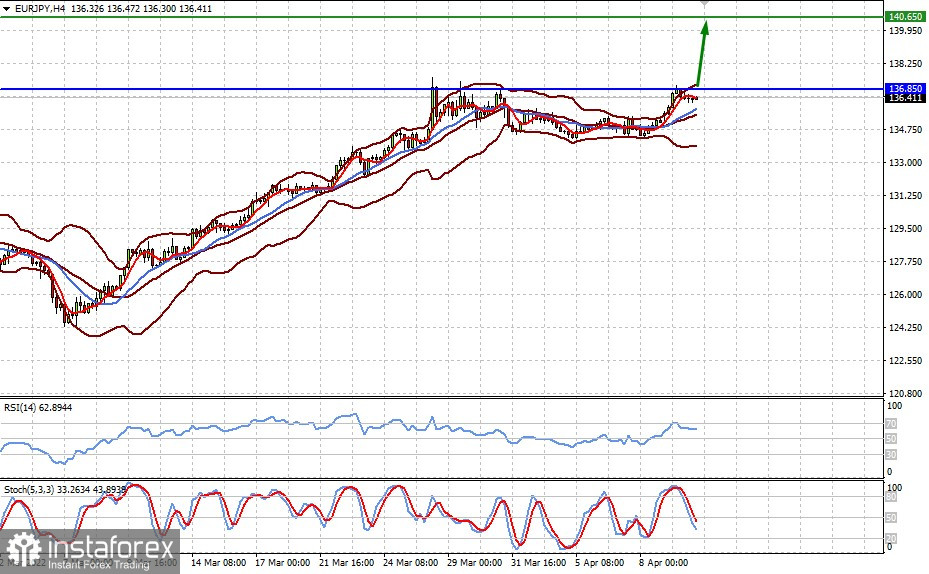

The EURJPY pair has every chance to continue rising to 140.65 after overcoming the level of 136.85 against the background of strong inflation growth in Germany.