Global yields continue to rise at a rapid pace, with 10-year UST showing an increase to 2.832%, just a few steps away from the multi-year peak set in December 2018. Investors continue to play hawkish comments from the Fed, which is aiming for a 1.5% aggregate rate hike at the next three meetings, and, more importantly, for the start of the balance sheet cut, which will be announced in May.

US equities continue to plunge deep into the red as markets see rising panic over a sharp slowdown in liquidity inflows. In the US, the current account deficit reached 820 billion, this is a record in history, the budget deficit in 2021 amounted to 2.8 trillion, and given the fact that the inflow of capital from Europe is slowing down before our eyes, the question of who will finance the cash gaps is becoming tougher.

On Tuesday, the dollar remains the market favorite as the main reserve currency amid growing risks.

NZDUSD

The RBNZ is set to hold a regular meeting on monetary policy on Wednesday, where it is expected to raise the rate by 0.5%, in response to rising inflationary expectations. In fact, the RBNZ faces exactly the same tasks, with the same risks as the Fed – to aggressively raise the rate in order to reduce inflationary expectations and at the same time do it in a way that does not plunge the country into recession.

The balance of risks is clearly skewed in favor of curbing inflation even at the cost of worsening the situation in the economy. The reason is simple – economic growth will recover sooner or later, but the loss of control over inflation will lead to much more serious consequences.

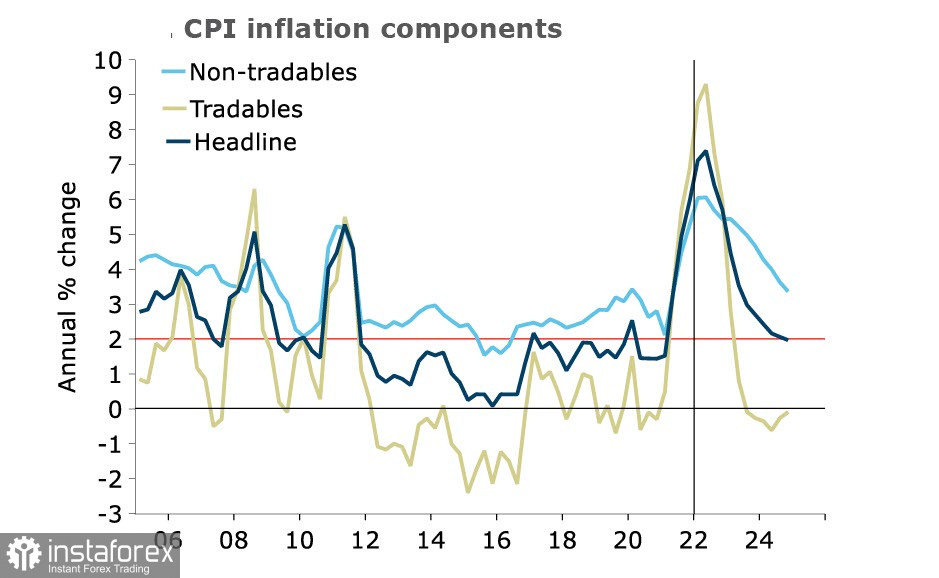

The quarterly NZIER business confidence index fell from -28% to -40%, but even such a negative result is unlikely to stop the resolve of the RBNZ. It is assumed that the rate will continue to rise just as aggressively and in a year will reach 3.5%. This is still well below the current inflation rate, so it is not clear whether the RBNZ policy will have the desired effect. ANZ Bank sees the risk of inflation rising to 9% by the middle of the year, and predicts a return to the target in 2024.

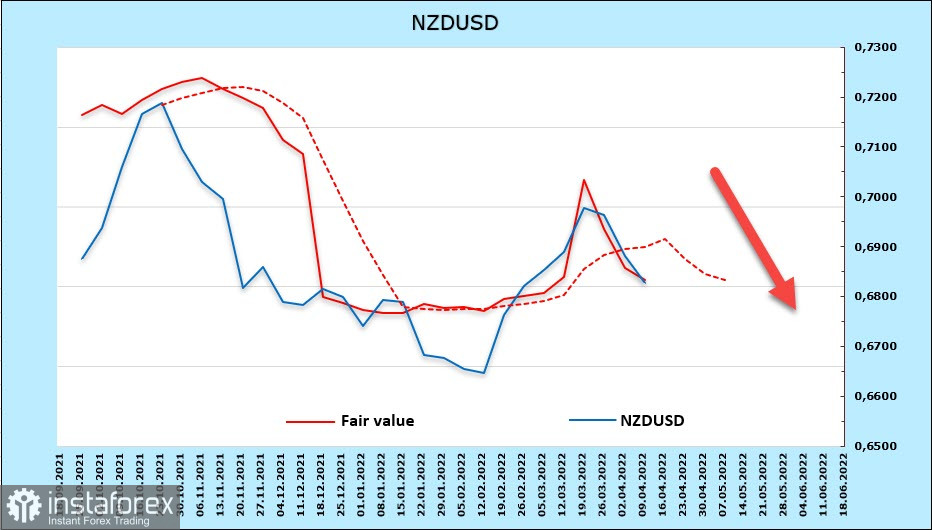

Despite rate expectations, New Zealand bond yields are growing slower than UST yields, reflecting market skepticism about the kiwi's rise. The SAES report is neutral with a minimal bearish margin, the weekly change is -49 million, the accumulated short position is -109 million, the estimated price is directed downwards.

We assume that the probable aggressive position of the RBNZ will provide an opportunity to go up, it will meet resistance in the area of 0.6870 NZD, where the growth may end. Sales with a target of 0.6770/80 are justified, the long-term target is 0.6695.

AUDUSD

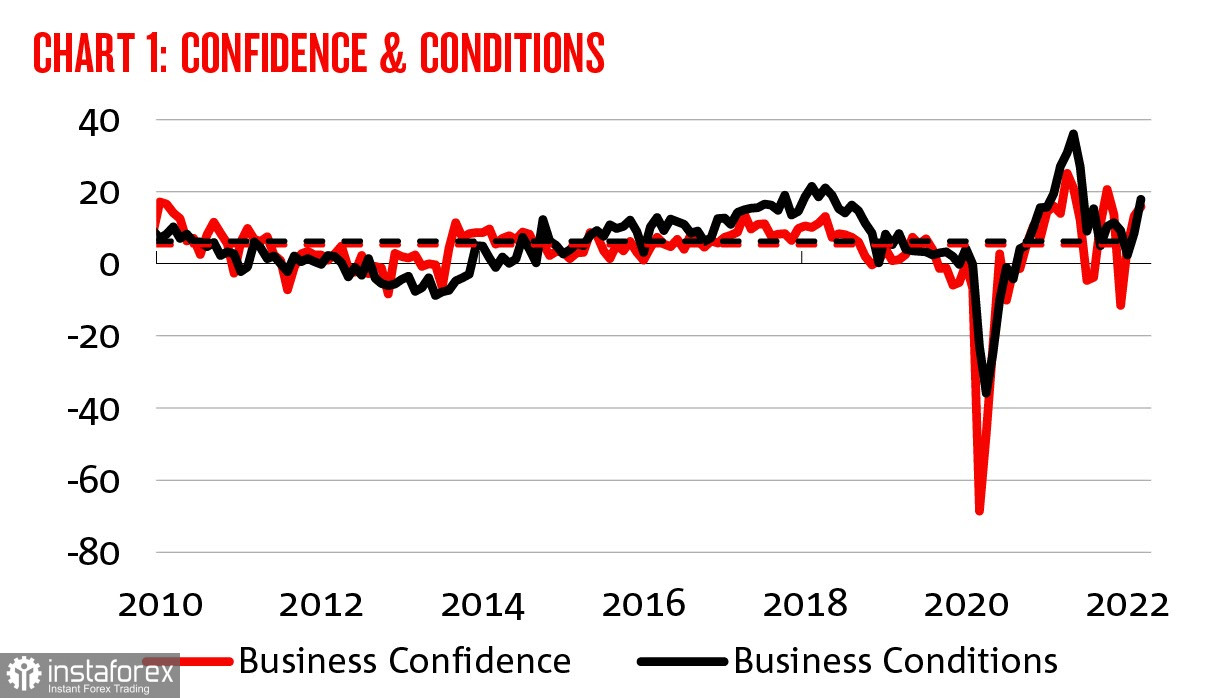

The NAB Business Survey for March showed both business conditions and confidence in the outlook well above long-term averages, along with steadily rising price pressures. Both figures were better than expected, with expansion and raw material costs at their highest ever recorded, the key here being that rising production costs are being passed on to consumers without issue as inflation is also rising at a record pace.

The report showed that business sentiment in Australia gives the RBA additional room to maneuver, as businesses are not yet concerned about a further deterioration in financial conditions, which is not the case for the US or New Zealand.

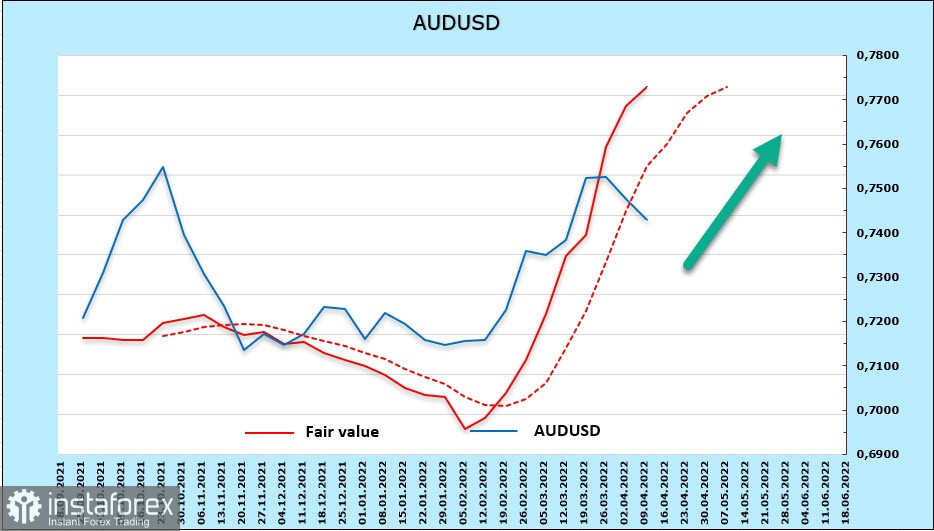

The Australian dollar still looks stronger than the NZD, the net short position decreased by 882 million over the week, this is the maximum change among all G10 currencies, and the estimated price is directed upwards.

Despite the pullback to the 0.74 support line (38.2% of the growth in January-March), the aussie has a good chance to form a local minimum and resume growth. The nearest target is 0.7540/60, consolidation above this zone will give every reason to count on testing the recent peak of 0.7664.